Phl peso strong on dovish Fed

In last week’s article “Philippines- unintentional beneficiary of the US-China trade war” – June 17, we discussed how the Philippine stock market and the peso have unintentionally benefitted from the US-China trade war. The sluggish global economy exacerbated by the protracted trade war prompted the Fed and other central banks to consider another round of monetary stimulus.

Lack of patience

The Fed held interest rates steady last Wednesday and lowered the Fed funds dot plot. Moreover, they removed the word “patient” from the text to indicate that they are opening the door for future rate cuts. This move by the Fed triggered a rally in EM currencies which recorded their biggest weekly gain in almost two years. The Philippine peso closed strong at the low end of its 16-month range at 51.57 last week.

Dovish Fed tempers US dollar strength

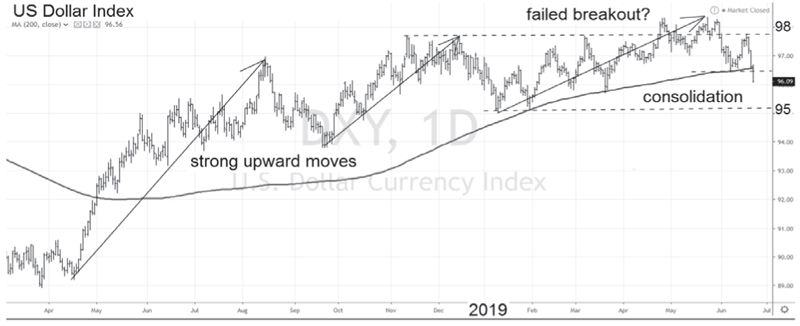

The Fed’s shift to a dovish posture and its decision to pause interest rate hikes tempered the strength of the US dollar. The dollar index (symbol: DXY) was rangebound between 95 to 98 during the past six months, which provided respite to emerging market currencies, including the Philippine peso. A failed breakout above 97.70 last April and May has brought down the DXY to a three-month low of 96.09. The dollar fell sharply last week after the Fed hinted of possible rate cuts in the coming months. The decline pushed the DXY below its 200-day moving average, which should translate to firmer EM currencies and stronger EM assets going forward.

Source: Tradingview, Wealth Securities Research

Philippine peso, most stable

As we first noted in “Divergent views on the peso” – Feb. 18 the peso has exhibited character change (refer to the chart below) following Powell’s dramatic pivot from hawkish to dovish. Volatility has dropped, and the peso has started to trade in a steady and narrow range. A recent Bloomberg report showed that Philippine peso has the lowest implied volatility and is the most stable among emerging currencies.

Technical analysis points to strong peso

Based on technical analysis, the outlook for the Philippine peso looks increasingly positive. Price has broken below the three-year upward channel and has crossed below the 40-week moving average which is bullish for the peso. A confirmed break below 51.50 should point to a retest of the next support level at 51, followed by strong support at 50.

Source: Tradingview, Wealth Securities Research

Long-term risk: a sharp yuan depreciation

Given the uncertainties of the US-China trade war, the major risk on emerging market currencies, including the peso, is a sharp Chinese yuan depreciation. Looking at the 20-year old chart of USD/CNY, it is clear that it bottomed (i.e. the yuan peaked) in 2014. A large cup and handle pattern has formed, and the chart shows that there is not much resistance to the upside if the USD/CNY breaks above 7.00. So far, however, the pullback in the US dollar is giving the yuan a much-needed breather.

Source: Tradingview, Wealth Securities Research

Divergent views on the peso

Market participants have divergent forecasts on the peso. Global investment institutions such as Credit Suisse, Deutsche Bank, ING Bank, and major local banks forecast the peso to trade back to the 54 levels. On the other hand, Goldman Sachs has a six-month target of 51.50 and 12-month target of 51 for the Philippine peso. Either way, we are optimistic that the peso is now more stable than it has been in previous years.

BSP assumes peso at 52 this year, 51.50 next year

Last week, BSP Deputy Governor Diwa Gunigundo mentioned that for their macroeconomic policies, the BSP economic team uses an exchange rate of 52 for this year and 51.50 for next year. While risks such as the escalation of the trade war and possible sharp depreciation of the yuan still abound, the peso is currently in a much stronger position. With US and global interest rates dropping, abating US dollar strength, moderate inflation, lower oil prices and an attractive positive carry, the Philippine peso should remain stable.

Philequity Management is the fund manager of the leading mutual funds in the PhilippinesVisit www.philequity.net to learn more about Philequity’s managed funds or to view previous articles. For inquiries or to send feedback, please call (02) 689-8080 or email [email protected].

- Latest

- Trending