Regions to impose taxes under federal gov’t

MANILA, Philippines — Under a proposed Philippine federal government, both the national and regional governments would have the power to impose taxes and exercise control over their respective budgets, while at the same time making sure that no double taxation will happen.

The consultative committee (Concom) reviewing the 1987 Constitution had proposed that certain taxes being charged by the Bureau of Internal Revenue (BIR) be transferred to the regional governments, said Concom spokesman Ding Generoso.

According to the Concom’s proposal, the federal national government still has “the power to levy and collect all taxes, duties, fees and other impositions.” The same provision further noted the transfer of certain taxes and fees to the regions, with the phrase “except those granted in federated regions.”

Generoso named these taxes and fees that the Concom proposes to be transferred to the regional governments as follows: estate tax, donor’s tax, documentary stamp tax, professional tax, games and amusement tax, environmental and pollution tax and similar taxes, road user’s tax, transport franchise and driver’s license fees, and local and other taxes that may be granted by federal law.

The taxes could be charged by the regional governments since these transactions happen in a particular locality, Generoso noted.

He said these taxes would benefit the regions more and would no longer be charged by a national agency based in Manila.

“Later on, as we go along and as we see the regions developing and becoming economically sustainable and viable, Congress may, by law, give them additional taxation powers,” he added.

With the setup, Generoso said that the Concom estimates that between P40 billion and P50 billion worth of taxes and fees will be in the hands of the regions, depending on the level of economic activity.

Generoso also gave assurance that no double taxation would happen under the federal government.

Anchored on the idea that federalism – under the Concom’s proposal – promotes distribution of power to the regions, he said that transferring certain taxes to the regions could promote “cooperative competition.”

“If you want to generate investments in the region, will you impose additional taxes so you become competitive against other regions? No, because they have to reckon with being able to cooperatively compete with the other regions for investments and business activity,” he said.

Besides, the Concom also proposes that whenever Congress enacts taxation laws, they must make sure that taxes imposed by these laws would be “uniform, equitable and progressive,” whether national or regional.

The federal regions, the Concom also proposed, will also have the power to create their own budgetary requirements.

“Regional governments can now attend to the priorities and needs of their constituents faster, more effectively and efficiently,” Generoso also said.

This kind of setup can shorten the budgeting period between one and a half to two years, unlike the current process of approval of budget for government programs and projects, which Generoso explained could take up to three years.

To achieve the shortened budgeting process, the regional legislative assemblies “would now have to create their own formula” for sharing revenues with the provinces and highly urbanized cities.

The regional legislative assemblies, led by the regional governor and the deputy regional governor, would create the budget for regional governments.

So far, the Concom proposes that 18 regions be created under the federal government. Generoso explained that these are the 17 regions already existing under the current government, with the addition of the Negros Island Region (which includes the province of Siquijor) and the establishment of the Bangsamoro region that will replace the Autonomous Region in Muslim Mindanao (ARMM).

Meanwhile, the Concom also proposed that certain revenues from tax collection be distributed to the regions.

After totaling revenues from the four top revenue sources of government – individual and corporate income tax, excise tax, value-added tax and customs duties – half of the revenue should be distributed equally to the regions while the other half will be retained by the federal national government for its own operations and programs.

The Concom also presented that a so-called “equalization fund,” wherein three percent of the annual national budget will comprise the fund, will be allotted to “fill in the gap for the needs of other regions that may fail to achieve the same level of revenue collection as other regions,” Generoso said.

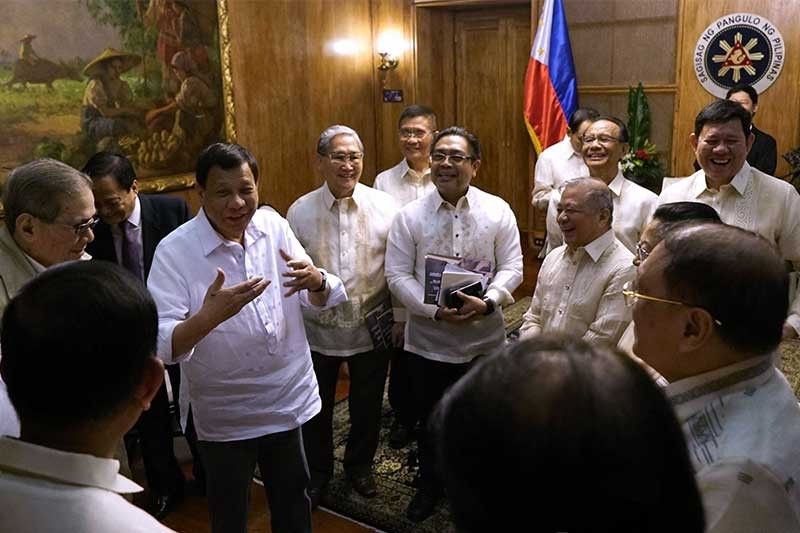

Members of the Concom, led by former chief justice Reynato Puno, are expected to vote on the draft of the proposed federal constitution today, and to submit it to President Duterte on or before July 9, Generoso said.

- Latest

- Trending