Quick takes from around the market

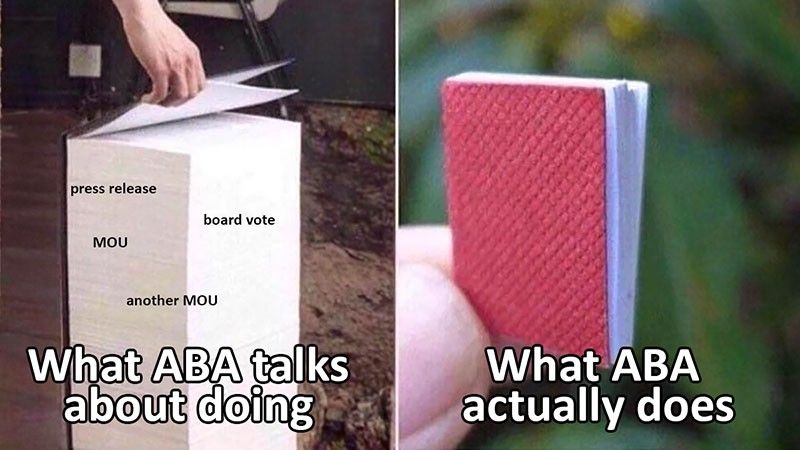

1. AbaCore Capital [ABA 1.03 unch; 64% avgVol] [link] said that the board of its subsidiary, Philippine Regional Investment Development Corp. (PRIDC), approved a measure giving the company the ability to sell up to a 40% equity interest in PhilStar Development Bank at a valuation pegged to 1.5 times adjusted book value. The ABA board approved a measure authorizing the company to use a P500 million credit line with Philippine Business Bank [PBB 8.60 unch; 52% avgVol] to “build its investment portfolio, develop its properties, provide additional funding for its current projects, and to augment working capital”.

MB quick take: ABA has been all bark and no bite for years, and this disclosure looks like more of the same. A teaser of something that might come. I’m just waiting to see the tangible things that it’s actually going to do. It’s sitting on a ton of potential in Batangas.

2. Steniel Manufacturing [STN suspended] reported yesterday that certain non-public shareholders sold a total of 130.9 million STN shares to “unrelated third parties” to boost STN’s public float to 22.27%. The move puts STN in compliance with the PSE’s minimum public ownership threshold of 20%, and allows STN to avoid involuntary delisting procedures. But as the PSE pointed out, STN is still in violation of the exchange’s structured reportorial requirements, so “trading of STN shares will remain suspended until further notice”.

MB quick take: The last annual report that STN filed was for FY21, so it’s more than a year behind on its reporting. As covered yesterday, the PSE is required by the rules to initiate involuntary delisting procedures against any company that fails to comply with the reporting requirements after the three-month suspension completes without compliance. I’m not sure how much more runway this company needs to get its reporting house in order. Maybe the PSE knows. Maybe that’s why they seem to be slow-walking this one.

3. Century Properties [CPG 0.30, down 1.6%; 32% avgVol] [link] announced the launch of its first move into the hospitality sector. CPG opened a 152-room Novotel Suites location at its Acqua development, which CPG CEO Marco Antonio said was just the beginning of the company’s move into the hospitality sector. According to BusinessMirror, Mr. Antonio declined to name any future projects.

MB quick take: In the Philippines, it pays to do what the government wants. One of the government’s big multi-year priorities is to push a ton of money and effort into the domestic and international tourism space, so this reads to me like CPG just trying to catch a piece of what could be an industry on the rise. For all of the group’s brash bluster, its recent moves have been oddly calculating.

-

Merkado Barkada is a free daily newsletter on the PSE, investing and business in the Philippines. You can subscribe to the newsletter or follow on Twitter to receive the full daily updates.

Merkado Barkada's opinions are provided for informational purposes only, and should not be considered a recommendation to buy or sell any particular stock. These daily articles are not updated with new information, so each investor must do his or her own due diligence before trading, as the facts and figures in each particular article may have changed.

- Latest