Quick takes from around the market

VistaREIT [VREIT 1.71 0.58%] [link] still has tax declarations and Condominium Certificates of Title pending with regulators. The stock still traded within the same pattern of “opening flash-crash”, followed by modest recovery and a late “push” to close the price up. Stock still feels heavy. Still waiting for an update from the stabilization agent to see how much lifting they’ve had to do to keep the stock from drifting lower. My feeling is: “quite a bit”.

Aboitiz Power [AP 29.00 0.51%] [link] was penalized P8.4 million by the Energy Regulatory Commission for exceeding the allowable outage days (6.8 days) for its power plants owned and operated by AP’s wholly-owned subsidiary, Hedcor Bukidnon. The run-of-river hydro facilities were damaged by flood, and required 102 days of “excess unplanned outage” to repair. AP will appeal the penalty, but the amount is really just salt on the much larger wound which was losing all of those days of electricity production. This is a risk for run-of-river systems, and worth keeping an eye on to see if changing weather patterns could expose this project (and others) to similar outages in the future.

SM Investments [SM 785.00 3.03%] [link] announced that it incorporated a subsidiary in Singapore (SMIC SG Holdings Pte. Ltd.). The subsidiary is registered as an investment holding company, and exists to take “potential minority stakes” in foreign companies. Analysts, like Chris Mangun with AAA Equities, think that this is part of SM’s strategy to diversify its portfolio outside of the Philippines and China. All the big conglos are doing it and in that regard, SM is showing up a little bit late to the “growth outside of PH and China” party.

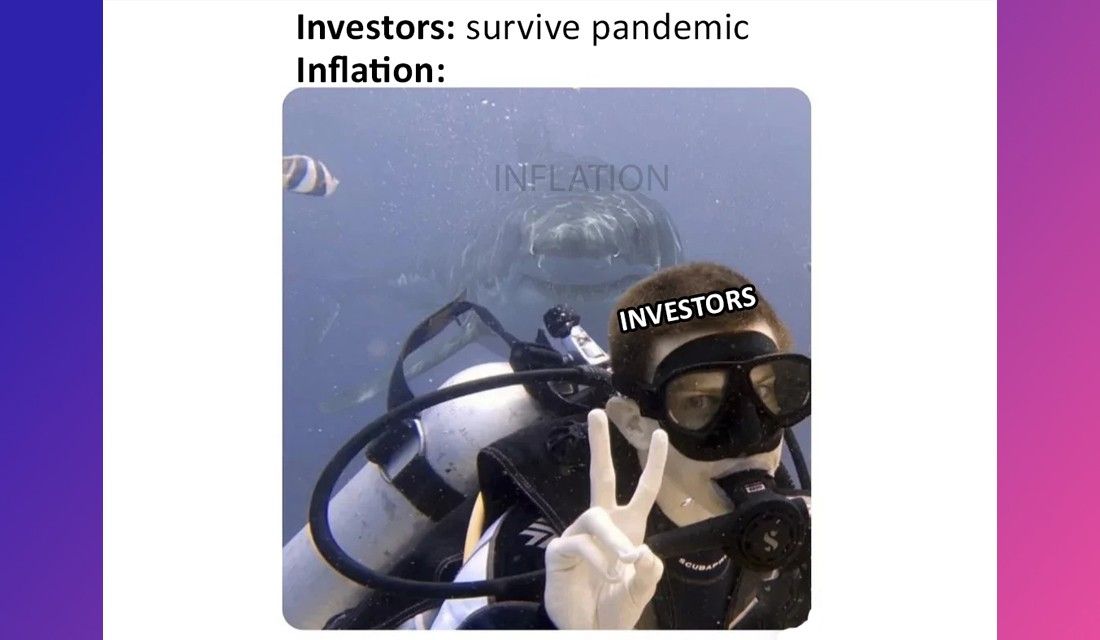

Inflation [link] is going to be the talk of 2022. Generally, there are two types of inflation; (1) “demand-pull” inflation, which is when demand exceeds the supply of products or assets, and (2) “cost-push” inflation, which is when higher input prices (labor, commodities) get passed on to consumers through higher product prices. Raising interest rates is a way to address demand-pull inflation, since raising the cost of “renting” money to buy stuff makes people and corporations less likely to buy stuff (reduces demand), but it doesn’t really change the demand for things like fuel, food, or essential components, like microchips, that are increasing in cost due to supply chain issues. Raising the cost of renting money doesn’t make a microchip less scarce, or suddenly increase wheat production. The cost-push inflation in food, for example, will probably not be impacted by the moves by central banks to raise interest rates.

--

Merkado Barkada's opinions are provided for informational purposes only, and should not be considered a recommendation to buy or sell any particular stock. These daily articles are not updated with new information, so each investor must do his or her own due diligence before trading, as the facts and figures in each particular article may have changed.

- Latest