From bear to bull

Most stock markets have undergone a dramatic shift to start the year, transitioning from a bear market to a bull market. Peak inflation, a slower pace of interest rate hikes, a reversal in the value of the US dollar, and China’s reopening have attracted investors back to stocks. Note that 74 percent of the 50 countries that compose the MSCI All-Country Weighted Index (ACWI) are already in a bull market. A bullish stock market is defined as a market index rising at least 20 percent from its lows.

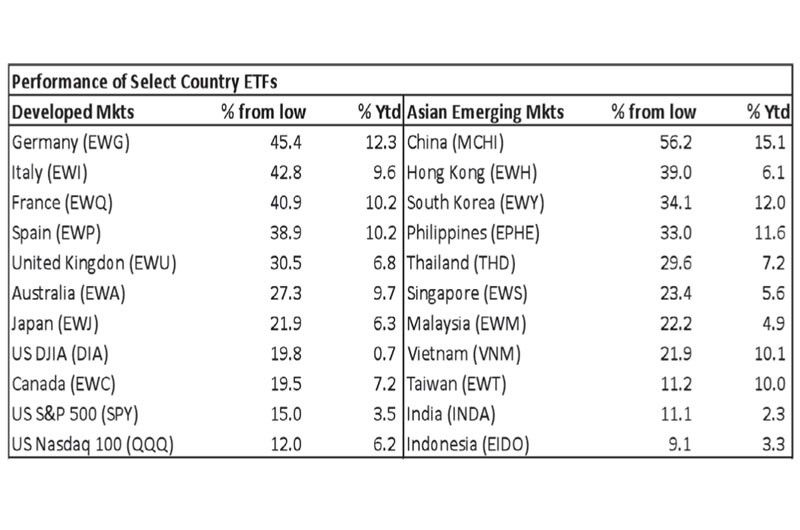

Philippine stocks have also entered a bull market, with the PSE Index climbing 25 percent from its October low and the iShares MSCI Philippines ETF (EPHE) rising 33 percent.

Source: Bloomberg, Wealth Securities Research

China is leading this new bull market, following a tumultuous 2022 due to the regulatory crackdowns, the “common prosperity” campaign, and the economic impact caused by COVID-19 restrictions. However, the recent easing of regulatory measures and support initiatives aimed at reviving the struggling property sector have provided a further boost to the stock markets in China and Hong Kong.

The performance of China-focused index funds has been particularly strong, with the iShares MSCI China index fund (MCHI) rallying as much as 56 percent from its lows last year. The iShares MSCI Hong Kong index fund (EWH) has also seen impressive gains, rising as much as 39 percent. These gains reflect the renewed investor confidence in the Chinese economy and the country’s ability to recover from the pandemic-induced downturn. Major investment banks such as Goldman Sachs, Morgan Stanley, and UBS are bullish on China this year.

Europe viewed as undervalued, attractive

European stock markets have also experienced strong returns, driven by several factors, including easing inflation, a stronger euro, and a lack of an energy crisis due to mild weather. These conditions have supported appetite for stocks in the region. Furthermore, Europe is currently viewed as both attractively valued and under invested, making it an attractive opportunity for investors. European banks are trading at multiples well below their 20-year average, making them an attractive opportunity for those seeking value in the market.

US stocks losing its luster?

According to the latest survey of Bank of America, investor sentiment is shifting away from US stocks and towards Europe and emerging markets. The bank’s global fund manager survey for January found that investors are currently the most underweight in US stocks since 2005, with a net 39 percent underweight position. In contrast, investors are overweight in Europe and emerging markets, driven by factors such as the recent weakness of the US dollar. The US dollar index (DXY) has dropped approximately 11 percent since its peak in October, making non-US assets more attractive to global investors and driving liquidity back to emerging and non-US developed markets.

Major rotation out of US

For over a decade, the US stock market has outperformed the rest of the world by almost 250 percent. However, this year, there are signs of a major rotation out of the US and towards non-US stocks. The chart below illustrates this trend, with the SPDR S&P 500 ETF (SPY) vs. MSCI All-Country Weighted Index ex-US ETF (ACWX) hitting new 52-week lows and breaking down the 12-year upward trendline that started in 2010, indicating that investors are increasingly looking outside the US for investment opportunities.

Source: Tradingview.com, Wealth Securities Research

Major risks to the nascent bull

Despite the recent peak in inflation and reversal in the dollar, there are still significant risks to the nascent global bull market. While inflation may have reached its peak, it may remain elevated for an extended period. Interest rates may also stay higher for longer. Additionally, the depth and duration of the possible recession remain uncertain. A deep recession will affect the global economy and stock markets worldwide.

The ongoing war in Ukraine remains a significant risk. This was highlighted by JP Morgan Chase CEO Jamie Dimon at the recent World Economic Forum in Davos. He stressed the importance of monitoring the situation closely, noting that the war could greatly affect global energy, food, and economic exposures. This also aligns with warnings from the World Bank that the war could lead to a major recession and stagflation in vulnerable countries.

Philequity Management is the fund manager of the leading mutual funds in the Philippines. Visit http://www.philequity.net to learn more about Philequity’s managed funds or to view previous articles. For inquiries or to send feedback, please call (02) 8250-8700 or email [email protected].

- Latest

- Trending