Energy crunch

The world is facing the worst power crunch in decades. This is happening as the global economy reopens and energy demand is exploding. More than half of the provinces in China are experiencing outages and power rationing in both industries and households alike. In the UK, people lined up for fuel for days. Britain had to put its army on standby after 90 percent of petrol stations ran out due to panic buying and a post-Brexit shortage of tanker drivers. Here in the Philippines, oil companies raised gasoline prices by P1.45 per liter, diesel prices by P2.05 per liter, and LPG prices by P4.00 per kilo to reflect the movements in the global oil market.

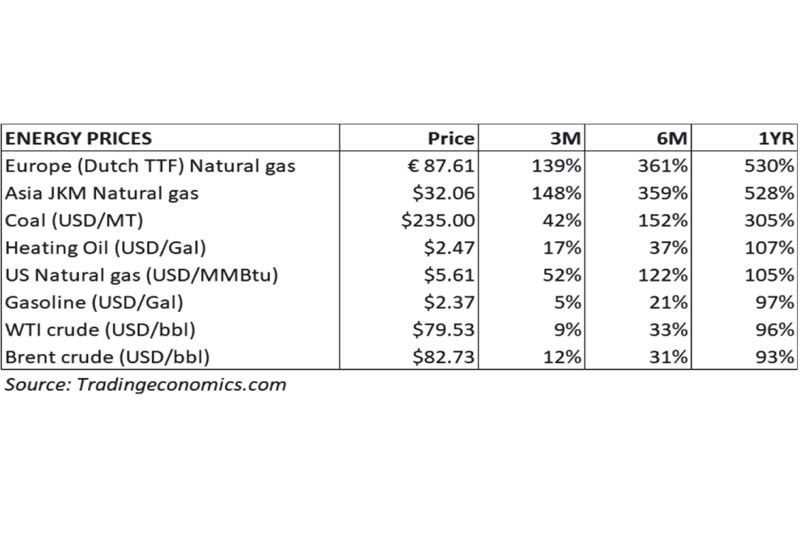

Energy commodities soar

Among the biggest gainers are natural gas and coal, which hit all-time highs amid shortages in Europe and China. Meanwhile, crude oil spiked to its highest in seven years after the OPEC+ group of producers maintained its planned output increase instead of expanding it further.

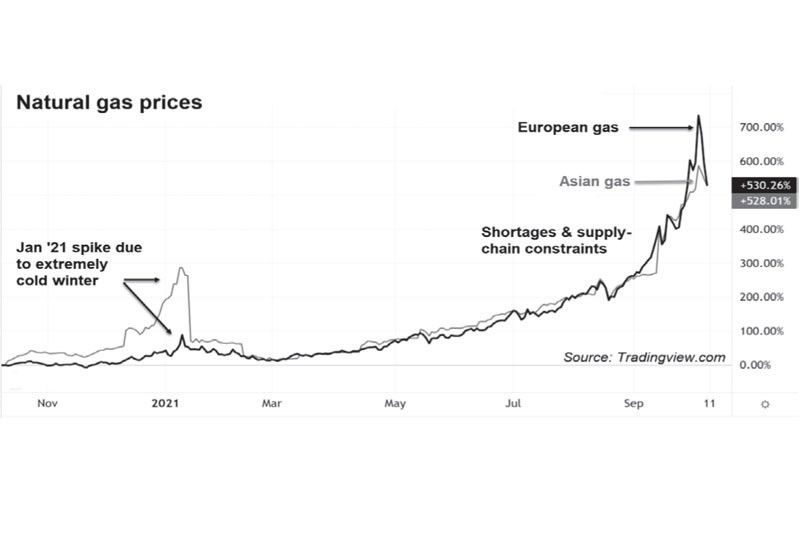

Natural gas explodes higher

The shortfall of natural gas is evident in Europe and Asia, where spot prices have exploded to record highs. Last Tuesday, the European natural gas benchmark TTF Netherlands rocketed to an all-time high of 116, showing more than 700 percent gains for the year before the sharp 25 percent pullback at end of the week. The Asia-Pacific spot LNG price is mirroring the move. The Japan-Korea Marker (JKM) benchmark soared to a record high of 35.06 on Tuesday.

Why are global energy prices skyrocketing?

1) Global oil demand recovering back to pre-COVID levels – The International Energy Agency (IEA) expects global oil demand to climb back above 100 million barrels per day by the second quarter of 2022. It cited the solid pent-up demand and the progress in vaccination as reasons for the sharp rebound.

2) Supply disruptions in coal and gas – There have been disruptions in coal production as heavy rainfall affected supplies from Australia to Indonesia, while Chinese domestic coal production has been declining for years. There were also supply disruptions in natural gas production from Australia, Russia, and the US following hurricane Ida.

3) Russia’s lower gas output – There were disruptions in Russian gas supplies earlier in the year. Its slow delivery of natural gas to the European region has raised questions about whether this is deliberate to speed up the EU’s approval of Russia’s Nord Stream 2 pipeline that delivers straight to Germany, bypassing Ukraine and Poland.

4) Diesel and heating oil stockpiles at 20-year lows – Many countries, including the US, are heading into winter with the lowest inventories of diesel oil and heating oil in 20 years. The previous harsh winter, which resulted in the 2021 winter blackout in Texas, caused a considerable drawdown in US gas and diesel supplies.

5) Drilling activity remains low – Crude and natural gas drillers, traumatized by last year’s unprecedented collapse in demand and prices, have not responded well to the recent market rebound. Drilling activities are forecast to increase by only eight percent this year, according to Moody’s.

6) Decommissioned coal mines – Years of decommissioning coal mines to reduce carbon emissions and transition the economy from fossil fuels to clean energy makes it a significant challenge to boost output.

7) US crude oil production remains low – Despite the oil price rally, US shale producers see minimal output expansion. A more capital-disciplined US shale sector is now showing restraint and enjoying record free cash flows. Since the second half of 2021, the US crude oil output remained at around 11 million BPD or15 percent below the pre-COVID average of 13 million BPD.

8) OPEC+ group reluctant to pump more oil – Opec+ has resisted calls to ramp up supply. Last week, the group decided to stick with its plan to raise oil output modestly and gradually instead of expanding it further. This increases the likelihood that crude prices will remain elevated.

Putin to the rescue

Last Wednesday, just as the European natural gas prices soared to a record high of 132.93 (up 42 percent in just three days), Putin announced to the world that Russia would send more gas supplies to Europe. This caused natural gas prices to slide 35 percent from record highs. Meanwhile, other countries are scrambling to address the monumental rise in prices. In an unprecedented move, China sold a part of its Strategic Petroleum Reserve (SPR). It also ordered Chinese coal mines to ramp up production to ease its power crisis. Vice premier Han Zheng directed state-owned energy companies to “secure fuel supplies for winter at all costs.” The US is considering and has set up plans to tap its SPR.

Energy prices will remain volatile

While the actions of Russia, China, and the US have caused energy prices to ease last week, many analysts see only a temporary respite. Unless the supply-demand imbalances in the energy market are addressed, prices are likely to remain volatile in the foreseeable future. We hope our government will be prepared, proactive, and decisive in addressing this looming energy crunch.

Philequity Management is the fund manager of the leading mutual funds in the Philippines. Visit www.philequity.net to learn more about Philequity’s managed funds or to view previous articles. For inquiries or to send feedback, please call (02) 8250-8700 or email [email protected].

- Latest

- Trending