US takes the lead

US stocks closed at new all-time highs last Friday. US jobs growth for June came in better than expected, signaling a stunning post-pandemic recovery aided by its successful vaccine rollout. Non-farm payrolls increased 850,000 last month, beating market expectations for 720,000 new jobs and substantially better than the 583,000 revised figure for May.

The broad S&P 500 rose for the seventh straight day of record highs, the longest streak since 1997. Closing at 4,352.34 last Friday, the S&P 500 has surged 15.9 percent year-to-date. Tech-heavy Nasdaq Composite also closed at a new all-time high of 14,639.32, gaining 13.6 percent year-to-date. Meanwhile, the Dow Jones Industrial Average has jumped 13.7 percent to 34,786.35 this year and is less than one percent off its May high.

Vaccination + fiscal & monetary stimulus

We have written numerous articles on COVID-19 and explained that the key to the stock market’s recovery is vaccines. The fast and expansive rollout of effective vaccines in the US has sharply reduced COVID cases and led to a broader economic reopening. With a 54.6 percent vaccination rate (47 percent fully vaccinated), the US is now No. 1 in Bloomberg’s COVID resiliency ranking.

In addition, the unprecedented fiscal and monetary stimulus have spurred investor optimism on the post-pandemic recovery in the US. As a result, economists are now looking for a GDP growth approaching 10 percent for the 2nd quarter. Meanwhile, the IMF earlier raised its 2021 US GDP growth forecast to 7 percent, the fastest pace in a generation.

Recovering from the COVID carnage

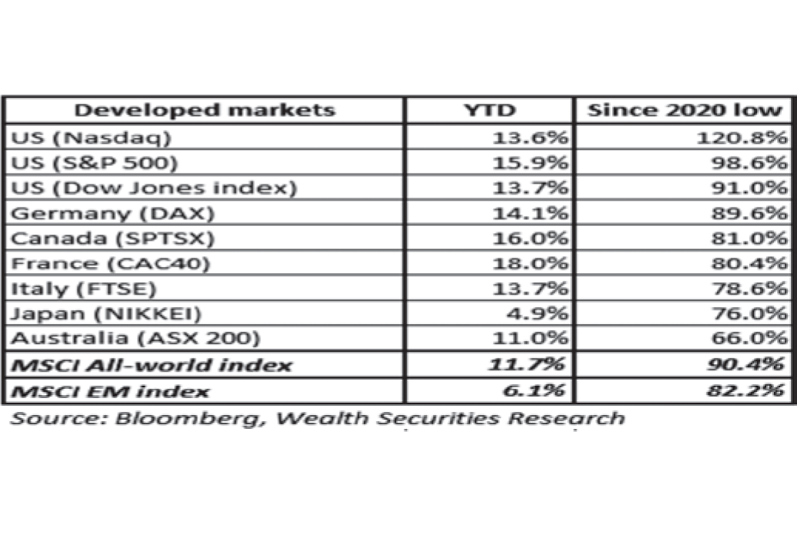

Global stocks have recovered strongly from the pandemic-induced carnage in 2020. The MSCI All-Country Weighted Index closed at an all-time high last Friday, surging 90.4 percent from its 2020 low. From the 2020 lows, the Nasdaq Composite leads developed market indices with a 120.8 percent gain. The S&P 500 and the Dow Jones Industrial Average are up 98.6 percent and 91 percen from their respective 2020 lows. Other indices like the German DAX and Canadian TSX Composite also hit record highs last week.

PSE Index - no longer the worst in the world

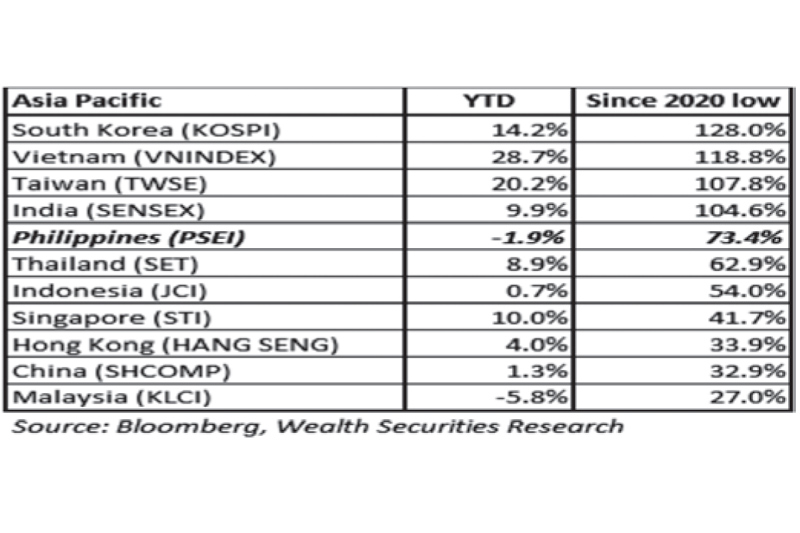

Since the 2020 lows, South Korea, Vietnam, Taiwan, and India are the best performing stock markets in Asia. Their respective stock indices recorded new all-time highs last week and have more than doubled from their 2020 lows. Despite being the epicenter of the COVID Delta variant, India is doing well as COVID cases have gone substantially down since May.

At one point, the PSE Index was the worst-performing index in the world when it reached 6,080 on May 14. However, the PSEI has since rebounded sharply after the vaccine rollout improved in June. While still slightly negative this year, the PSE Index has rallied 73.4 percent from its 2020 low of 4,039. It is now at 7,002, recovering 15.1 percent from its 2021 low. Meanwhile, Colombia is now the worst-performing market globally, down -10.3 percent year-to-date. This is followed closely by Peru, which is down -9.8 percent year-to-date. Malaysia is the worst in Asia, declining -5.8 percent year-to-date.

Inflation concerns subside

Over the past month, investors have lowered their inflation expectations, causing global stock markets to extend their rally. Despite signals from the Fed that it may cut back on QE sooner than expected, the yield on the benchmark 10-year US Treasuries has fallen to three-month lows at 1.42 percent.

US dollar continues to strengthen

As we wrote last week, the US dollar reversed its intermediate downtrends against major and emerging market currencies. The US dollar index (DXY) rose 2.81 percent in June, its biggest monthly gain since November 2016. The euro fell to an intraday low of 1.1807 last Friday, the weakest in 12 weeks. Meanwhile, the peso hit 49.31, its weakest level since July 2020. With the US ranking No. 1 in terms of COVID resiliency, not only are US stocks leading, but the US dollar likewise continues to strengthen.

Philequity Management is the fund manager of the leading mutual funds in the Philippines. Visit www.philequity.net to learn more about Philequity’s managed funds or to view previous articles. For inquiries or to send feedback, please call (02) 8250-8700 or email [email protected].

- Latest

- Trending