Financial markets finish strong in turbulent 2020

MANILA, Philippines — Financial markets ended 2020 in a high note on Tuesday, helping cut losses from massive sell-offs for most of the year that investors were barreled by uncertainties from the pandemic.

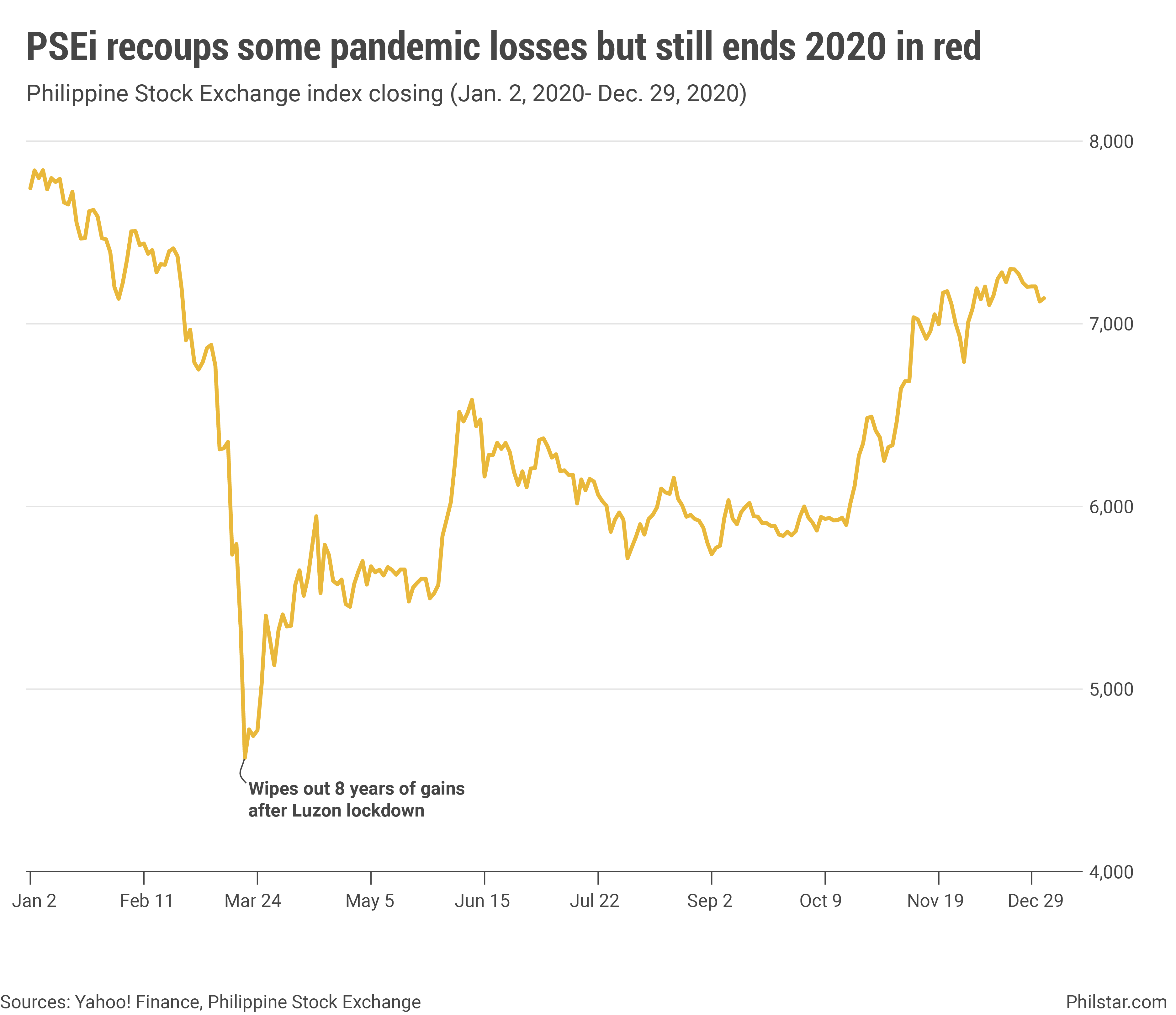

The Philippine Stock Exchange index (PSEi) inched up 0.25% to close at 7,139.71. The broader all-shares index, meanwhile, gained a slightly bigger 0.43%.

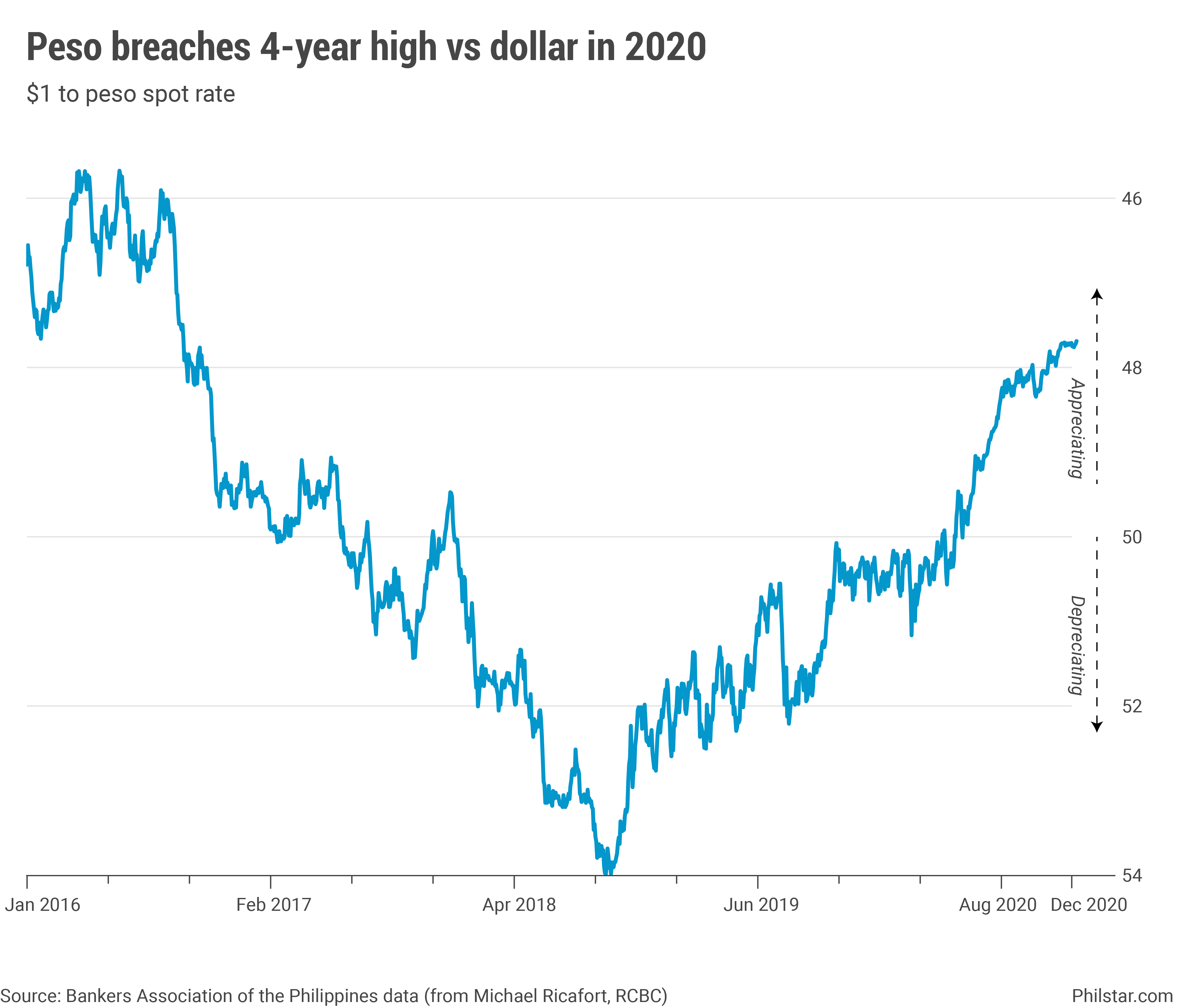

At the foreign exchange market, the peso also ended 2020 with fireworks, outperforming other Asian currencies this year. The local unit firmed up to P48.023 against the US dollar, stronger than the previous day’s close of P48.055.

For the entire year however, the peso and PSEi had varying performance. The benchmark index shed 8.6% of its value at the end of last year, while the peso, owing to weak imports that remarkably slashed dollar demand this year, soared 5.3% against the greenback.

Analysts painted a rosy outlook for both the bourse and the peso next year, counting on promises from the Duterte administration to facilitate economic recovery. For the stock market, April Lee Tan, vice-president and research head at COL Financial Group Inc., a brokerage, said this could mean more companies going public, especially technology-based firms.

But Beatrice Lopez also of Regina Capital was cautiously optimistic. “We cannot definitively say if (companies) will revisit (their IPO) plans in 2021, especially since the business environment has been challenging,” she said in a Viber message.

In 2020, only three companies braved market volatility by raising funds through getting listed, half of the six originally expected by the PSE. They were MerryMart Consumer Corp., Ayala-led AREIT Inc. and Converge ICT Solutions Inc., the latter raising a record amount.

As for the peso, Jonathan Ravelas of BDO Unibank Inc. and Robert Dan Roces of Security Bank Corp. both expect the currency to weaken to as much as P50 to a dollar in 2021, which is good news since it means imports finally rebounding from the ongoing 18-month slump, signaling stronger local demand.

“Improved global trade means a wider trade deficit and more USD demand locally. Expansionary policy in the US means a support for a stronger (US) currency,” Roces said in an online exchange.

- Latest

- Trending