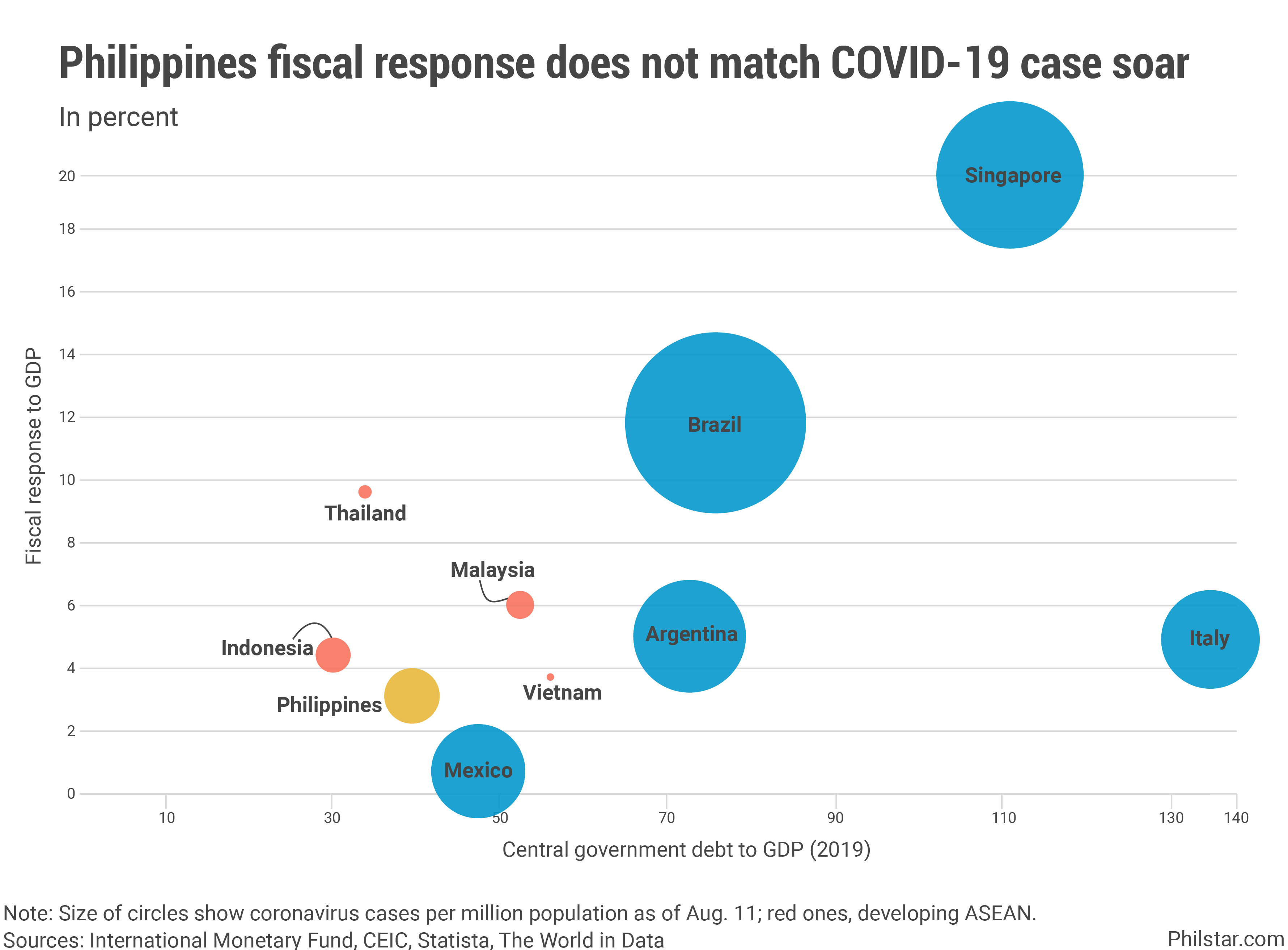

Philippines still lags ASEAN in fiscal response while cases spike, economy sinks

MANILA, Philippines — The Philippines is home to Southeast Asia’s largest coronavirus caseload, recorded the deepest contraction in the region, and, as it now appears, has allocated the least amount of budget to fight the pandemic.

According to the International Monetary Fund (IMF), the country has so far allotted P595.6 billion in direct fiscal support to counter the effects of the coronavirus disease-2019 (COVID-19) pandemic. The amount is equivalent to 3.1% of economic output.

While appearing to be sizable, the government’s fiscal stimulus is the lowest in developing Southeast Asia. In Indonesia, which until recently was host to the largest number of COVID-19 infections before Philippines surpassed it, a stimulus worth 4.4% of gross domestic product (GDP) was readied.

Three tranches of fiscal support, meanwhile, were laid out in Malaysia. Combined, the stimulus which include wage subsidies and tax relief, has an amount corresponding to 6% of GDP, IMF data showed.

The comparison gets more interesting when one considers that Malaysia has a bigger debt pile vis-à-vis GDP than the Philippines as of last year. This means that between Kuala Lumpur and Manila, the latter has more fiscal space to boost spending. The same case can be said when compared to Hanoi.

Within the developing region, Indonesia and Thailand have better debt metrics, and bigger stimulus, than the Philippines. Singapore, which is a developed nation and has a larger number of COVID-19 cases per million population than Philippines, is spending the equivalent of 19.7% of GDP.

Outside Southeast Asia, Mexico, which is behind Philippines one notch in terms of credit rating under Fitch Ratings and S&P Global Ratings, is faring worse than the Philippines in the value of fiscal stimulus. Italy, which is rated similarly with Philippines under Moody’s, but with a much bigger debt pile and a developed economy at that, has allotted way more budget against COVID-19.

In detail, the Philippines’ stimulus plan is not far from that advocated by neighboring countries. Apart from cash transfers to poor households, additional health budget, loans and guarantees are also offered by Manila’s peers. The key difference, however, is the amount, as economic managers tried to limit fresh allocations for fears it would damage the country’s investment grade rating.

The amount set aside does not also include interventions from the central bank, which has cut interest rates to record-lows to spur borrowing and give consumers and investors cash for economic activities. For Sonny Africa, executive director at IBON Foundation, a non-government think tank, the Duterte administration needs to do more.

“The logic of a stimulus package is to provide an adrenaline boost to a faltering economy. And the economy is certainly faltering,” Africa said in an article posted on IBON’s website on Tuesday.

“What’s clear though is how small their proposals are for the magnitude of the crisis at hand,” he added. — with Prinz Magtulis

- Latest

- Trending