Jobless rate likely hit highest level since financial crisis in Q2— Nomura

MANILA, Philippines — The proportion of jobless Filipinos likely rose to a level not seen since the onset of global financial crisis as disruptions brought by the coronavirus disease-2019 (COVID-19) and the lockdowns implemented to control its spread put people out of work.

In a report sent to the media Monday, Japan-based investment bank Nomura estimated that jobless rate would likely jump to 8% this quarter when the next reading on unemployment numbers will be based.

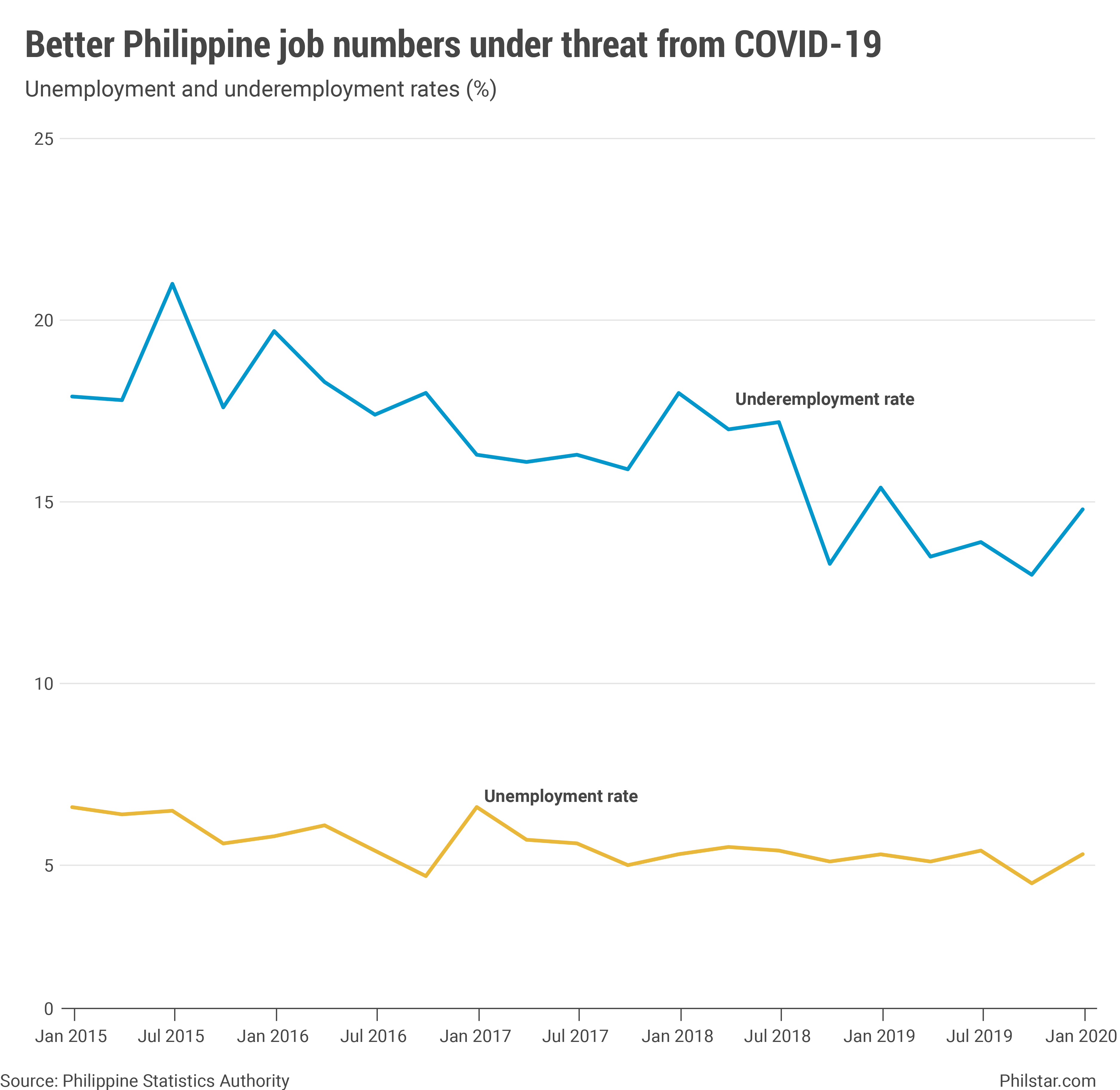

Jobless figures are gauged every quarter, and the latest Nomura forecast, if realized, would mean jobless rate hitting a 13-year high and marking a break from a general decline in unemployment numbers since 2007. As of January, government data showed jobless rate hit 5.3%, up from 4.5% in October last year which was the lowest since 2005.

Nomura’s grim assessment was based on the labor department’s report over the weekend where the agency said 1.05 million Filipinos in the formal sector were displaced by the outbreak and the lockdowns implemented by national and local governments.

While President Duterte placed the entire Luzon island in enhanced community quarantine until April 30, local governments in 1,488 municipalities and 122 cities also enforced their own localized lockdowns as of April 6, data showed.

“We believe the DOLE numbers are still likely to rise, as these are based on firms claiming assistance under an amelioration program for those affected by the outbreak. The lockdown was also extended to end-April,” Nomura said.

On top of that, the government has also fallen behind its regional peers in laying out a clear budgetary support to counter COVID-19 impact on the public, leaving thousands of displaced workers with little to no earnings.

Indeed, the Bangko Sentral ng Pilipinas (BSP) was left with the tough job of supporting the economy with “deeper” rate cuts forthcoming even after its 50 basis-point decrease two weeks ago, and a government bond-buying program worth P300 billion meant to increase state liquidity.

Against this backdrop, BSP is expected to do more, with Nomura projecting another 75 bps cut in rates to 2.5% “delivered in the second quarter,” starting on May.

Apart from rate cuts to encourage banks to lower loan interest rates, BSP Governor Benjamin Diokno already indicated further reduction on bank reserves by another 200 bps, in a bid to free up more cash for banks to lend, and boost economic activity.

“With discussions within government of a supplementary budget still limited, the Philippines appears to be lagging regional peers on urgently needed fiscal measures,” Nomura said.

- Latest

- Trending