YEARENDER: ‘Philippines economy to remain resilient amid challenges’

MANILA, Philippines — The Philippine economy is expected to remain resilient to internal and external uncertainties weighing on trade and investment, thanks largely to strong consumption and the continued implementation of the government’s infrastructure program, according to economic managers.

Following a periodic review, the inter-agency Development Budget and Coordination Committee (DBCC) trimmed last month the economic growth target for 2019 to a range of six percent up to 6.5 percent from the previous full-year projection of six to seven percent in consideration of the actual growth figures for the first three quarters of the year.

Growth targets for 2020 throughout 2022, meanwhile, was pegged at 6.5 percent to 7.5 percent, unchanged for 2020, but lower than the previous target of seven to eight percent for 2021 and 2022.

Even with this growth rate, the country is still be expected to be among the fastest growing economies in Asia.

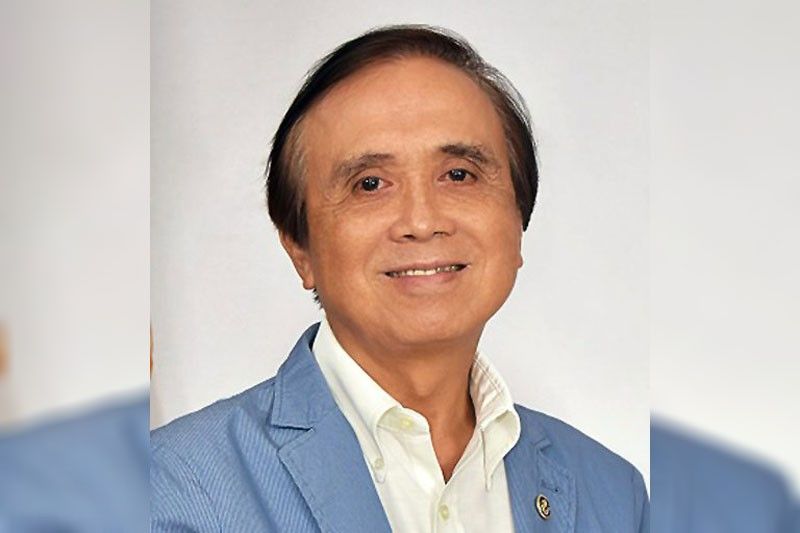

Socioeconomic Planning Secretary Ernesto Pernia believes that with the downward revision, the growth target for 2019 will be more attainable because of the robust consumption in the fourth quarter owing to the holiday season and strong inflow of remittances.

“That is achievable given we have already reached 6.2 percent in the third quarter. In the fourth quarter, consumption spending really got boosted by bonuses,” he said.

This as remittances from overseas Filipino workers also surged at the start of the fourth quarter in October by 7.7 percent year-on-year.

“That has contributed to increased consumption spending which accounts for about two-thirds of gross domestic product. That can be a big boost for the fourth quarter,” said Pernia. “We also have our catch-up plan on spending on infra projects and that also made some impact on increasing economic growth for the fourth quarter.”

Economic growth accelerated to 6.2 percent in the third quarter, in line with market expectations, supported by stronger government spending and household consumption, recovery in the agriculture sector and steady growth in services.

This was faster compared with the 5.5 percent gross domestic product (GDP) growth in the second quarter of the year and six percent in the third quarter of 2018. This brings the year-to-date average to 5.8 percent which is slightly below the lower end of the government’s full-year growth target.

Risks

While the growth outlook for 2020 is stable, Pernia noted that several domestic and external challenges could dampen growth prospects this year.

The prevailing trade war between the US and China will continue to put a strain on trade prospects, putting pressure on the country’s already weak exports.

“On the downside, the trade war between the US and China is still continuing although it has softened a bit and we hope it will soften further,” said Pernia, referring to the recent so-called Phase One trade deal agreed upon by the two countries which involves the rollback of some of the tariffs imposed on Chinese goods exported to the US.

This development has the potential to revive the manufacturing supply chain in Asia.

The possible water shortage in the summer of 2020 as the tail end effects of El Niño are felt will also create pressure on water security in the country.

This concern may be aggravated by the prevailing uncertainties over the future of the water contracts of Metro Manila water concessionaires Maynilad and Manila Water as their concession agreements with the government come under review and renegotiation.

“There is a possible water shortage in the summer months especially given that the concessionaires are now set back in their plans,” he said. “Or maybe they will be pushed forward, they will be pressured to deliver better service in 2020.”

NEDA Undersecretary Adoracion Navarro said that in the event of supply shortage from the Angat Dam – which supplies 98 percent of Metro Manila’s water needs – supply for irrigation would be the first to be cut to give priority to the supply of potable water to households.

Possible delays in infrastructure projects is also a risk to growth in the coming year.

Upside

On the upside, no delay in the passage and enactment of the 2020 national budget is seen for next year, ensuring the funding for the government’s priority programs and projects.

“So that would already be a good start for the year and in the home stretch. Government spending on infra will increase further because we want to finish as many infrastructure projects as possible,” said Pernia.

Stable inflation and lower unemployment is also seen to give consumption a boost in the coming year.

Preliminary results of the 2019 Annual Estimates of Labor Force Survey (LFS) conducted by the Philippine Statistics Authority showed that based on the average of the four LFS rounds – January, April, July and October – unemployment eased during the year even as more Filipinos joined the workforce.

“Private consumption will be really robust given the slow inflation, especially food inflation,” said NEDA Undersecretary Rosemarie Edillon.

The DBCC has also revised its 2019 inflation forecast to a range of 2.7 to 3.5 percent from the previous assumption of three to four percent. For 2020, the assumption two to four percent was retained.

Flagship projects

In line with the continuous implementation of the Build Build Build program, the government revised the list of flagship projects to accommodate more smaller projects in the regions.

From the initial list of 75 big-ticket projects, there will instead be around 100 flagship projects that are smaller and more feasible to deliver in terms of technology and available financing.

Many of the smaller projects will also be pursued under public-private partnership.

“We want to focus on those that are finishable by 2022 as well as those that can be started substantially such that it will be more difficult for the next administration to reverse,” said Pernia.

To augment domestic sources of financing, Pernia said the Philippines would step up the negotiations for official development assistance (ODA) for its massive infrastructure program within the grace period allotted for countries graduating to upper middle income (UMIC) status.

The country is currently classified as a lower middle income economy, having a gross national income (GNI) capita of $3,830 as of 2018. By next year, the country is expected to become an upper middle income country with a GNI per capita income range of $3,996 to $12,375.

A three year grace period will be in effect before the country becomes ineligible for concessional loans or borrowings with interest rates that fall below market rates.

Pernia said that as the Philippines and its top ODA partner, Japan, accelerate the processing of assistance for priority infrastructure projects, the government would also reach out more to other development partners to shore up more funds for its ambitious infrastructure program.

“Japan is still willing to lend more funds at very low rates. We are going to be reclassified as an upper middle income country by next year and the downside to that will be less access to concessional loans so we really have to make sure that we finish our major infrastructure projects that are big ticket projects in terms of cost by 2023. Because after that, we will be classified as an upper middle income country,” he said.

“We will have to accelerate getting loans. Korea, for example is also an open partner so we shall be getting loans from Korea faster so that we do not hit the deadline which is 2023,” he said.

Through the country’s cooperation with the Japanese government, the Philippines enjoys concessional rates of 0.1 percent for loans at 40 years repayment period under Japan’s Special Terms of Economic Partnership (STEP).

Once the Philippines graduates to UMIC status, however, the Japanese government’s assistance to the country may instead be channeled through other forms of assistance like technical cooperation and assistance to the private sector.

Improve credit rating

In preparation for the eventual ineligibility for concessional sources of capital, the country will need to improve its credit worthiness to access commercial funding at favorable rates.

“We are also drafting a roadmap so that we get an A” credit rating hopefully by 2022. So this means it will reduce the cost of capital. We will no longer qualify for concessional loans by 2023, but this means we will have to access more of the commercial loans,” said Edillon.

“So it’s really important that we stay the course especially with respect to the reform agenda in the revenue and expenditure management side, and more importantly on the infrastructure spending so we will increase the country’s competitiveness,” Edillon said.

- Latest

- Trending