Has the currency war begun?

Last week, the People’s Bank of China (PBOC) allowed the yuan to weaken past the CNY 7.00 to $1 level for the first time since 2008. The weaker yuan is meant to provide support to the country’s export sector as the Chinese economy continues to reel from higher tariffs imposed by the US. It comes as a direct response to Trump’s imposition of a 10 percent tariff on $300 billion worth of Chinese goods effective Sept. 1, in addition to the $250 billion already targeted.

Is this the start of a currency war or just a warning shot from China?

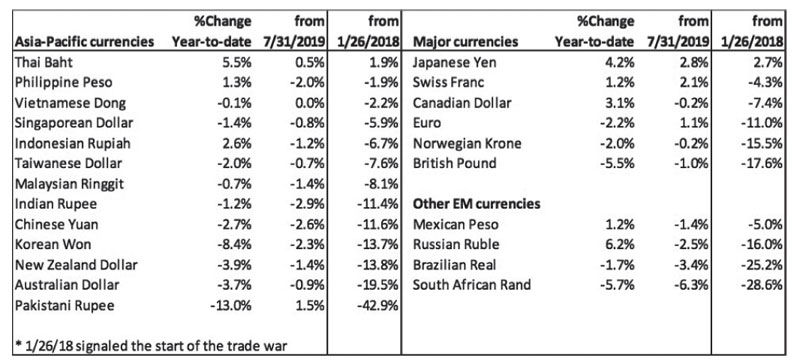

The breakout of the Chinese currency past the crucial resistance of CNY 7.00 has dragged currencies worldwide into the fray. The Philippine peso fell as much as 2.8 percent, while the South Korean won fell as much as 3.4 percent following the yuan’s move. Meanwhile, the Aussie dollar dropped as much as 3.2 percent as it slumped to a 10-year low vs the US dollar. Although these currencies have partially recovered as of last Friday, these developments have raised concerns that the trade war has now turned into a currency war.

US Treasury labels China, a ‘currency manipulator’

The yuan’s recent slide prompted Trump and the US Treasury to label China a currency manipulator. Although China has long been accused of currency intervention, it is only now the US Treasury branded them as such. This move further escalates the trade war between the two countries and opens the door for US sanctions and more tariffs against China. Last Friday, Peter Navarro, assistant to President Trump and director of trade and manufacturing policy, said the US would take strong action against China if it devalues the yuan to neutralize the effects of tariffs.

Why is the 7.00 level for the USD/CNY significant?

The breakout above 7.00 for the USD/CNY is crucial because it is a level that the PBOC has defended in the past. The timing of the break is also vital. The breach of the 7.00 level occurred right after Trump’s announcement of additional tariffs. Allowing the yuan to weaken beyond 7.00 is China’s retaliatory response, and it signals that it is not backing down, marking a further escalation in the US-China tensions. Based on technical analysis, there is no apparent resistance beyond this level. The chart points to a target of 7.70 for USD/CNY based on the breakout from the cup-and-handle formation, as shown below.

USD/CNY Rate Weekly Chart (2007 – Present)

Source: Tradingview.com, Wealth Securities Research

Yuan’s move rattle EM currencies

A weaker Chinese yuan, coupled with a stronger US dollar, puts pressure on emerging market currencies, including the Philippine peso. Investors are wary of a repeat of August 2015 when a similar sharp break in the yuan caused a sell-off in emerging market currencies raising fears of a currency contagion.

Source: Bloomberg, Wealth Securities Research

Race to zero interest rates

Trump‘s demand for more easing for the Fed to weaken the dollar and the recent sharp depreciation of the Chinese yuan has prompted a cycle of competitive rate cuts worldwide. An estimated $15 trillion worth of government bonds now trades at negative yields. Major countries such as Germany, Japan, Switzerland and France have negative-yielding 10-year bonds. Last week, the central Banks in New Zealand, India, Thailand, surprised the markets when they announced larger-than-expected rate cuts. The Bangko Sentral ng Pilipinas (BSP) cut rates by 25 bps, but signalled another 25 bps cut and another reduction in banks’ reserve requirements (RRR) this year.

Phl peso, top performer despite the trade war

In a previous article, we mentioned that the Philippines is relatively insulated from a sharp deterioration of global trade and less vulnerable to the ongoing trade war (see Philippines – unintentional beneficiary of the US-China trade war, June 17). In fact, from the table above, we see that the Philippine peso, together with the Thai baht and the Vietnamese dong, are the more stable Asian currencies since the start of the US-China trade war back in January 2018. Still, we must continue to be vigilant. The situation continues to be volatile. Nobody knows how this will end.

Save the date

Philequity will hold its Annual Stockholders’ Meeting and investors’ briefing on Aug. 31, (Saturday), 9:30 a.m. at the Meralco Main Theater, Pasig City. We will discuss the US-China trade war and its effects on the global economy, interest rates, currencies, inflation and the stock market. Our guest speaker, David Leechiu of Leechiu Property Consultants, Inc., will talk about the Philippine property market and its prospects.

Philequity Management is the fund manager of the leading mutual funds in the Philippines. Visit www.philequity.net to learn more about Philequity’s managed funds or to view previous articles. For inquiries or to send feedback, please call (02) 689-8080 or email [email protected].

- Latest

- Trending