Red all over

For most of the year, only US stock markets remained in the green as money flowed into US assets (see USA vs. the world, Sept. 3). However, US equities finally succumbed to a multitude of factors. Thus, investors were left seeing red all over.

Truly a Red October

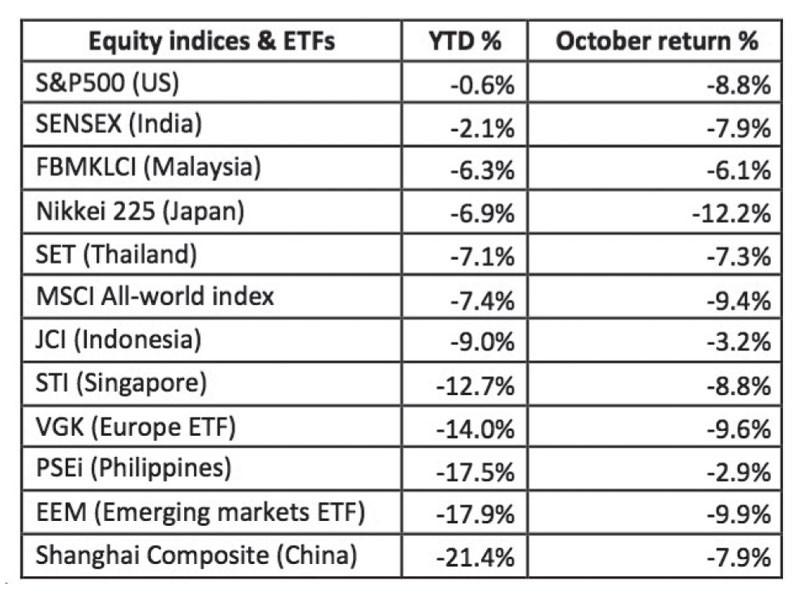

Once the frontrunner globally, the sharp drops and wild swings in US equity indices in the past two weeks ended up dragging down stock markets around the world. In fact, up until September, both the Dow Jones index and S&P 500 were firmly in the green. However, as fear gripped markets, the Dow Jones index lost 1300 points in two days in early October and had a one-day, 600-point drop last week. This erased the YTD gains of the Dow Jones index, bringing the S&P down with it. As can be seen in the table below, not only is everything red, but the drop in the US made matters worse for Europe and Asia as they went further into negative territory. Clearly, the Philippines is not alone in its poor performance this year.

YTD and October percentage returns of various equity indices

Source: Wealth Securities research

Looking at the table above, one will see that bulk of the correction for many equity markets occurred just in October. As we wrote two weeks ago, it seems that October is truly a spooky month for stocks as many infamous market crashes happened in this month (see Red October and 10-year cycles, Oct. 15). Unless the PSEi stages a miraculous recovery in the next two months, 2018 would see the largest annual drop for the index since the US Financial Crisis in 2008.

Risks exacerbate an already weak PSEi

The sharp drop in US stocks were triggered by a spike in US bond yields. This led to fears that growth may be at risk if interest rates rise too much. Sadly, these fears were reinforced by poor economic data in the US, such as weak housing starts and poor car sales. Adding fuel to the fire was Trump’s criticism of the Fed, as he called them “loco” and “the biggest threat” to him and the US economy. On the local front, a number of factors exacerbated an already weak market, namely:

1. Above forecast inflation

2. Depreciating peso

3. Below forecast corporate earnings

4. Rising interest rates

5. US-China trade war

42 days and counting

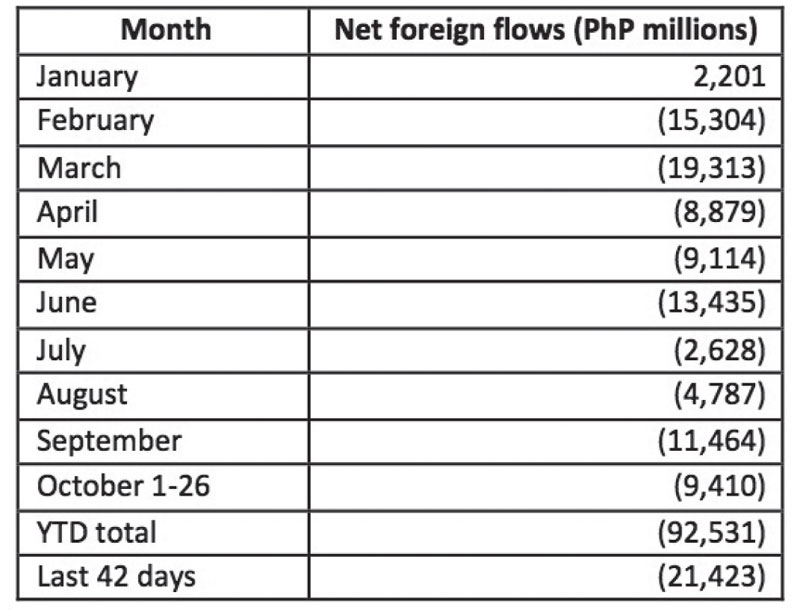

With US markets turning from green to red and emerging markets falling into bear market territory as Chinese stocks crashed, foreign funds dashed for the exits and dumped their Philippine stocks. As can be seen in the table below, we have seen net foreign outflows every month this year since February. Moreover, we are in the middle of the longest streak of daily net foreign selling in history – a record 42 days and counting. During this record two-month streak, P21 billion worth of foreign funds exited Philippine stocks. This year, we are also witnessing the largest annual foreign outflow on record – P92 billion.

Monthly net foreign flows for Philippine stocks in 2018

Source: Wealth Securities research

A time to reflect

During turbulent times such as these, one should take time to reflect on their investment objectives and their character as an investor. Clearly, this volatile and punishing market environment is not for the faint-hearted. Thus, one should use this opportunity to reexamine one’s asset allocation, risk tolerance and time horizon. Volatility in stock markets should not make one lose sleep. While stocks eventually recover from these drops, one should make sure that he can have a good night’s sleep, especially during these spooky Halloween nights.

Philequity Management is the fund manager of the leading mutual funds in the Philippines. Visit www.philequity.net to learn more about Philequity’s managed funds or to view previous articles. For inquiries or to send feedback, please call (02) 689-8080 or email [email protected].

- Latest

- Trending