December, strongest month for stock market

Since we are just 24 days away from Christmas day, it is inevitable that the Christmas season would start to be felt more. December is a time when the festive holiday mood intensifies, as Christmas carols and songs start to be heard everywhere. It is that part of the year when everyone is excited about shopping for gifts for their family and loved ones. It is also a time when gatherings and parties happen everywhere almost every day, as many companies will be having their Christmas parties this month.

Since today is the first day of December, we thought it is timely to write about how our stock market performs in the last month of the year. We also looked at history and analyzed some statistics to see how other global stock markets have performed during the month of December.

Party month in the stock market

The party mood that everyone feels during the month of December spills over to the stock market. In one of our previous articles, we mentioned that December is the strongest month for the stock market in terms of price appreciation (From Halloween to Valentine’s, Oct. 27, 2014).

Since December is the last month of the year, it is a time when yearend window-dressing ensues. This happens as fund managers and institutions engage in buying sprees to pump-up their annual results for their investors. Moreover, investors generally have more money to invest in the stock market, as this is the time when most companies give their yearend bonuses. These, along with the jovial holiday mood that everyone is in, tend to push stock prices higher during the month of December (Santa Claus Rally and the January Effect, Dec. 26, 2005).

Highest return, high batting rate in December

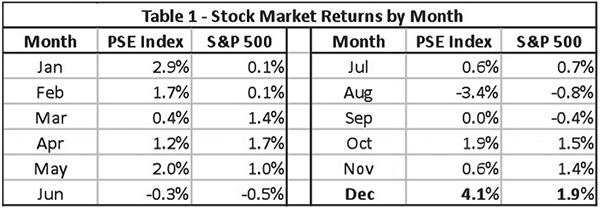

As we show in the table below, average monthly returns for the Philippine and US stock markets are highest in December. Average return of the PSE Index for the month of December, from 1990 to 2013, is at 4.1 percent, soundly outperforming returns from all the other months of the year. Moreover, our index posted positive December returns in 17 out of the last 24 years, equivalent to a batting rate of 71 percent.

On the other hand, average return of the S&P 500 for the month of December, from 1990 to 2013 is at 1.9 percent, also outperforming all other months of the year. Moreover, the S&P 500 posted positive December returns in 20 out of the last 24 years, resulting to a batting rate of 83 percent.

Table 1 – Stock Market Returns by Month

Sources: Wealth Securities Research, Bloomberg

December rally – a global phenomenon

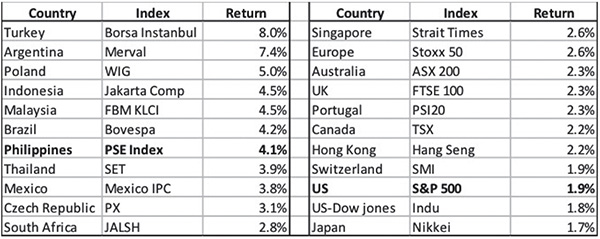

We earlier showed that December delivers the strongest stock market returns for the Philippine and US stock markets. We note that this is not only true for our country and the US, but it is also something that we saw in other global stock markets. Among the 20 other countries that we tracked, 14 countries or 70 percent posted the highest monthly returns in December.

Even as December is the strongest month for the Philippine and US stock markets, there are other countries that perform even better. In the table below, we show that countries such as Turkey, Argentina, Poland and Brazil, as well as our Asean neighbors Indonesia and Malaysia, all posted December returns that are better than ours and that of the US.

Table 2 – December Returns by Country

Sources: Wealth Securities Research, Bloomberg

Only 18 trading days in December

However, December in the Philippines this year is flooded with national holidays that were declared by the government. As such, there are only 18 trading days this month. In fact, there will only be one trading day (December 29) between December 24 and January 4. This means less time for investors and traders to enjoy the December rally. For those who will be off on December 29, it will be a long 12-day vacation. Unlike the US where trading happens during some bank and national holidays, the PSE decided to follow the national declaration for holidays. Though we wish that it will still be a happy and profitable month for the stock market as a whole, we also hope that the limited trading days in December is something that regulators can address in the future.

December rally – an opportunity to make money

There are various reasons that explain why stock markets in general are strongest in December. As we have shown, it is also a global phenomenon that is experienced by many other countries in the world. Despite the limited number of trading days for our market this month, history and statistics show us that the Santa Claus rally in the stock market will probably happen again this year. As we have experienced in the past, the stock market’s strong performance usually spills over to January, as the New Year brings new hope and optimism that things will be better. Since today is December 1, stock market investors and traders can take advantage of the Santa Claus Rally and the January Effect in order to ride the two strongest months of the year in terms of stock market returns.

Learn more about Philequity’s managed funds at www.philequity.net. To invest with Philequity, call (02) 689-8080 or send an email to [email protected].

- Latest

- Trending