Pandemic sparks gold rush

Amid the gloomy economic outlook and uncertainty brought by the coronavirus disease 2019 or COVID-19 pandemic, one asset class that emerged a clear winner is gold. Investors have flocked to this “barbarous relic” as a safe-haven to protect against volatile equities and bond markets.

Gold also acts as an inflation hedge for the trillions of dollars in monetary and fiscal stimuli issued by central banks and governments worldwide.

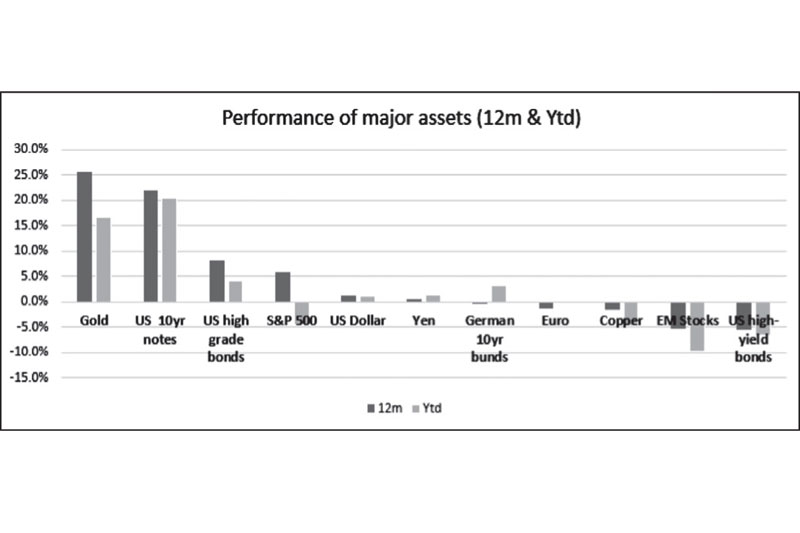

The 2020 pandemic has sparked a gold rush that has pushed prices to its highest levels since 2012. Gold closed at $1,771/oz last Friday, up +25.7 percent year-on-year. Gold is the best-performing asset in the past 12 months.

Reasons for owning gold

1) A safe-haven during a pandemic. In times of crisis, investors tend to hold on to cash or cash-equivalents like short-term US treasuries and money market funds. Some investors consider gold as “hard” currency and hold it as a cash proxy. It acts as a safe-haven during times of economic stress and uncertainty, especially during this coronavirus pandemic.

2) Protection against debasement of fiat currencies. Investors concerned about the long-term impact of global central banks’ cash splurge and the potential debasement of fiat currencies have turned to gold. In the past five years, gold has surged 66.9 percent against the US dollar. It has substantial gains against the euro (+61.8 percent), the British pound (+99.5 percent), the Japanese yen (+48.9 percent), and the Chinese yuan (+82.0 percent) over the same period. Gold is now trading at all-time highs against every other currency, except the US dollar.

3) Gold as an inflation hedge. Jeremy Siegel, Wharton professor and author of the book “Stocks for the Long Run,” declared that the 40-year old bond bull market is over and sees higher inflation over the next several years. This benefits gold because it does well during inflationary periods, like in the mid-1970s and early 1980s.

4) A store of value in a zero and negative-rate environment. In the past, the opportunity cost of holding a non-interest-bearing asset such as gold have dissuaded investors from owning it. But with near-zero interest rates in the US and negative rates in Europe and Japan, gold has steadily regained its status as a store of value.

5) An excellent portfolio diversifier. Many asset allocators, such as sovereign wealth funds and university endowments, have gold as part of their asset allocation. Ray Dalio, founder and chief investment officer of the world’s largest hedge fund firm, Bridgewater and Associates, recommends having a five percent to 10 percent allocation of gold in one’s portfolio. GLD, a gold exchange-traded fund (ETF), is the second biggest holding in the funds he manages, comprising 11.9 percent of Bridgewater’s portfolio as of 1Q2020.

6) Record inflows in gold ETFs. Inflows into the largest gold ETF (GLD) totaled 623 tons from January to May 2020. This represents a total value of $33.7 billion, already exceeding the largest annual inflow of $24 billion seen in 2016.

7) PBOC and other central banks boost their gold reserves. Central banks’ gold buying has reached record levels in recent years, adding 650 tons in 2019. The People’s Bank of China (PBOC) alone has nearly doubled its gold reserves in the past five years. According to a May 2020 survey by the World Gold Council, most central banks are looking to increase their gold reserves over the next five years. Two-thirds of those surveyed believe gold reserves will rise to 15 percent to 25 percent of total international reserves, up from 13 percent as of 3Q2019.

8) Investment banks call for a test of gold’s all-time high. Last week, Bank of America’s chief global technical strategist Paul Ciana said he expects the 2012 highs of $1,795-1,805/oz to be tested, with a rally towards the all-time high of $1,920/oz if prices break the $1,800 resistance. Other major investment banks such as UBS and Goldman Sachs say that gold could reach $2,000/oz in the next 12 months.

Phl mining industry’s growth potential

The Philippines is the fifth most mineral-rich country in the world for gold, nickel, copper, and chromite. Yet, the country’s mining sector remains largely untapped. In 2018, the Philippines only produced 36.8 tons of gold, ranked 24th in the world. According to the Philippine Statistics Authority, estimated gold reserves in the Philippines as of 2017 was over 200 million tons. Gold is often found with copper in the Philippines, and copper reserves (fourth largest in the world) is estimated to be over five billion metric tons. Nickel ore and its products (mixed nickel-cobalt sulfide and scandium oxalate) accounted for 49% of the country’s total metallic mineral output in 2019. The Philippines is the 2nd largest nickel producer in the world, behind Indonesia.

Time to expand sources of dollar revenues

With many of our OFWs returning home, BSP forecasts remittances to drop five percent this year. Tourism growth has also stalled because of travel restrictions and people’s increased fear of traveling. Likewise, there are concerns of a possible decline in BPO and POGO revenues due to an economic slowdown caused by the pandemic. With gold prices projected to rise over the next few years and metal commodities on an upward trajectory, it may be time for the country to prioritize other sources of dollar revenues, such as mining. It will also create much-needed jobs, which will mitigate the unemployment created by the pandemic. Just as investors diversify their assets to reduce portfolio risk, it is also prudent for the government to expand its dollar revenue sources to cushion the impact of the pandemic on the country.

Philequity Management is the fund manager of the leading mutual funds in the Philippines. Visit www.philequity.net to learn more about Philequity’s managed funds or to view previous articles. For inquiries or to send feedback, please call (02) 8250-8700 or email [email protected].

- Latest

- Trending