Balai Ni Fruitas Q2 profit balloons 350% y/y, up 50% q/q

Balai Ni Fruitas [BALAI 0.68 1.45%] [link] Q2/22 profit of P9 million, up 350% from Q2/21 profit of P2 million, and up 50% from Q1/22 profit of P6 million, driven by improved gross margins, improved store performance, and what BALAI refers to as “continuous business expansion.”

BALAI’s Q2 revenues were up 242% y/y to P84 million, and its H1/22 revenues were up 159% to P145 million. BALAI said that it was on-track to reach 80 Balai Pandesal stores by the end of 2022.

MB BOTTOM-LINE

This report helps fill in a few holes in the financial record that BALAI carried into and through its IPO.

While the company’s stock went on sale after the end of Q1 in 2022, it only had financial information up to the end of September 2021 that investors could use to evaluate the business, and to make things even more challenging, the company was still pursuing its strategy of “continuous business expansion” during that dark period between the end of the recorded financial data and the IPO.

As of September 2021, BALAI had 69 stores, but that number grew 10% to 77 by the end of the year.

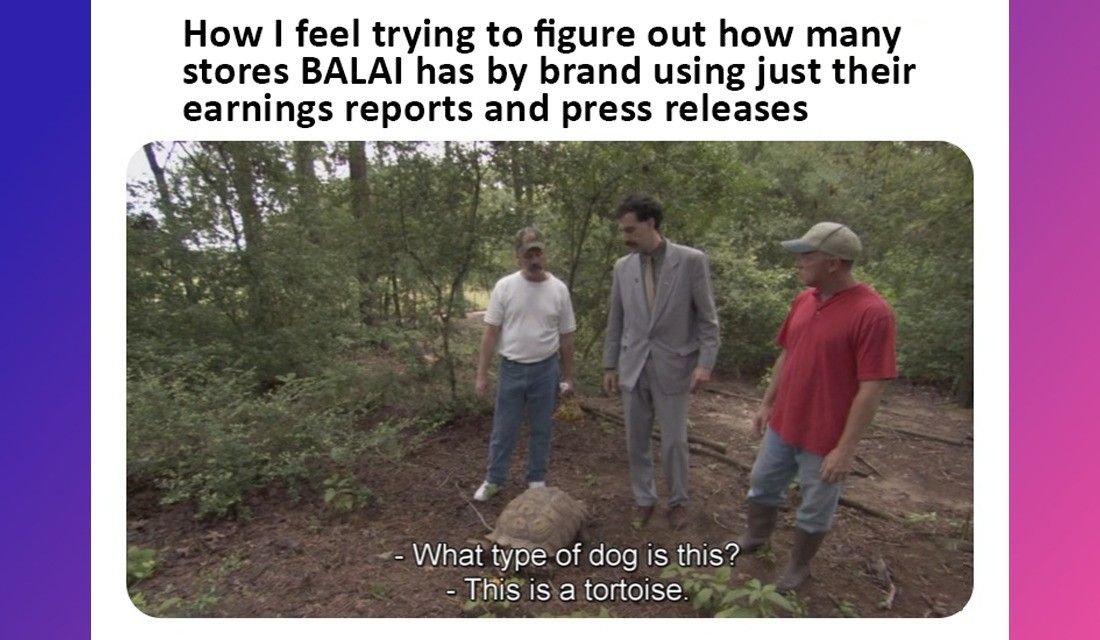

After the IPO, BALAI said that it had 38 Balai Pandesal stores, and now at the end of Q2 it’s saying that it’s on track to hit 80 Balai Pandesal stores, But what about the other brands that BALAI owns and operates, like Balai Ni Fruitas and Fruitas House of Desserts?

Where is the diagnostic data that would help investors track and evaluate the operational performance of the brands and products through information like same-store sales data?

A company as huge and complex as Jollibee [JFC 205.00 0.19%] has no trouble providing segmented information for each of its many brands, including same-store sales figures.

BALAI has a much smaller portfolio, and yet it feels like we’re left trying to sift through the disclosures to piece the story together.

As an investor, I want to see which brands are performing, and use the guidance data in the prospectus, along with the updated economic data, to help me predict revenues going forward. I can do this with JFC. I can do this with Max’s Group [MAXS 4.63 0.22%].

But here, I’m left just having to take it all at face value, which, again, wouldn’t be so bad if things weren’t changing so rapidly behind the scenes.

This is BALAI’s first quarterly earnings disclosure, so I’m ok to wait and see if the company will improve its reporting in Q3, but this isn’t the Fruitas [FRUIT 1.04 0.97%] group’s first time around the track. Help us see the whole picture!

--

Merkado Barkada's opinions are provided for informational purposes only, and should not be considered a recommendation to buy or sell any particular stock. These daily articles are not updated with new information, so each investor must do his or her own due diligence before trading, as the facts and figures in each particular article may have changed.

- Latest