Surprise benefits of recent banking failures

The recent banking turmoil significantly affected the financial industry, with multiple US banks and Credit Suisse experiencing failures and rescues. These events have raised concerns about contagion and the potential for more problems to emerge. However, the banking scare has also brought some surprising benefits. These include a slowdown in the pace of interest rate hikes by the Federal Reserve (Fed), lower US Treasury yields, a weaker US dollar, stronger stock markets, and softer oil prices.

Banking turmoil eases Fed tightening

The turmoil has resulted in the moderation of the pace of the Fed’s interest rate hikes, with indications suggesting that the hiking cycle may be nearing its end. The Fed has revised projections, predicting one more hike in 2023 before pausing and changing course next year. It has also stated that it will closely monitor the situation and take appropriate measures to support the economy. This shift in policy indicates a willingness to adapt to the evolving economic situation and has significant implications for the direction of monetary policy after a year of aggressive tightening.

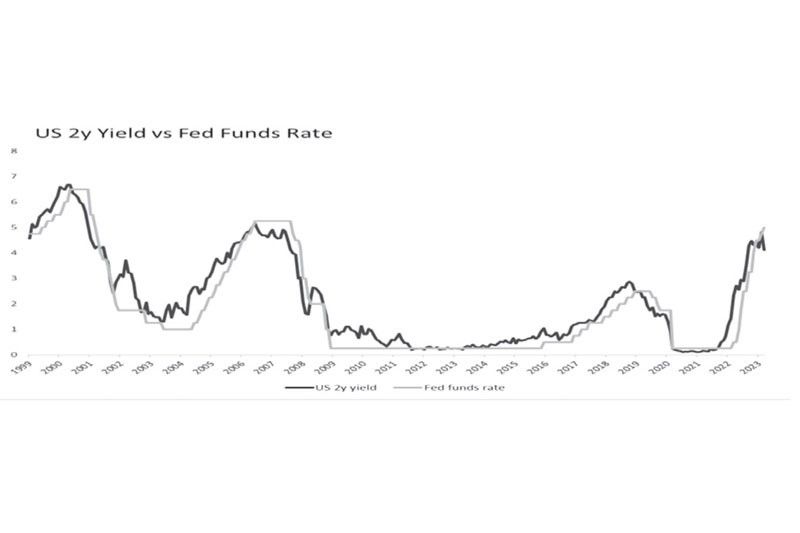

2-year yield signals Fed policy shift

The two-year Treasury yield is a useful technical indicator to gauge the direction of the Fed funds rate. Historically, when the two-year yield and the Fed funds rate intersect, it indicates an upcoming shift in policy. This pattern had held in several instances, including early 2000, 2006, and late 2018, when a reversal in the Fed funds rate followed. Notably, the two-year Treasury yield slipped below the Fed funds rate again last month amid the banking tumult. This indicates that the Fed funds rate has likely peaked and is poised to decrease soon.

Source: Bloomberg, Wealth Securities, Inc.

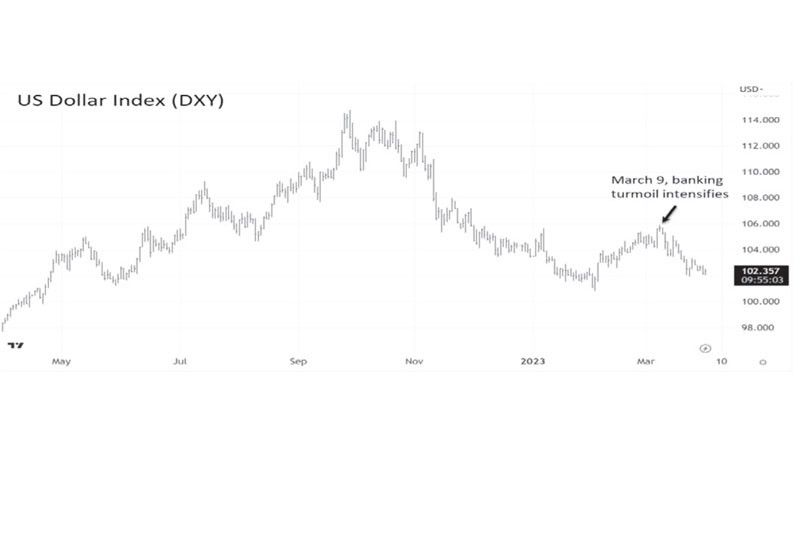

US dollar weakens on lower yields

The US dollar has weakened due to declining US treasury yields, with markets factoring in peak inflation and interest rates. The US dollar index (DXY), which measures the dollar against a basket of six other major currencies, had already fallen 3.2 percent to 102.54 since hitting an intraday high of 105.88 last March 9, when the concerns over the banking industry intensified. This decline reflects the market’s anticipation of lower rates, prompting investors to seek other major currencies such as the Swiss franc, British pound, euro, and the Japanese yen, which gained at least 2.5 percent last month. Emerging market currencies, such as the Philippine peso, also gained ground against the US dollar, with a nearly two percent appreciation in March.

Source: Tradingview.com, Wealth Securities Research

Fed policy shift boosts risk sentiment

Global risk assets soared to new heights in the first quarter as financial markets recalibrated their expectations of Fed policy and the US dollar exhibited weakness. Technology stocks, particularly those that are interest-sensitive, led the rally. The Nasdaq 100 posted an impressive 9.3 percent gain in March and a staggering 20.5 p[ercent for the quarter. The Nasdaq also has increased 26.3 percent from the low, signaling a new bull market. The broader S&P 500 also saw a healthy upswing, rising 3.5 percent in March and 7.1 percent for the quarter.

Source: Tradingview.com, Wealth Securities Research

Banking turmoil boosts global markets

It is ironic and surprising that the recent banking failures would be the catalyst for an improvement in investor sentiment and a boost in the global capital markets. While this may seem paradoxical, it is not entirely unexpected. Markets tend to anticipate and factor in possible scenarios, such as a credit crunch, that could slow down the economy. This possibility may prompt the Fed to pause its hiking cycle and change course. However, if the economy undergoes a hard landing and plunges into a deep recession, the markets could suffer a setback once again. Volatility may persist as bulls and bears fight for direction. Nevertheless, as shown in previous bear market endings, the turn from bear to bull can be highly rewarding as this phase offers investors very substantial gains.

Philequity Management is the fund manager of the leading mutual funds in the Philippines. Visit www.philequity.net to learn more about Philequity’s managed funds or to view previous articles. For inquiries or to send feedback, please call (02) 8250-8700 or email [email protected].

- Latest

- Trending