A good start

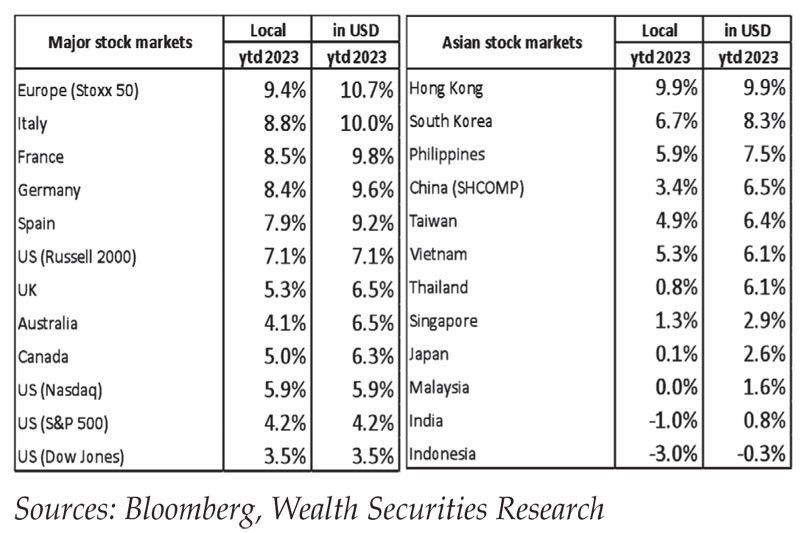

Despite their poor performance last year, global equities had a very good start this year. The S&P 500 is up 4.2 percent year-to-date and the MSCI All-Country World Index (ACWI) ETF has gained 5.7 percent. The US dollar is down 1.3 percent this year, paving the way for the sustained rebound of all currencies. The PSEi joined the global stock market rally and is up 5.9 percent year-to-date in peso terms and 7.5 percent in US dollar terms.

China’s rebound

The strong start of equities this year was partly driven by the surge in Chinese stocks. Year-to-date, MSCI China is up 13.4 percent while Hong Kong is up 9.9 percent. China was one of the worst market performers last year, falling by 15.1 percent in local currency terms and 21.8 percent in US dollar terms. However, stark changes in major government policies sparked a resounding rebound in Chinese assets.

Is China investable again?

China started relaxing its ultra-stringent zero COVID policy and gradually reopened its borders towards the end of last year. More recently, China pulled back on the regulatory scrutiny of its most powerful mega-tech corporations. In 2021, China initiated a heavy-handed crackdown (see China crackdown, Aug. 2, 2021). This was in support of the government’s campaign of “common prosperity,” which went after multi-billionaires as it sought to promote more equitable wealth distribution (see Common Prosperity, Aug. 30, 2021). Those policies triggered many fund managers to dump their Chinese exposure, thereby causing a plunge in Chinese stocks. Many investors consequently labeled China as uninvestable. However, top officials last week indicated that the regulatory attacks are basically over, and that the government would “promote the healthy development of internet platforms.” In addition, China reversed its stance and started providing policy support for its troubled property sector.

Raise then hold

Bullish investor sentiment was somewhat tempered by hawkish comments made by US Federal Reserve (Fed) officials. Atlanta Fed president Raphael Bostic believes that the Fed should raise interest rates above five percent and then go on hold for a long time. Kansas City Federal Reserve president Esther George sees a Fed terminal rate of above five percent “and staying there for some time… until we get the signals that inflation is really convincingly starting to fall back toward our two percent goal.” Federal Reserve Bank of St. Louis president James Bullard favors raising interest rates above five percent and stated that “it would be appropriate to get there as soon as possible.” San Francisco Fed president Mary Daly said, “I think something above five is absolutely, in my judgement, going to be likely.” These comments, as well as the very hawkish stance of Fed chair Jerome Powell, sparked recession concerns anew and caused some volatility.

Mild recession

Last Friday, major US banks disclosed their earnings and provided their macroeconomic outlook. JPMorgan delivered better-than-expected earnings, but the bank indicated in its outlook that it sees “a mild recession in the central case.” JPMorgan chairman and CEO Jamie Dimon said, “We still do not know the ultimate effect of the headwinds coming from geopolitical tensions, including the war in Ukraine, the vulnerable state of energy and food supplies, persistent inflation... and the unprecedented quantitative tightening.” Bank of America chairman and CEO Brian Moynihan shared a similar view in their earnings call and stated that “our baseline scenario contemplates a mild recession.”

Market vs the Fed

Though global markets had a strong start this year, there is a seeming disconnect between investor perception that inflation has peaked and the continued hawkishness of the Fed. This sparked fears of a deep recession that may be caused by central bank overtightening. This, likewise, raised concerns about the potential downgrade of corporate earnings estimates. Equity strategists of top American investment houses thus remained cautious on the stock market.

Is the worst over?

On the other hand, recent data showed that US headline CPI for December fell 0.1 percent month-on-month while year-on-year growth slowed to 6.5 percent from a peak of 9.1 percent in June. Last week, Bangko Sentral ng Pilipinas (BSP) Governor Felipe Medalla said, “I think the worst is over... although the year-on-year is quite high, the month-on-month is back to the normal 0.3 percent.” Clearer indications of a slowdown in interest rate hikes, a peak in inflation and the US dollar, coupled with major policy changes that spurred the market rebound in China, may signal that the worst is over for investors.

Philequity Management is the fund manager of the leading mutual funds in the Philippines. Visit www.philequity.net to learn more about Philequity’s managed funds or to view previous articles. For inquiries or to send feedback, please call (02) 8250-8700 or email [email protected].

- Latest

- Trending