2022 year-end review

2022 was a tumultuous year for investors. Financial markets experienced a massive decline on the back of historic inflation and extremely aggressive monetary tightening by global central banks. Markets began to slide early in the year when it was clear that high inflation was going to be persistent and that central banks would have to unwind their ultra-accommodative monetary policies. This was exacerbated by Russia’s invasion of Ukraine in February, resulting in shortages of key agricultural commodities and an energy crisis in Europe. The Chinese regulatory crackdown (common prosperity), property crisis, and covid-situation added to market uncertainties.

With inflation at a 40-year high, central banks worldwide led by the US Federal Reserve hiked interest rates at a record pace. The sharp rise in rates took its toll on markets, driving up volatility and causing a severe drawdown in almost all asset classes, such as stocks, bonds, real estate, and cryptocurrencies.

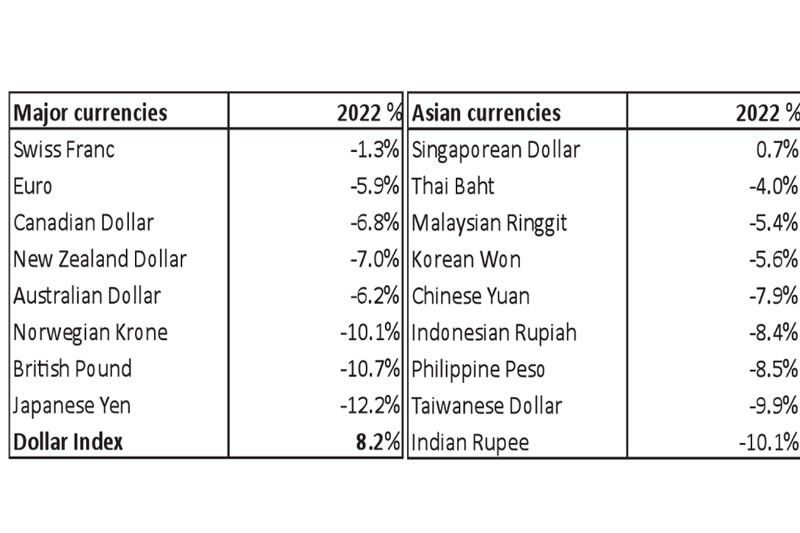

Currencies – King dollar in 2022

The US dollar benefitted from improved yield differentials and safe-haven status after the Fed tightened monetary policy ahead of other major central banks. As a result, the US dollar index ended 2021 with an 8.9 percent gain. Last September, we may have seen the peak of the US dollar after the dollar index (DXY) hit a 20-year high of 114.78. It has since pulled back nearly 10 percent the past three months to close the year at 103.49.

The Japanese yen is the worst-performing major currency, down 12.2 percent against the US dollar. At one point in October, the yen fell past 150 for the first time in 32 years due to the Bank of Japan’s yield-curve control and ultra-loose monetary policy. However, it has since appreciated 15 percent to 131.12 as markets price in a slowdown in the Fed’s pace of hiking and BOJ’s recent decision to widen its target yield band.

The British pound and the Norwegian Krone also had double-digit declines against the US dollar, losing 10.7 percent and 10.1 percent, respectively. Almost all currencies in the world depreciated against the US dollar in 2022, except for the Singapore dollar, which appreciated 0.7 percent.

Among Asian EM currencies, the Indian rupee was the worst performer, with a 10.1 percent decline, followed by the Taiwanese dollar, which weakened by 9.9 percent.

Source: Bloomberg, Wealth Securities Research

Philippine peso recovers

After reaching 59 against the US dollar in September, the Philippine peso has since rallied to 55.74. The recovery erased nearly half of its decline from the January to September period. The peso ended 2022 with an 8.5 percent loss against the US dollar.

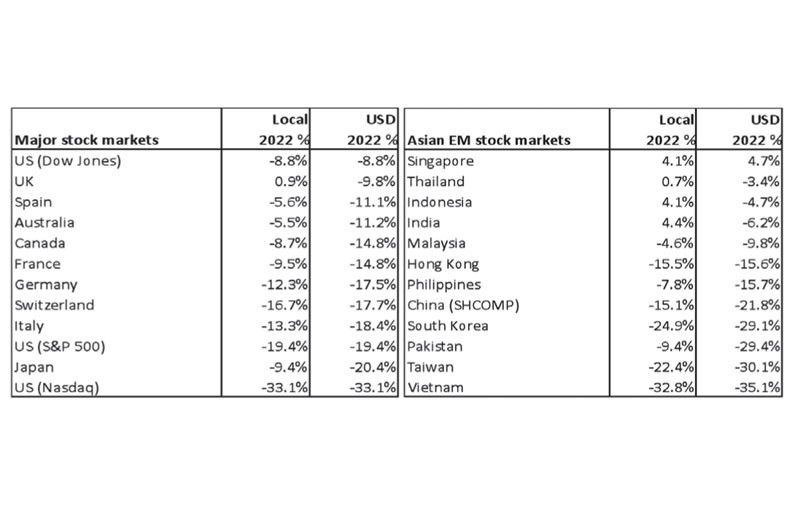

US Stocks – worst performance since 2008

Following a strong performance for most major indices in 2021, the benchmark S&P 500 (SPX) and the Dow Jones Industrial Average (DJIA) recorded new all-time highs in early January. But with inflation climbing nearly double digits and interest rates rapidly rising, stock markets experienced significant declines the rest of the year. SPX ended down 19.4 percent, its worst performance for the year since the global financial crisis in 2008. The tech-heavy Nasdaq dropped a staggering 33.1 percent. With the yen depreciating 12.2 percent against the US dollar last year, the Nikkei fell 20.4 percent in US dollar terms. Most major markets were down double-digit percentages in US dollar terms.

Singapore is the only country in Asia with positive stock market returns for 2022, up 4.7 percent in US dollar terms. Its economy was one of the first in the region to bounce back after lifting covid curbs much earlier than its neighbors. Singapore’s central bank was also among the early few who started tightening its policy stance to manage inflation. On the other hand, Vietnam’s VN-Index was the worst performer in the region, dropping 35.1 percent due to a credit crunch affecting its property sector.

Source: Bloomberg, Wealth Securities Research

Philippine stocks – 2nd worst year since 2008

It was a lackluster performance for Philippine stocks in 2022 as the PSE Index fell 7.8 percent in peso terms. In US dollar terms, however, it was down 15.7 percent. This is the second-worst performance for the year for the PSE index since 2008. In 2018, the PSE Index lost 17 percent in US dollar terms.

2023 – A buying opportunity for stocks?

The aggressive tightening of central banks worldwide in 2022 has increased the likelihood of a recession. Many analysts and renowned fund managers expect volatility to remain elevated as the Fed overtightens into a weaker economy. But peak inflation is mainly behind us, and the US dollar may have also peaked, which should be positive for stocks. While another leg down is possible on the back of recession fears and negative estimate revisions, 2023 may finally yield an ultimate buying opportunity before the Fed starts cutting rates by 2024 to support an economy that is slowing down.

We wish everyone a happy, healthy, safe and prosperous New Year!

Philequity Management is the fund manager of the leading mutual funds in the Philippines. Visit www.philequity.net to learn more about Philequity’s managed funds or to view previous articles. For inquiries or to send feedback, please call (02) 8250-8700 or email [email protected].

- Latest

- Trending