Taper without tantrum

US stocks continued to make record highs last week. This was driven by the speech of Fed chairman Jerome Powell on Aug. 27 at Jackson Hole. There, he announced a dovish taper program that will not necessarily translate to imminent interest rate hikes. Powell’s speech calmed the markets and soothed investor anxiety about the Fed tapering. This was a stark contrast to the wild tantrum that the stock market threw when former Fed chair Ben Bernanke hinted of tapering in 2013.

Taper tantrum in 2013

In May 2013, Bernanke shocked markets when he hinted of a tapering or reduction in the Fed’s bond purchases during the Q&A portion of his briefing. Since the Fed’s extraordinary monetary stimulus was the main driver of stock market performance, the unexpected suggestion of the Fed tapering suddenly brought uncertainty which impacted the risk appetite of fund managers and investors. This led to large-scale unwinding and deleveraging. The US dollar strengthened as portfolio funds flowed back to the US in search of higher yields. This also resulted in a vicious market correction which was more pronounced in emerging market (EM) equities. In the span of one month, EEM dropped by 15.6 percent while the PSEi fell 21.6 percent. The peso depreciated by five percent over that period in tandem with the decline of other EM currencies. We wrote about these events in a previous article (see Tale of the Taper, July 22, 2013). Those who would like to read it may visit the Philequity Corner archive in our website http://www.philequity.net.

Dovish taper

In contrast to Bernanke’s off-the-cuff remark which shook global markets in 2013, Powell delivered a dovish taper speech that stabilized the markets. Powell stated that “if the economy evolved broadly as anticipated, it would be appropriate to start reducing the pace of asset purchases this year.” However, he clarified that “the timing and pace of the coming reductions in asset purchases will not be intended to carry a direct signal regarding the timing of the interest rate liftoff.” Powell further explained that there will be no interest rate hikes “until the economy reaches conditions consistent with maximum employment, and inflation has reached two percent and is on track to exceed two percent for some time.” The Fed chairman conceded that there is much ground to cover before reaching maximum employment. This is evident in last Friday’s report of the August non-farm payroll which showed a growth of 235,000 vs. expectations of 720,000. It also remains to be seen if inflation can stay above two percent on a sustainable basis. Although there has been a recent pickup in inflation, Powell believes that this was mainly driven by transitory factors that can fade over the medium-term.

Telegraph future actions

Even before the speech at Jackson Hole, Powell and the other Fed members have discussed tapering in their various speeches and interviews. It seems that this was deliberately done to telegraph the policy views of the Fed members. This acted as an advanced signal which prepared and conditioned the minds of investors for the start of the Fed tapering later this year.

54 record closes

Despite the rising number of COVID-19 cases brought by the prevalence of the Delta variant, the S&P 500 notched its 54th record close of 2021 last week. The S&P 500 is now up 20.7 percent year-to-date while the Euro Stoxx 50 is 18.3 percent higher. The US dollar pulled back, industrial metals staged a rebound, and EM currencies strengthened.

Meanwhile, the peso appreciated to 49.82 last week from its recent low of 50.84. Though many Asian countries are currently grappling with new waves of coronavirus infections, EEM has gone up 4.2 percent while the PSEi is 1.6 percent higher since Powell’s speech.

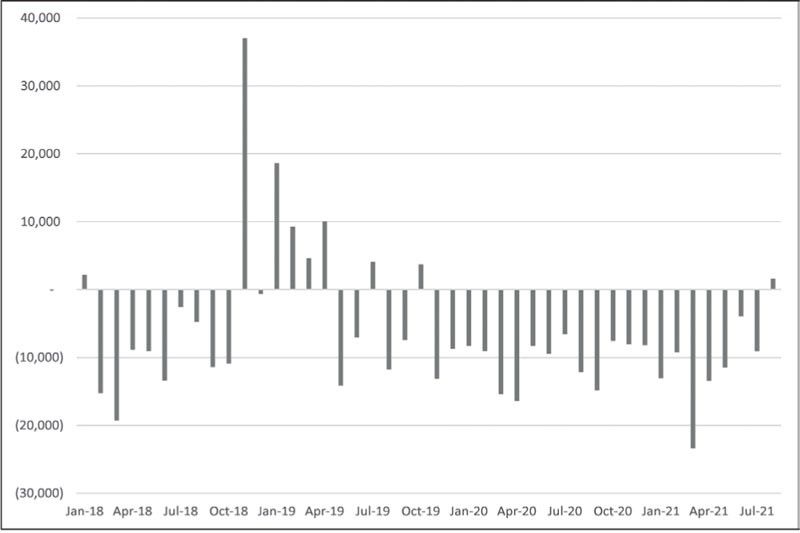

End of exodus

Last month, the PSEi recorded P1.6 billion in net foreign buying. As shown in the table below, August marked the first month of net foreign buying after 21 straight months of net foreign selling. According to Bloomberg, the PSEi posted a return of 9.3 percent in August, its highest monthly return since September 2010.

Monthly net foreign flows

Encouraging signs

As a result of Powell’s dovish speech and the Fed’s early signaling, the stock market did not throw a tantrum this time when the Fed announced the potential start of tapering. In fact, US stocks led global equities higher despite the the grim backdrop of rising COVID-19 cases around the world. The strong move of global indices was underpinned by monetary stimulus from the Fed and other global central banks. Our stock market’s net foreign buying in August, the warm reception of recent IPO and REIT listings, the strong performance of IPOs post-listing, and the rebound of the peso have likewise contributed in lifting the PSEi. Though we are not out of the woods yet, we view these recent developments as encouraging signs that are supportive of a strengthening stock market.

Philequity Management is the fund manager of the leading mutual funds in the Philippines. Visit www.philequity.net to learn more about Philequity’s managed funds or to view previous articles. For inquiries or to send feedback, please call (02) 8250-8700 or email [email protected].

- Latest

- Trending