China fights back

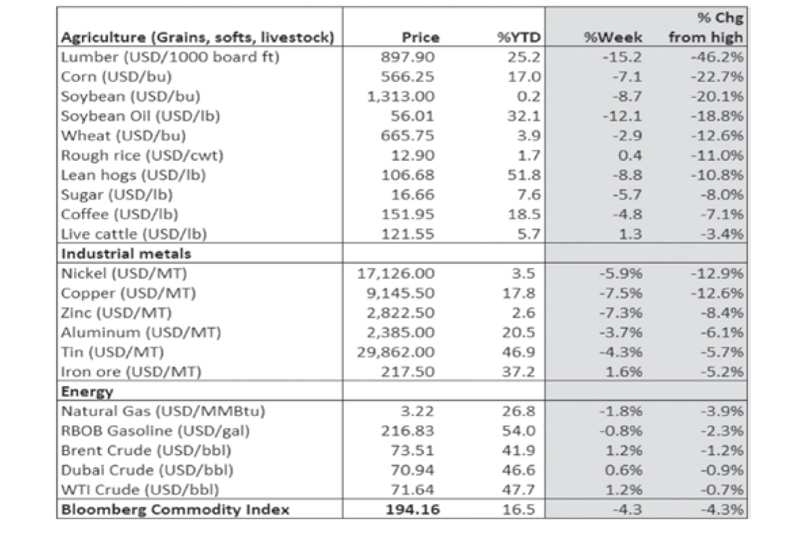

Commodities fell sharply last week after China took measures to fight back against soaring prices. The state ordered a crackdown on speculators and hoarders. Last week alone, the price of copper fell by 7.5 percent, zinc declined by 7.3 percent, and nickel was down 5.9 percent. In addition, several agricultural/soft commodities like lumber, corn, and soybean had significant declines for the week. Across the board, many commodities have now seen sizeable corrections from their recent highs.

China to sell strategic stockpile

China announced last Wednesday its plans to increase the supply of copper, aluminum, and zinc. The State Reserves Bureau said it would auction off the essential metals from its reserve stockpile. This measure aims to dampen inflationary pressures after last week’s China Producer Price Index (PPI) reached nine percent, its highest since September 2008.

Copper prices have more than doubled the past year, while zinc and aluminum are nearing decade highs. Prices of industrial metals have skyrocketed the past year, resulting in surging costs for China’s metal-intensive industries and manufacturers. China is the world’s largest metal consumer accounting for 51 percent of the total global copper consumption and 56 percent of global aluminum demand. It also imports 69 percent of the world’s iron ore imports.

Fed statements alter market direction

Another notable event that can alter market direction is the Fed FOMC meeting. Market participants closely watch FOMC statements and minutes because it tends to have a significant impact on the movement of the US dollar, interest rates, bond prices, and equities.

Last week’s June FOMC meeting was more hawkish than anticipated. While the Fed funds rate remain unchanged, the Fed dot plot showed that the policymakers now expect two interest rate hikes to happen in 2023. Note that in the previous meeting in March, most of the FOMC members projected interest rate hikes would start only in 2024.

The Fed also raised its inflation forecast this year to 3.4 percent from an earlier projection of 2.4 percent, following last week’s CPI figures which was the highest in 13 years.

Fed taper to start sooner

With the two potential rate hikes coming in ahead of schedule, the Fed may start tapering its $120 billion monthly bond purchases sooner than expected. While the Fed did not indicate when the tapering will start, Fed chairman Jerome Powell acknowledged that the committee is also beginning to discuss the idea of tapering. Investment banks like Bank of America and Barclays expect the Fed to formally announce a taper at the September FOMC meeting and begin slowing bond purchases at the November meeting.

US dollar has best week in 2021

The Fed’s decision to move up its timeline for rate hikes resulted in the dollar’s biggest weekly gain for 2021. The US dollar index (DXY) surged 1.87 percent for the week, hitting its strongest level in two months. The dollar sharply gained in response to the prospect of an earlier tapering. As a result, the US dollar has broken downtrend lines against major and emerging market (EM) currencies. We will discuss this in our article next week.

The strong US dollar also helped commodity prices to soften. Commodities, which are primarily priced in US dollars, often move inversely with the greenback. The strong US dollar also caused foreign funds to trim long positions on EM currencies and decrease EM equity holdings.

Phl peso weakens to 48.43

The hawkish Fed and the prospects of QE tapering triggered significant losses for emerging market currencies, including the Philippine peso. As a result, the peso suffered its biggest weekly decline against the greenback in five years, falling by 1.51 percent to close at 48.43 last week. The peso’s sharp decline indicates a reversal in the peso’s intermediate trend and signals a more prolonged bout of weakness.

Commodities hit intermediate peak

With China fighting back to tame inflation, the Fed’s increased projection for inflation and rate hikes, and the stronger US dollar, the prices for many commodities have started to trend down. Given the sizeable declines across the board in metals, lumber, corn, wheat, soybean, lean hogs, and rice, it looks increasingly likely that commodity prices may have hit an intermediate peak.

Philequity Management is the fund manager of the leading mutual funds in the Philippines. Visit www.philequity.net to learn more about Philequity’s managed funds or to view previous articles. For inquiries or to send feedback, please call (02) 8250-8700 or email [email protected].

- Latest

- Trending