Fewer closures as banks display strength amid pandemic

MANILA, Philippines (UPDATE 10:18 a.m., March 4) — Fewer banks were forced to shut down last year despite the pandemic saddling them with unpaid debts that in previous meltdowns triggered a spate of closures.

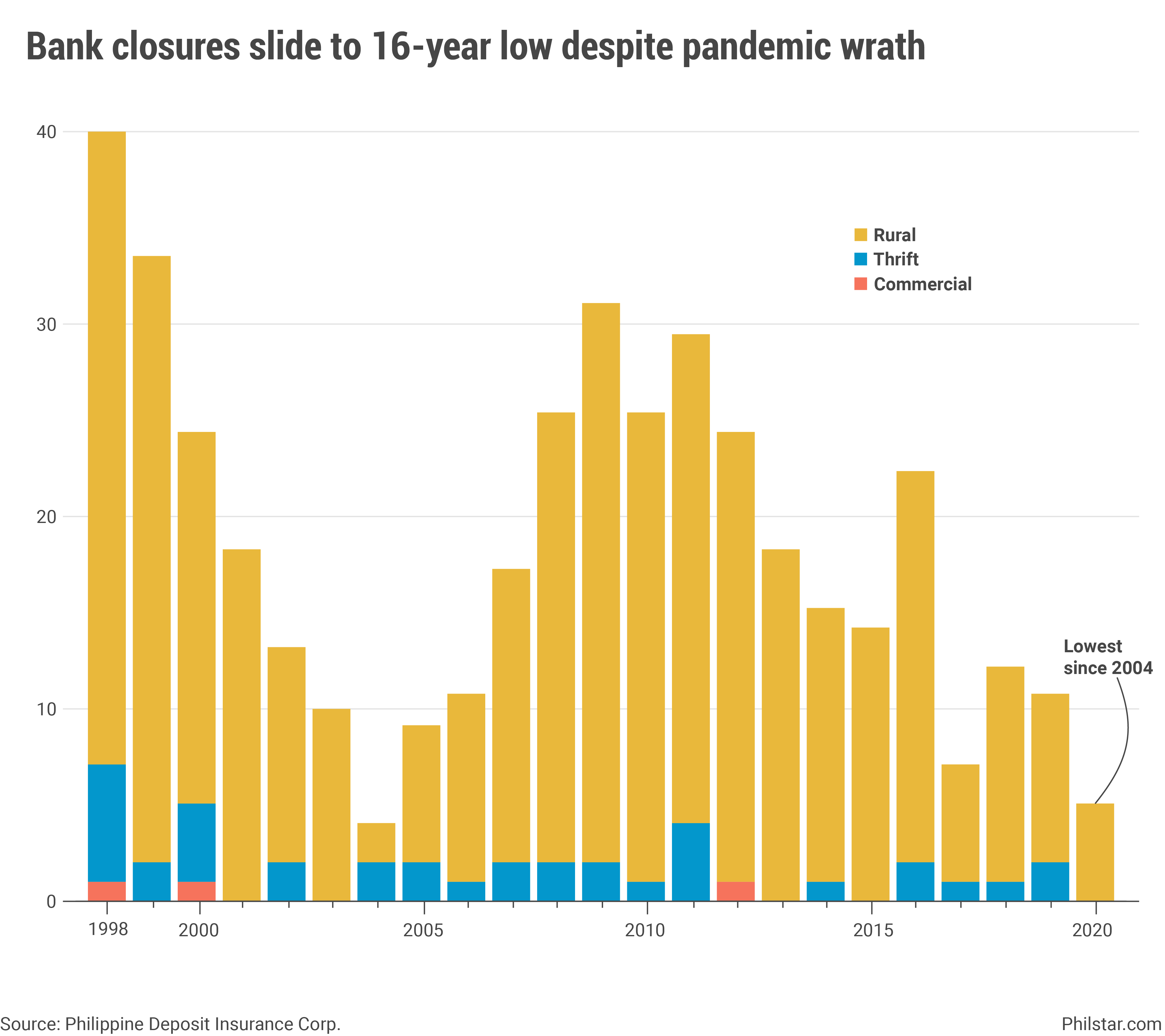

Only five rural banks were put under receivership by the central bank in 2020, the lowest number since 2004, data from the Philippine Deposit Insurance Corp. (PDIC) showed. PDIC oversees financially struggling lenders.

Including thrift and big banks, last year’s closures were also the lowest in 16 years. Back in 2004, two savings lenders were likewise shuttered together with their two rural counterparts.

Countryside lenders are most at risk of closure from financial stress that in recent years, regulators have incentivized them to merge with each other, so they get stronger. A crisis like the pandemic may easily cause double the damage so much like the year after the global financial crisis when 29 closed shop and after the Asian financial crisis in 1998 when 33 of 40 banks that shut down were based in far-flung areas.

But BSP Deputy Governor Chuchi Fonacier indicated rural banks are on stronger footing now, helped as well by “regulatory relief” offered by the central bank that allowed them to postpone payments and setting aside costly reserves.

Even in far-flung areas serviced by these banks, Fonacier said some have also invested in “digital transformation” to keep servicing their clients prevented from visiting branches last year due to movement restrictions.

While small in scale and size— representing 1.6% of the banking system’s loan books and 1.4% of deposits as of June—rural banks are critical source of credit in poor areas where bigger lenders find too risky to penetrate. Hence, over the past decade, BSP has gone through lengths in ensuring this type of lenders thrive.

Indeed, the impact of the hard times on rural banks was more pronounced. Gross non-performing loans— which are unpaid debts at least 30 days past due— accounted for 13.47% of total loans as of June last year, BSP data showed. That figure was more than four times the industry average of 3.6%.

In the broader banking sector, Geeta Chugh, senior director at S&P Global Ratings, a debt watcher, said the recently enacted Financial Institutions Strategic Transfer (FIST) should help in unloading some bad debts, but hesitated to gauge the law’s net effect since many of its components remained unclear.

For instance, while under the law FIST essentially allows banks to sell their bad debts to a separate company to reduce the burden of carrying them, Chugh asked whether the sale is a “true sale” that totally erases the debt from financial statements or merely temporary. “Is the loan taken off from banks’ books? The real reduction in NPL will depend on this operation,” she said in a webinar on Wednesday.

“Most banks will find disposing these NPAs (non-performing assets) lucrative…But it’s a bit difficult or it’s a bit early to establish the success of FIST today. The devil will be in the details,” she said.

For the time being therefore, banks will continue to be risk averse and avoid lending out over fears credit will be left unpaid as joblessness remain elevated. Loan growth did decline for the second straight month by 2.4% in January, according to BSP, underscoring what Chugh said is a “spillover” from last year’s weakness.

The good news is dismal credit activity hardly impairs a projected rebound in gross domestic product this year as much as potential return of lockdowns and faster inflation, Vincent Conti, S&P’s senior economist for Asia Pacific, said in the same webinar.

“It (slower credit growth) is a risk for the rest of the economy, but these two factors I mentioned are drivers of economy this year. The demand push from these two factors can kind of open the tap for credit growth once again,” he said.

Editor's note: Chart amended, story intact.

- Latest

- Trending