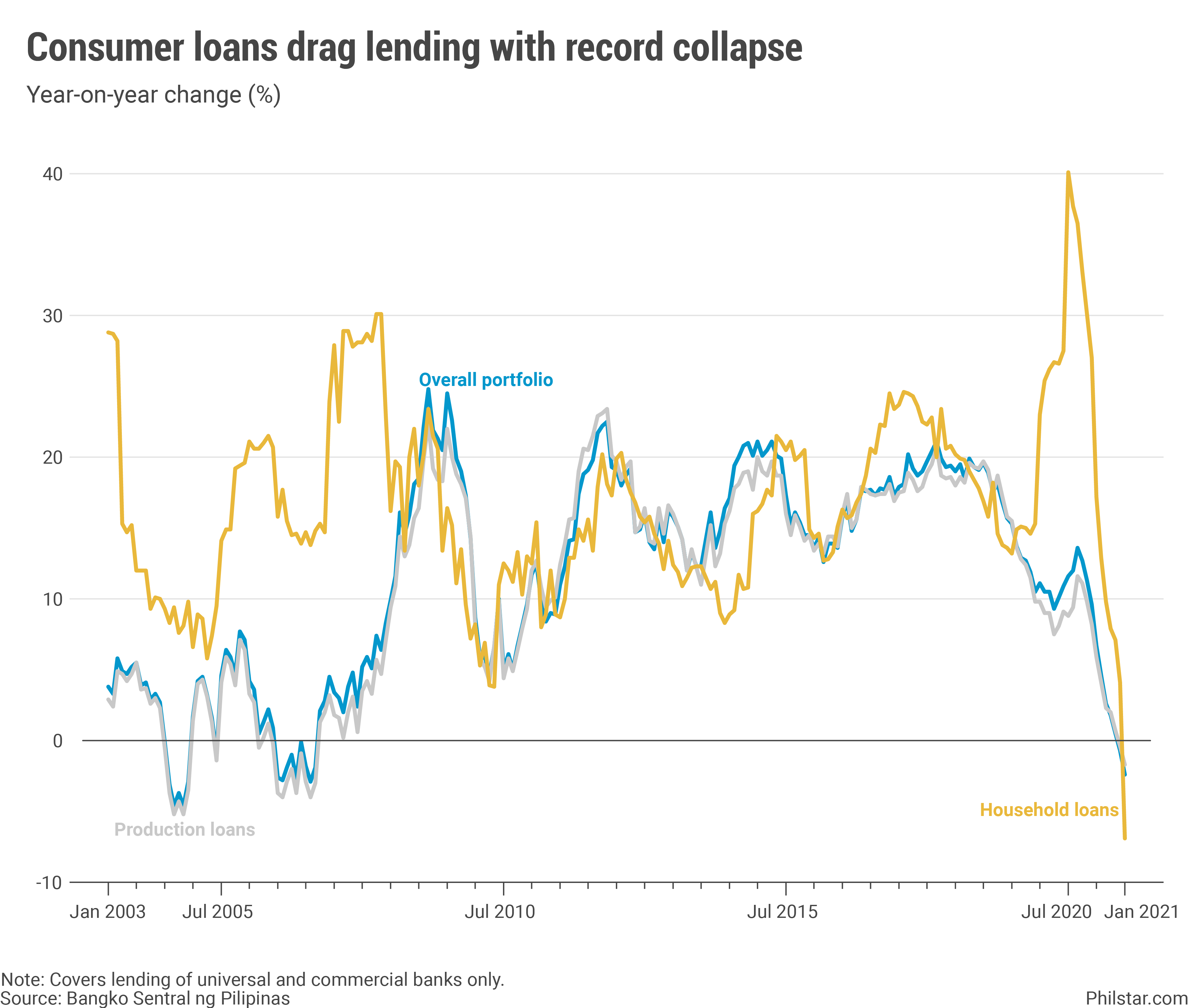

Households, used to drive loans, are now dragging them down

MANILA, Philippines — A record drop in consumer loans pulled down lending activities of big banks in the first month of 2021, central bank data showed on Tuesday.

Outstanding loans by universal and commercial banks sank 2.4% year-on-year in January, the second consecutive month of decline and the worst performance since August 2006.

The latest data adds to prevailing evidence monetary easing has hit a wall to fix the damage left by the health crisis. The Bangko Sentral ng Pilipinas (BSP) slashed policy rates by 200 basis points last year and is holding steady in the face of rising inflation, but depressing lending figures showed it may not be creating much of an economic impact.

In January, household loans, long a reliable source of growth, shifted hard to the negative territory with a 6.9% drop year-on-year, the first decrease on available record from 2001. The contraction was massive considering that in previous month, consumer lending was growing 4.1%. In simple terms, consumers are holding back from swiping their credit cards, or taking auto and home loans.

The decline only exacerbated the shrinking loan portfolio for larger production activities, which nonetheless represented the bulk of lending. This segment inched down a smaller 1.7%, although it has been on the red for the second consecutive month.

Whether or not lending already hit a bottom remains also uncertain. Loans had been slowing down until November last year, and crossed the negative line in December. The persistent weakness, coupled with a hesitant fiscal policy, is adding to worries the economy may not have picked up as warranted in the first quarter.

Essentially, a pull-back in lending means consumers are not getting financial support to fund purchases or investments for a variety of reasons. On one hand, lenders at the onset may be reluctant to lend because of the costly burden from unpaid loans, or on the other, borrowers may not be applying for loans at all to avoid default.

With banks not lending, the growth of money supply in the financial system is also easing. M3 grew 9% year-on-year to P14 trillion in January, slower than December's 9.5%, BSP data showed.

Michael Ricafort, chief economist at Rizal Commercial Banking Corp., a universal bank, also said in a commentary some firms may have opted “fund-raising activities in the capital markets,” instead of availing themselves of loans.

BSP, for its part, is sticking to its guns. “The BSP’s accommodative monetary policy stance continues to complement critical fiscal and health interventions in supporting economic activity and market sentiment,” it said.

- Latest

- Trending