Virus-induced foreign borrowings breach $7 billion

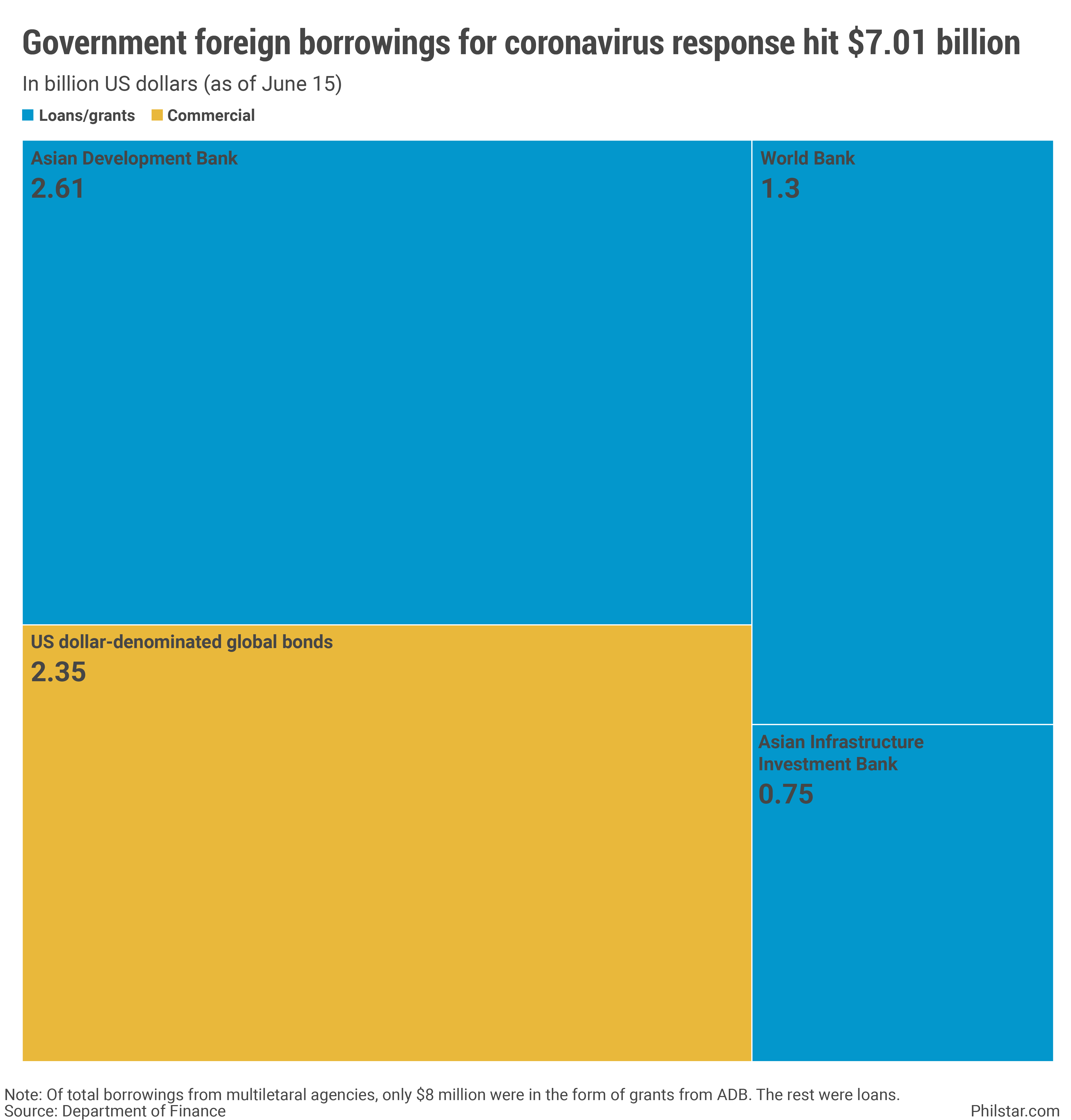

MANILA, Philippines — Three months into the lockdown and resulting business disruptions, the Duterte administration has raised $7.01 billion from foreign lenders to build up its war-chest against the coronavirus disease-2019 (COVID-19) pandemic.

The latest addition to the fund pool was the $500-million Expanded Social Assistance Program from the Asian Development Bank (ADB) meant to finance aid to 4.3 million conditional cash transfer beneficiaries during the outbreak. The loan was signed June 15.

“This budget-support loan will not only help bridge our funding gap for our COVID-19 response, but will also strengthen our social protection program as we restart our economy and help people get back on their feet amid the pandemic,” Finance Secretary Carlos Dominguez III said in a statement on Wednesday.

Economic managers have increasingly turned to loans and grants to raise cash for an unanticipated pandemic that engulfed the globe beginning January, but only accelerated its spread in early March. The fallout from the pandemic, as well as that of state-initiated lockdowns, was greatly felt with the economy shrinking 0.2% in the first quarter, and revenues dropping 39.2% annually in April.

With revenues weakening, borrowings became a crucial source of funding. The finance department listed down loans and grants the agency signed with multilateral partners since March. The tally reflects agreements secured as of June 15, athough not all funds were necessarily already credited to state coffers.

Breaking down the tally, the Philippines secured most of its debt from ADB which lent a total of $2.61 billion since March.

Broken down further, only $8 million of ADB credit were grants, meaning the Philippines got them for free. The rest were in the form of loans, charged with applicable concessional interest rate of 0.6% each. So-called commitment charges, which are smaller than the interest, were also slapped.

After ADB, proceeds from an international bond sale accounted for a huge part of funding for COVID-19 contingency programs. In April, the government raised $2.35 billion from selling 10- and 25-year debt papers to investors at 2.457 and 2.95% interest.

Following proceeds from the bond sale in terms of amount were loans from the World Bank. Figures showed the Washington-based lender lent out $1.3 billion as of June 15 under concessional rates of less than 1%.

The last in the list was the China-led Asian Infrastructure Investment Bank which loaned out $750 million to the government.

On its website, the finance department assured the public that while the government’s debt pile is expected to rise due to funding needs of COVID-19 offsetting projects, debts are being managed “responsibly.” “There are no collaterals in any of the loan agreements signed by the Philippine government,” the agency said.

Lack of budget space

With cash slowly becoming less of a problem, challenges now occur on how these funds can be used without going beyond the P4.1-trillion limit under the national outlay. No less than Dominguez has repeatedly stressed a narrowing “budget cover” to spend so much so that even with huge borrowings, spending is being capped to what was provided in the budget.

A supplemental budget authority from Congress would have fixed the problem, but Dominguez reiterated that augmenting this year’s outlay requires new revenues, and that borrowings or debts do not qualify as one. He has since turned to the justice department to issue a legal opinion on the matter.

- Latest

- Trending