Philippine peso, the strongest currency in EM

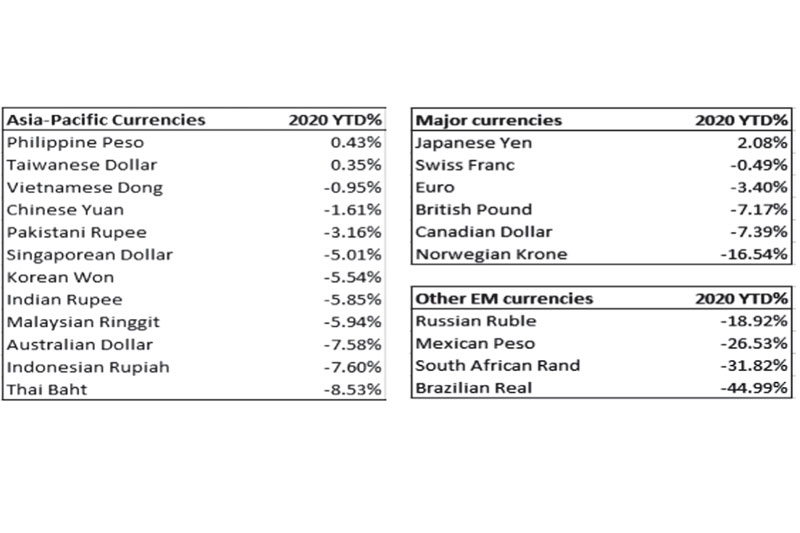

The Philippine peso continues to diverge against most emerging market (EM) currencies, which we first noted back in February (see Contrasting currency moves caused by COVID-19, Feb. 17). Investors have recently sought the haven of the US dollar amidst the coronavirus threat, crushing many EM currencies. The peso, however, emerged at the top and remained one of only two EM currencies that is positive against the US dollar this year.

The road to the coveted “A-rating” credit suffered a setback last Friday. Fitch Ratings revised the outlook on Philippines long-term foreign-currency issuer default rating (IDR) to Stable from Positive resulting from the impact of the COVID-19 pandemic and the lockdown measures to contain the spread of the virus. Fitch, however, affirms the Philippines’ credit rating at BBB, citing the country’s fiscal and external buffers, low government debt-to-GDP ratio, net external creditor position, and still strong medium-term growth prospects. Fitch expects the Philippine GDP to contract one percent in 2020.

Phl – 6th in EM in terms of financial strength

The Economist recently ranked the Philippines 6th among emerging market economies in terms of financial strength. While the fiscal measures to contain the coronavirus spread will result in the deterioration of the Philippines’ near-term macroeconomic and fiscal outlook, the country remains one of the more financially stable emerging economies.

Fiscal, external positions, and record forex reserves supportive of the peso

The country’s healthy fiscal and external positions have been supportive of the peso. The public debt-to-GDP ratio has fallen from a record high of 71.6 percent in 2004 to multi-decade lows of 41.5 percent as of 2019. The external debt-to-GDP ratio had dropped from an all-time high of 73.9 percent in 2001 to a record low of 22.2 percent in 2019. Gross international reserves (GIR) are likewise at record highs, hitting $89 billion as of March 2020.

Carry trade boosting the demand for the peso

The absence of yields in traditional safe havens have made Philippine bonds and the peso attractive. Today, more than $17 trillion worth of bonds in Europe and Japan have negative yields. With the US seemingly going in the same direction, trillions of dollars more will be looking for a place to park. The widening interest rate differential and the significant positive carry boosted peso demand.

Lower oil prices benefit the peso

Recently, we wrote about the oil price crash which sent prices below zero (see Below Zero, April 27). The decline in oil prices has been a boon for the peso. Oversupply and demand destruction due to the COVID-19 pandemic and economic contraction worldwide continue to put downward pressure on oil prices.

Too strong a peso would be counterproductive

However, too strong a peso may be counterproductive. It hurts the export sector and puts the BPO industry at a disadvantage. Note that India, our main competitor in the BPO space, now has a weaker Indian rupee (-5.85 percent year-to-date). A strong peso would also mean less income for OFW remittance beneficiaries.

Risks to the peso

The risks to the peso will be a further deterioration of the country’s current account balance caused by the decline in exports and tourism revenues, job loss and salary cuts for our OFWs, especially the seafarers. The anticipated spike in the fiscal deficit due to the government’s social amelioration program (Pagbibigay Ayuda) will also be negative for the peso.

Peso is range-bound

Based on technical analysis, short-term support for the USD/PHP rate lies at 50.50, while resistance ahead is at 51.50. In the medium-term, we expect the peso to trade at a range between 50 and 52.

Philequity Management is the fund manager of the leading mutual funds in the Philippines. Visit www.philequity.net to learn more about Philequity’s managed funds or to view previous articles. For inquiries or to send feedback, please call (02) 8250-8700 or email [email protected].

- Latest

- Trending