DOF wants public listing of firms receiving tax perks

MANILA, Philippines — The Department of Finance has proposed to make public the list of companies that receive fiscal incentives to make a “more accountable and transparent” corporate taxation system.

In a statement, the DOF said it wants “improvements” to the Tax Incentives Management and Transparency Act, or TIMTA, to enable the government to publicize the names of corporations receiving tax incentives, including the amount of their perks and contributions to the economy.

“We recognize the value of incentives as a key component of a country’s policy toolkit,” Finance Undersecretary Karl Kendrick Chua was quoted as saying in a news release.

“We assert, however, that incentives should not be given indiscriminately at the expense of building up our more powerful attractions: first, a skilled and hardworking talent pool that needs sufficient human capital investments, second, an ambitious infrastructure development program that requires fiscal commitment, and third, a sizable SME community that deserves to be treated fairly,” Chua added.

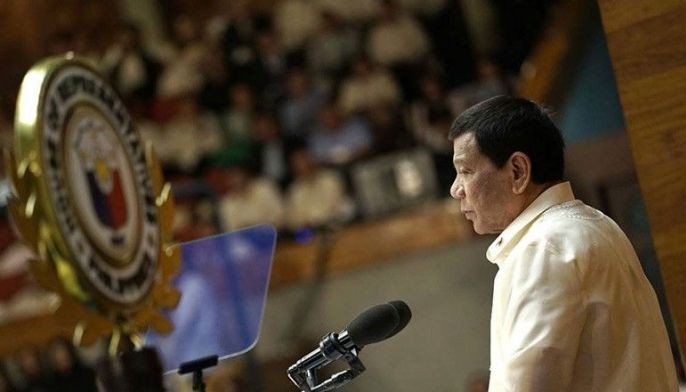

The Duterte administration is seeking to lower corporate income tax and rationalize investment tax incentives.

But senators, some of whom are seeking reelection on next year's midterm polls, are concerned the measure could force investors to relocate and result in job losses at a time prices of basic goods and commodities are rising fast and hurting consumers.

According to Chua, “the first important step towards a fairer and more accountable tax incentives system was taken" by the previous Congress and then-Aquino administration when they enacted the TIMTA in 2015.

The TIMTA “allowed the government to verify the scale of the problem on the grant of incentives” and enabled it to determine that in 2015 alone, it gave out a total of P301 billion worth of incentives, he added.

Last month, Fitch Solutions said the proposed corporate tax reform won’t boost investment without an improvement to the business environment. — Ian Nicolas Cigaral

- Latest

- Trending