Philippines to sustain growth momentum – FMIC

MANILA, Philippines — The Philippines is expected to sustain its growth momentum despite challenges brought about by inflation, rising interest rates and a weak peso, First Metro Investment Corp. (FMIC) said yesterday.

During its mid-year economic and capital markets briefing, the investment banking arm of the MetroBank Group also said the Bangko Sentral is expected to raise policy rates anew by 50 basis points this quarter, an aggressive move aimed at taming rising inflation by the end of the year.

In relation to this, bond yields are expected to move upward alongside the rate hike and efforts by the government to raise funds for its huge infrastructure projects.

FMIC retained its forecast in January of an economic growth rate of seven to 7.5 percent this year as macroeconomic fundamentals remain solid. Amid internal and external challenges, the domestic economy would continue to be driven by robust domestic demand, strong infrastructure spending, higher job creation, resurgence in manufacturing, and rising tourist arrivals.

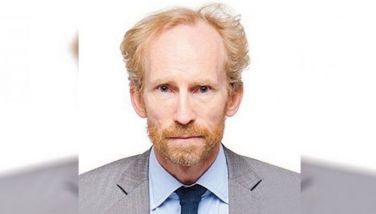

“The Philippines has been unfairly lumped with weaker emerging markets. But the Philippines stands on sounder fundamentals. And so we remain optimistic the economy will grow at a fast pace,” FMIC president Rabboni Francis Arjonillo said during the briefing.

“This will also come on the heels of the tapering off of the inflation growth that we are experiencing lately and sustained OFW and BPO remittances,” he added.

FMIC noted that despite weak exports, domestic demand has been seeing an eight percent growth since the beginning of the year due to strong consumer demand. Foreign direct investments have also grown 24.3 percent from $2.6 billion to $3.2 billion in the first four months of the year.

Infrastructure spending under the Build Build Build program also rose by an average of 20 percent in the last seven months.

The resurgence in the manufacturing sector is also viewed a positive sign as the Philippines stands the chance of being an alternative manufacturing destination for Taiwanese and Japanese companies that previously invested in China.

FMIC expects the peso to remain weak against the dollar this year as the US Fed raised interest rates anew in June. The local currency is expected to trade at an average of 53.90 against the dollar for the rest of the year.

“We think the peso will continue to depreciate but this will augur well for our economy and for the majority of the Filipinos,” Arjonillo said.

He noted that a weak peso could discourage more imports and produce more exports, potentially narrowing the trade deficit over the medium term. A stronger dollar would also benefit families of OFWs.

“Its impact on both the short and medium term is positive,” he said.

FMIC also said the prevailing slump in the equities market is expected to lift within the year as corporate earnings are seen to receive a boost on account of higher consumer spending leading to the 2019 senatorial elections.

The company expects the PSEi to rally to 7,900 to 8,200 with earnings per share growth of 11.5 percent and price earnings ratio of 18 to 19x.

“We believe the stock market will bounce back strong and reach our projected levels,” Arjonillo said.

- Latest

- Trending