IPO seen to dilute PLDT stake in German firm

MANILA, Philippines - Leading multimedia and telecommunications giant Philippine Long Distance Telephone Co. (PLDT) sees its stake in Rocket Internet AG being diluted further after the initial public offering (IPO) of the German firm is completed.

After the IPO of the German firm, PLDT said its stake would be reduced to 6.4 percent from the original 10 percent it acquired for 333 million euros last August.

This would be the third time that PLDT’s stake in Rocket Internet would be reduced.

Initially, the 10-percent interest was slashed to 8.6 percent and further to 8.4 percent with the entry of European investors last August.

PLDT assumed that its interest in the German firm would be reduced once greenshoe option of the IPO is exercised in full. A greenshoe is a clause that allows underwriters to buy up to an additional 15 percent of company shares at the offering price.

The company announced the successful pricing of the shares of Rocket at 42.50 euros per share and would raise 6.7 billion euros after the IPO.

The offering comprise of 32.94 million newly issued shares and an over-allotment of 4.94 million shares.

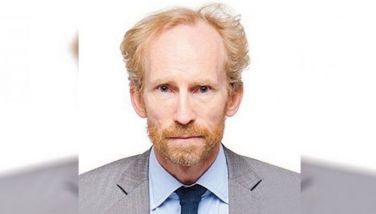

PLDT president and chief executive officer Napoleon Nazareno said in a statement that the IPO of Rocket Internet was well received by investors.

“We are delighted with the news that Rocket’s IPO was warmly received by investors. This affirms our belief in Rocket’s unique platform for establishing new Internet companies and proven track record in successfully rolling out these businesses in fast growing markets,” Nazareno said.

Last Aug. 7, PLDT chairman Manuel V. Pangilinan announced the company’s biggest overseas investments after closing a deal acquiring a 10-percent stake in Rocket Internet worth 333 million euros.

PLDT has already made an initial payment of 50 percent while the remaining 50 percent was supposed to be paid within a period of 12 months upon the achievement of certain milestones.

Last month, PLDT decided to fully settle its biggest overseas investments in the German firm that is set to go public through an IPO at the Frankfurt Stock Exchange later this year.

Rocket Internet intends to use the proceeds of the fund raising activity to finance its future growth through the launch of new business and providing further equity capital to its network of companies.

Rocket Internet provides a platform for the rapid creation and scaling of consumer Internet businesses outside the US and China. It has more than 20,000 employees in its network of companies across over 100 countries, with aggregated revenues in excess of €700 million in 2013.

Its most prominent brands include leading Southeast Asian e-Commerce businesses Zalora and Lazada, as well as fast growing brands with strong positions in their markets such as Dafiti, Linio, Jumia, Namshi, Lamoda, Jabong, Westwing, Home24 and HelloFresh, in Latin America, Africa, Middle East, Russia, India and Europe.

- Latest

- Trending