PSE jacks up Q1 income 58% to P144 million

Manila, Philippines - The Philippine Stock Exchange Inc. (PSE) jacked up its first quarter net income by 57.8 percent to P144.08 million as it benefited from higher trading volumes.

In a financial report submitted to securities regulators, PSE said operating revenues improved 8.83 percent to P222.96 million. Trading-related fees grew 31.39 percent to P62.28 million as trading volume surpassed the past year’s level.

Average daily turnover value reached P7.84 billion, 54.3 percent higher than the previous year.

Service fees generated by wholly-owned unit Securities Clearing Corp. of the Philippines climbed 54.48 percent. Listing related income, however, fell 38.34 percent due to lower listing fees from initial public offerings (IPOs) and additional listings.

Listing maintenance fees, on the other hand, increased 4.74 percent to P50.68 million due to higher market capitalization of listed companies.

Other income amounted to P45.45 million, accounting for 17 percent of total revenues. The figure is 235.85 percent higher than the year before, mainly due to mark-to-market gains on financial assets. These revenues came from the investment in equity funds managed by two external fund managers.

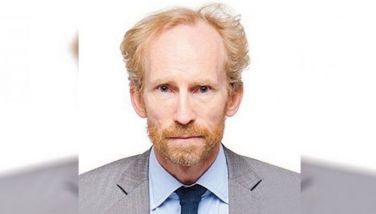

“The PSEi continues to be one of the top performing markets in Asia and we have seen a healthy increase in trading activity arising from this. The extension of trading hours into the afternoon at the start of the year has helped our market to accommodate this renewed interest from investors. We hope that revenues from listings will catch up as more companies have started to go to the stock market to raise capital,” PSE president and chief executive officer Hans B. Sicat said.

Sicat said funds raised from the equities market (which include IPOs, follow-on share sales, stock rights and private placement) could hit P200 billion this year, or nearly double that of last year’s P107.5 billion.

He also cited that the steep losses incurred by JP Morgan Chase and Europe’s possible exit from the euro zone as the culprit for the massive sell-off in the local broad market and not the deepening rift between China and the Philippines over a territorial dispute at the Panatag (Scarborough) Shoal.

- Latest

- Trending