E-money transactions reach P1.1 T in 2016

MANILA, Philippines - The net inflows of electronic-money transactions reached P1.1 trillion in 2016 with the rapid evolution of digital technology, particularly of smartphones, the Bangko Sentral ng Pilipinas (BSP) reported.

The advent of digital banking revolutionized the provision of financial services providing unprecedented access to customers allowing them to perform banking transactions and make payments anytime, anywhere and at their own convenience.

The BSP said electronic service delivery channels provide a faster and more efficient alternative to reach a wider base of clientele, particularly those in rural communities.

The central bank said e-money transactions coursed through banks amounted to P870.1 billion last year and accounted for 78.2 percent of the total net inflow of e-money transactions.

Two of the most popular forms of e-money in the country are Smart Money of PLDT Inc.’s Smart Communications and G-Cash of Ayala-led Globe Telecom Inc.

The BSP said the increasing use of e-money in the Philippines has resulted to the growing number of participating banks and e-money transactions.

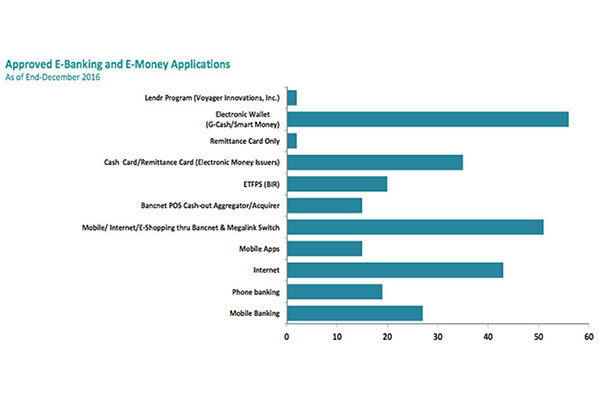

In early 2000, the regulator allowed banks to engage in electronic banking to expand client reach and improve financial access. The number of banks engaged in electronic banking grew by more than 12 times to 119 in end December last year from only nine banks in end-December 2000.

In 2009, the BSP issued the guidelines allowing e-money as an instrument of efficient and affordable delivery of financial services to low-income households in non-urbanized and underbanked areas.

Currently, there are 29 bank electronic money issuers, two non-bank electronic money issuers, five other electronic money issuers and three qualified electronic money network service providers.

The BSP said digital transformation of banking services and industry consolidation are gradually restructuring the banking system’s overall landscape into a more streamlined, technology-driven, and inclusive financial ecosystem.

There were five cases of mergers, acquisitions, and consolidations next year resulting to the decrease in the number of banks to 602 from 632 in 2015. The BSP’s Monetary Board has ordered the closure of 22 problematic banks last year.

- Latest