Jollibee impresses with huge surge back to profitability

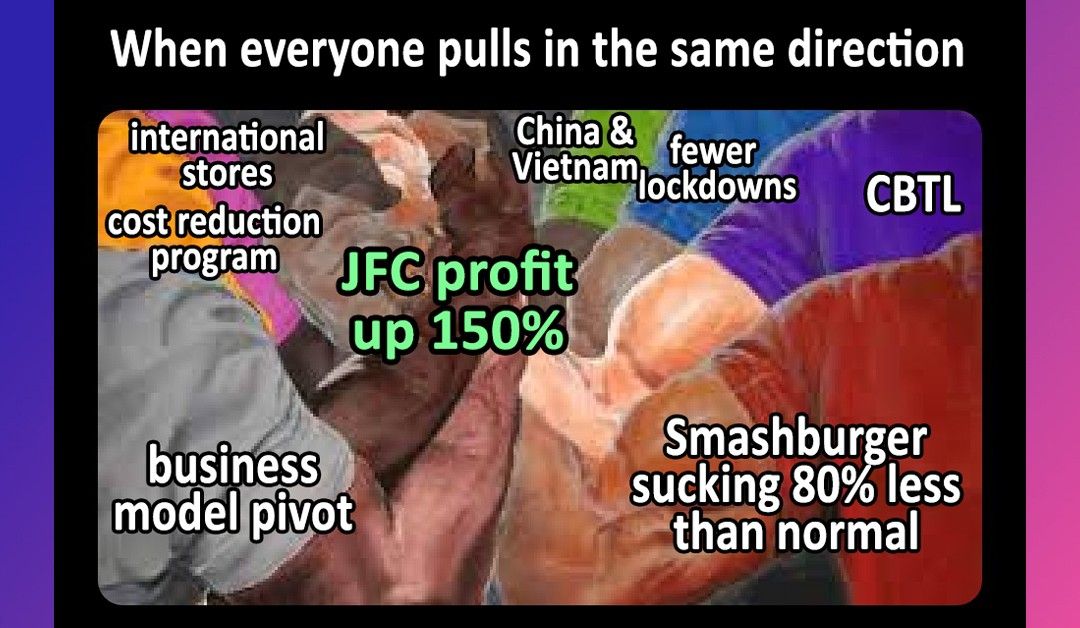

Full-year FY21 profit of P5.9 billion, up 152% from FY20 net loss of P11.5 billion. Q4/21 profit of P3.3 billion, up 61% from Q4/20 profit of P2.0 billion. JFC’s earning teaser was full of tasty bites for investors, who have seen the stock price recover to a point where it is within spitting distance of Jollibee's [JFC 244.00 0.99%] “pre-Smashburger” level of around P300/share.

Net income and typical financial metrics aside, the most useful statistics for getting a feel for the on-the-ground operation of the stores themselves are “system-wide sales”, which is a measure of all the revenue earned as a result of operations, and “same-store sales”, which measures current performance against previous performance, but only between stores that existed in both periods.

System-wide sales hints at the health of the company’s “top-line” (the ability of the company to grow revenues in operations), and same-store sales hints at the health of the company’s “bottom-line” (how efficiently the company generated revenues). JFC reported a 20% increase in system-wide sales in 2021, with a 25% increase in Q4 y/y.

For same-store sales, in 2021 JFC did not report a unified measure, but said that same-store sales in the Philippines were up 24%, and internationally were up 9%.

The company said that its Coffee Bean & Tea Leaf (CBTL) brand saw a 29% increase in same-store sales and achieved profitability in 2021.

JFC said that it is looking forward to a total recovery this year if restrictions are fully lifted, and the anticipated election spending bump actually materializes.

MB BOTTOM-LINE

In some ways, COVID caught JFC with its pants down, as it was forced to weather a prolonged period of demand destruction while it was over-extended after the expensive back-to-back acquisitions of Smashburger and CBTL.

Investors that were grouchy about Smashburger’s drag on the financials and wary of CBTL’s huge price-tag were vocal and impatient as COVID caused the stores to go dark in 2020.

Unease grew as the losses mounted and the future of in-person dining appeared in great jeopardy. Instead of doing nothing, JFC acted on the data that showed changes in the consumption habits of customers would be wide-ranging and long-lasting.

It closed unprofitable stores and renovated the remaining stores to better suit a model that was dine-out dominant, a huge change from the “pack as many Filipinos in a room as possible” model that had brought it decades of uninterrupted success.

It doubled down on international expansion, both of the Jollibee brand, but also of more local-facing brands in Vietnam and China.

Looking back, the CBTL purchase provided international stability when the Philippines was going through its marathon, world-leading lockdown.

The international expansion smoothed the revenues (and losses) as waves of COVID hit different parts of the world at different times. JFC even reported that Smashburger, that ever-present anchor of sadness, had cut its annual losses by 80% in 2021.

Can you imagine a world where Smashburger is profitable, where CBTL continues to perform, and where the Philippines-based Jollibee franchises rebound to full capacity?

Shareholders are hoping to see that world in 2022.

Those dreams have been interrupted before, like in December 2020, May of 2021, and this January as the Omicron wave caused another round of hesitancy, but the charts don’t lie.

JFC is in a long-term uptrend.

Yes, there are risks, but there’s also still potential upside here if the management team continues to get it right.

--

Merkado Barkada's opinions are provided for informational purposes only, and should not be considered a recommendation to buy or sell any particular stock. These daily articles are not updated with new information, so each investor must do his or her own due diligence before trading, as the facts and figures in each particular article may have changed.

- Latest