AEV sells 25% stake in AboitizPower to Japan’s largest power generator

The deal between Aboitiz Equity Ventures [AEV 53.10 2.12%] and Jera, a Japanese joint venture between TEPCO and Chubu Electric that is Japan’s largest power generator, saw Jera gain a 27% stake in AboitizPower [AP 34.20 4.75%] for approximately P80 billion.

AEV will receive approximately P75 billion out of the deal (it sold 25% of AP to Jera) in a single lump sum at closing, and another Aboitiz Family-owned private company will receive approximately P5 billion (it sold 2% of AP to Jera).

According to Jera, it acquired the stake in AP to “boost its presence in a country where power demand is growing”, expand its renewable portfolio, and “enable Aboitiz to develop a world-class LNG power plant with competitive fuel procurement and efficient operation.”

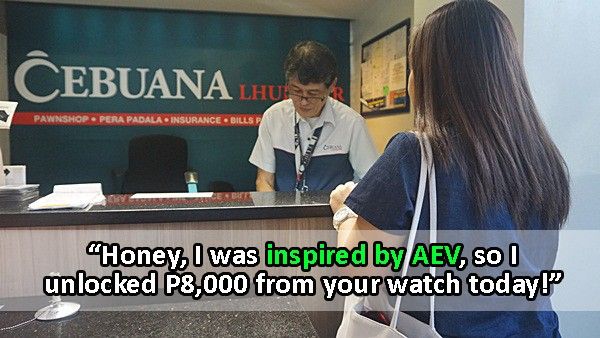

For AEV, the deal “unlocks significant capital” that it can use for other “AEV Group’s growth initiatives”, like the LNG-to-power projects that Jera teased in its media on the acquisition.

MB BOTTOM-LINE

This is actually a really interesting deal. AEV brokered a deal to take on Jera as a “strategic investor”; that’s where a larger company (usually in the same industry) takes a stake in a smaller company for reasons that go beyond simple trading profits.

For example, in this case, Jera is interested in sharing its LNG-to-power know-how and hopes to grow the value of its stake through sharing its knowledge and technology with AP to develop assets of this type.

For AEV, the sale leaves it with about a 51.87% stake in AP, and a massive pile of cash that it can use to inject into any of its capital-intensive businesses. I chuckled to myself at AEV’s framing of the sale, that it “unlocked” the P75 billion, because I felt like that was a hilariously positive way to spin selling a huge chunk of the family’s crown jewels to raise some money.

This deal has plenty of potential romantic benefits for AP and AEV that go beyond the bare vulgar terms of the exchange, so perhaps it was more accurate to say that the 25% stake in AP “unlocked” a strategic relationship with a massive long-term partner with extensive experience and sophisticated technology that can add value to its power business.

Either way, the deal prices AP’s marketcap at P300 billion, which is a 25% premium over the P240 billion that AP was worth before the announcement.

--

Merkado Barkada is a free daily newsletter on the PSE, investing and business in the Philippines. You can subscribe to the newsletter or follow on Twitter to receive the full daily updates.

Merkado Barkada's opinions are provided for informational purposes only, and should not be considered a recommendation to buy or sell any particular stock. These daily articles are not updated with new information, so each investor must do his or her own due diligence before trading, as the facts and figures in each particular article may have changed.

- Latest