OPEC+ vs central banks

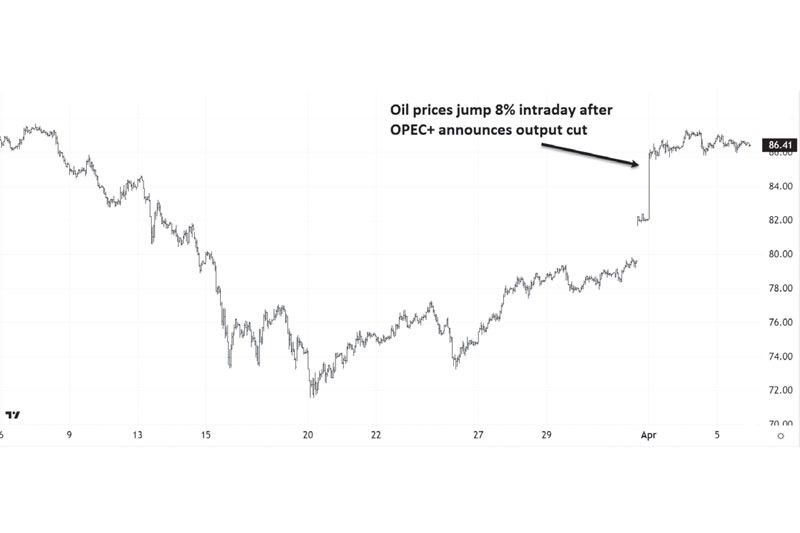

The recent move by OPEC+ to cut crude oil production by one million barrels per day has thrown a monkey wrench into the works of the Federal Reserve (Fed) and other central banks. While they are working to control inflation and lead the global economy into an acceptable growth path, OPEC+’s actions could potentially undermine their efforts. This move caused an 8% jump in oil prices, shaking the markets just as they were recovering from recent banking failures.

The surprise production cuts by OPEC+ could have far-reaching consequences. These cuts threaten to exacerbate inflation, and at the same time, risk putting the global economy on the brink of recession. As financial markets remain on edge, the Fed and other central banks face a daunting task of finding a way to reconcile their policies with OPEC+’s actions.

Brent Crude Oil prices (30-min chart)

Source: Tradingview.com, Wealth Securities Research

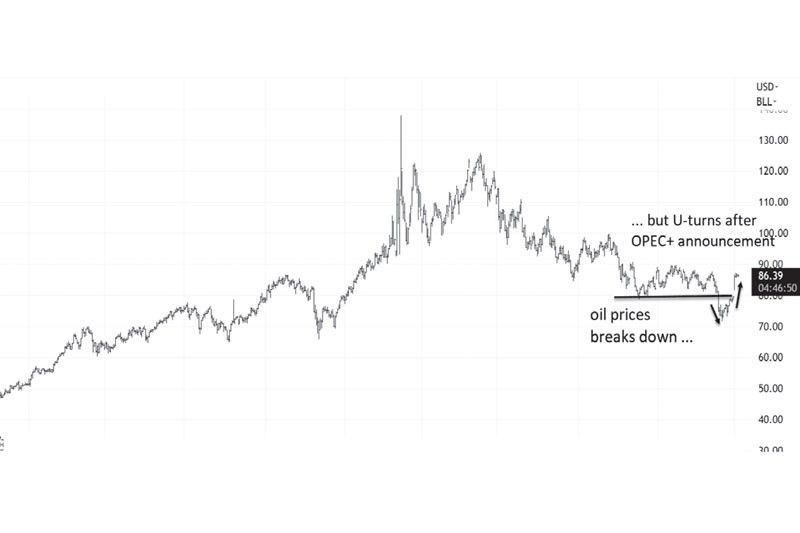

Oil U-turns

Before the announcement, the benchmark Brent crude oil had just broken down below $80 per barrel and was trading between $70 to $80. However, OPEC+’s cut caused oil to U-turn, effectively establishing a floor price for oil at $80 per barrel.

Brent Crude Oil prices (Daily chart)

Source: Tradingview.com, Wealth Securities Research

Cuts may lift oil prices above $100

Several analysts and economists believe that the surprise production cuts may exacerbate tightness in the oil market and potentially propel prices above the $100 per barrel threshold. Leading financial institutions, such as UBS and Goldman Sachs, have raised their oil price projection upwards. Goldman Sachs, for instance, now anticipates prices to hit $95 per barrel by the end of this year and $100 by the end of 2024.

Strained relations and political tensions

In October 2022, OPEC reduced production by two million barrels per day in response to the US announcement of an additional 10 million barrels of oil release from its Strategic Petroleum Reserve (SPR) in September 2022. This effectively nullified the impact of the US action, resulting in a heated debate and criticism from the Biden administration. This incident underscored the current strained relations between the US and Saudi Arabia, the biggest and most influential member of the OPEC+.

Diokno weighs in on OPEC+ moves

BSP Governor Benjamin Diokno has weighed in on the recent decision by OPEC+ to cut crude oil output, citing it as an anticipatory measure ahead of a forecasted global economic slowdown. Speaking at a press briefing last week, Diokno remarked: “I think the OPEC countries are kind of anticipating that oil prices, if they do not do anything, will go lower than what it is right now. So this is kind of anticipatory. There are many, many moving parts. So we don’t know yet what will be the impact.” When asked about the move’s potential impact on Philippine inflation, Diokno acknowledged that it was uncertain, but the BSP had set a threshold for oil prices at $90 per barrel.

Investors brace for uncertain market impact

The clash between OPEC+ and central banks has created a complex and uncertain environment for investors. With OPEC+ seeking to boost oil prices and central banks focused on maintaining global economic stability, the struggle appears to have no clear end in sight. As investors brace for uncertain market impacts, the potential implications for inflation, interest rates, and global economic growth remain unclear, making it important to monitor these developments closely.

Philequity Management is the fund manager of the leading mutual funds in the Philippines. Visit www.philequity.net to learn more about Philequity’s managed funds or to view previous articles. For inquiries or to send feedback, please call (02) 8250-8700 or email [email protected].

- Latest

- Trending