Market turmoil

“There are decades when nothing happens; there are weeks when decades happen.” – Lenin.

Last week was such a week.

In a previous article, we said the Fed should be careful what it wishes for. “Actions of the hawkish Fed have far-reaching effects on all asset classes. Central banks globally should be vigilant as said policies may trigger a full-blown currency crisis similar to what happened in the past.” – see Peso drops to record low, Sept. 5, 2022.

The Fed is stuck with rate hikes as inflation stayed hot, raising the fed funds rate by 75 basis points during its September meeting. Moreover, the Fed warned that rates would go higher and stay elevated for a longer period. Central banks worldwide like the BOE, ECB, and BSP also hiked rates. This is what happened next:

1) The S&P 500 broke below the lows in June, registering a new bear market low of 3,585.62 last Friday. The S&P 500 is now down 25.6 percent from the all-time high of 4,818.62 set in January this year.

2) The Dow Jones Industrial Average registered new lows, hitting 28,725.52 last Friday. It has declined 22.2 percent from the peak in January 2020.

3) The Nasdaq Composite 100 index ended below its June 16 low, closing at 10,971.22. It has fallen 34.6 percent from its November 2021 high.

4) The yield of the 10-year US Treasury breached four percent intraday last Wednesday, the highest level since October 2008 after the Lehman crisis.

5) The Vanguard Total Bond Market Index (BND), which provides broad exposure to the investment-grade US dollar-denominated bond market, fell to its lowest level since November 2008.

6) Last Monday, the British pound registered a record low of 1.035 against the US dollar after the UK unveiled the biggest tax cuts package in decades as part of a growth plan.

7) The yield of 30-year UK bonds, a.k.a. gilts, jumped to an intraday high of 5.12 percent last Wednesday, its highest level since 1998. The single-day move last Wednesday was the 30-year gilt’s biggest fall since 1992.

8) The US dollar index hit 114.78 on Wednesday, its highest since June 2002.

9) The Philippine peso weakened and reached 59 before closing at 58.625 last week.

10)The PSE index decreased 8.3 percent for the week to 5,741, its lowest since October 2020. Last week’s decline is the biggest since March 2020.

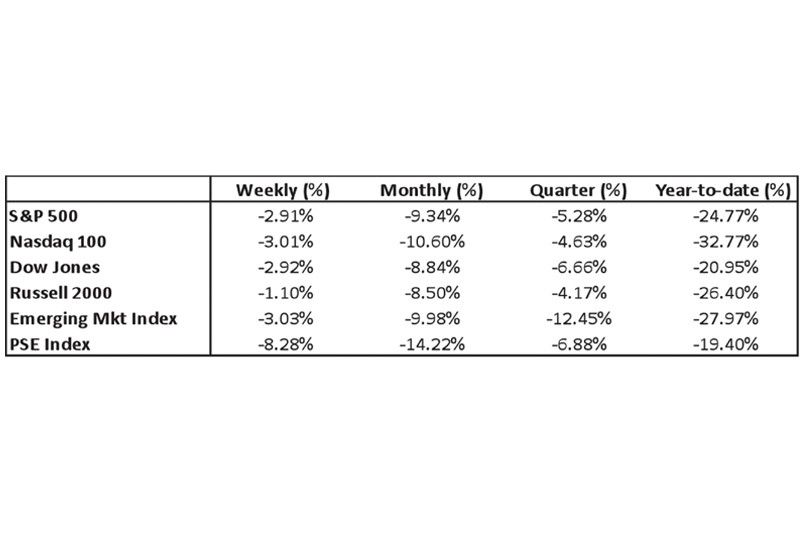

What a week, month, quarter, and year!

The benchmark S&P 500 index (as well as other US major indices) ended the week, month, quarter, and year-to-date in the negative. It has entirely erased the 14 percent gain in July to mid-August and ended the third quarter of this year with a 5.3 percent loss. US stocks suffered their worst monthly rout since March 2020. According to Bloomberg, the S&P 500’s drop in the first nine months is the third worst since 1931. Following the movement in the US markets, the Emerging market index (EEM) and the PSE index likewise suffered their worst monthly declines since March 2020, which was the height of the COVID pandemic scare.

Source: Bloomberg, Wealth Securities Research

British pound takes a pounding

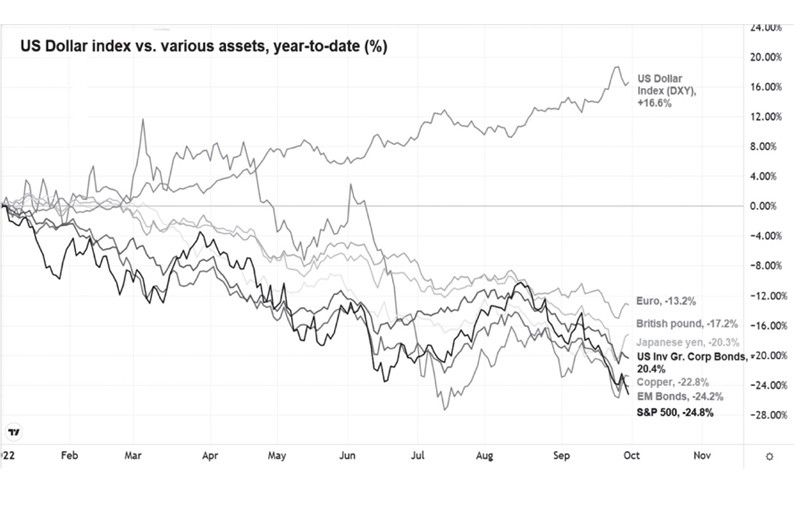

In previous articles, we wrote about the relentless melt-down from the exponentially rising US dollar, pummeling the yen, euro, yuan, peso, and most other currencies, not to mention global stocks and bonds. Last week, it was the British pound that took a pounding. The British pound traded at its lowest level when it touched 1.035 vs. the US dollar intraday last week. It closed at 1.117 last Friday and is down 17.2 percent year-to-date. The Japanese yen is trading at its lowest since 1998, with a decline of 20.3 percent year-to-date.

Source: Tradingview.com, Wealth Securities Research

Bonds having the worst year

As the New York Times notes, “this has been the most devastating year for bonds since at least 1926, and maybe in centuries.” Bonds - supposed to bring a steady income stream - are being hammered around the globe. UK gilts sold off sharply last week, and the Bank of England intervened. The yield of 30-year UK gilts jumped to an intraday high of 5.12 percent last Wednesday, its highest level since 1998. The iShares JP Morgan Emerging Markets Bond ETF (EMB) has tumbled 24.2 percent. Even the iShares US Investment Grade Corporate Bond ETF (LQD) has fallen 20.4 percent year-to-date. Before this year, its largest loss was 3.8 percent in 2018.

Dollar cash is king

With all asset classes dropping like a rock, only cash in US dollars has withstood the turmoil. The carnage was caused by the Fed’s determination to raise interest rates to fight inflation at the expense of growth. There are fears that overtightening by the Fed will lead to a deep recession worldwide. The volatility will continue until such time that the Fed changes it’s hawkish stance, stops its rate hikes, and pivots.

Philequity Management is the fund manager of the leading mutual funds in the Philippines. Visit www.philequity.net to learn more about Philequity’s managed funds or to view previous articles. For inquiries or to send feedback, please call (02) 8250-8700 or email [email protected].

- Latest

- Trending