Is gold losing its luster?

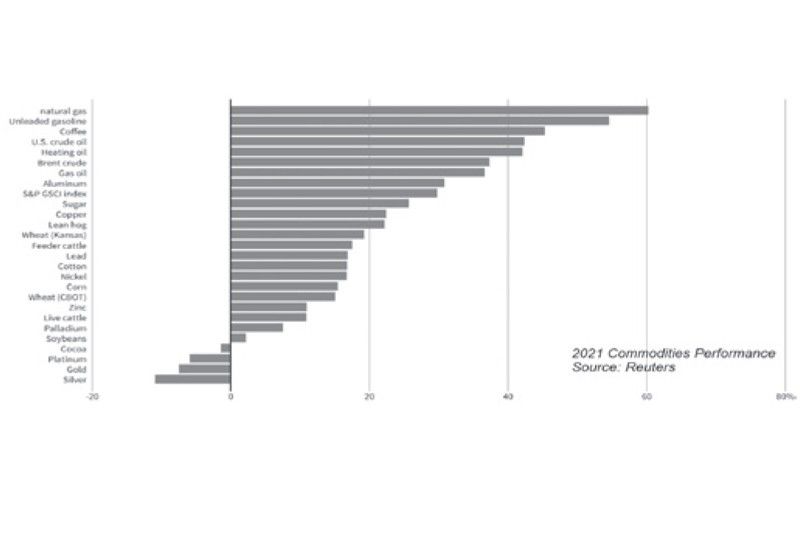

Gold, a haven during the early days of the pandemic and one of the best assets to own in 2020, is the second-worst performer in the Bloomberg Commodity Index for 2021. Gold appears to have lost its luster this year, with investors preferring energy, industrial metals, and agricultural commodities as the global economy rebounded from the pandemic lull. As a result, gold has declined 7.5 percent year-to-date, dropping to the bottom rung of the commodity ladder together with silver and platinum. Below, we cite the reasons for the underperformance of gold.

Industrial metals outshine gold

Industrial metals from copper to aluminum to nickel and iron ore have outshined gold this year. As the global economy recovers from the pandemic, demand for cars, electronics, infrastructure, and renewable energy has driven prices of these metals higher. Biden’s trillion-dollar infrastructure plan undoubtedly benefits industrial metals. Aluminum is up 30.8 percent year-to-date, while copper and nickel have respective gains of 22.4 percent and 16.7 percent this year.

Inflation more manageable

Gold is a well-known inflation hedge and has performed well during inflationary periods like the mid-1970s and early 1980s. However, the July data reveals that inflation will likely be more manageable and that the recent price pressure may be peaking. Core CPI (which excludes the volatile energy and food prices) registered a monthly increase of 0.3 percent, below market expectations of 0.4 percent, and significantly less than June’s 0.9 percent rise.

Taper talk intensifies

Talks that the Fed would soon end its massive bond-buying program have intensified lately, which has bearish implications for gold in the short run. Boston Fed’s Rosengren mentioned last Monday that he favors announcing the taper plans as early as September. Dallas Fed’s Kaplan said last Wednesday that the taper should begin in October. Meanwhile, Atlanta Fed’s Bostic urges a fast taper in case of another strong month or two of employment gains. Other Fed officials, including Fed Vice Chairman Clarida, made similar comments during the prior week.

Strengthening US dollar

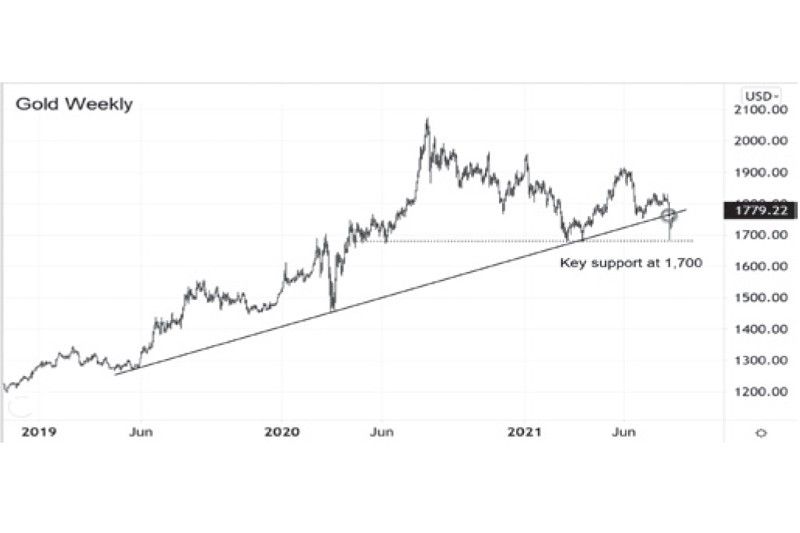

The strengthening US dollar is another significant headwind for gold. The dollar touched a four-month high last week after the strong US jobs report bolstered expectations that the Fed would tighten its monetary policy soon. Gold immediately fell to its lowest level in four months, briefly trading below $1,700 per oz before rallying higher to close the week. A strengthening dollar diminishes the demand for alternative assets like gold. Gold has an inverse relationship to the dollar.

Losing ground to crypto

Traditionally, institutional investors allocate 10 to 20 percent of their assets to alternative investments like private equity, hedge funds, and gold. This year, however, gold seems to be losing ground to cryptocurrencies that have now gone mainstream. Cryptocurrencies are no longer in the realm of early adopters (geeks and programmers) and millenials. Today, a growing number of institutional investors have allocated a percentage of their portfolios to Bitcoin, Ethereum, and other digital assets. As a result of increasing demand and institutional support, Bitcoin has gained 54.7 percent year-to-date, while Etherum has surged 335.7 percent over the same period.

Record highs after record highs

Despite surging new COVID cases due to the Delta variant, the US stock market continues to make new all-time highs on optimism about the gradual recovery from the pandemic. Last Friday, the S&P 500 rose for a fourth consecutive session, hitting a record closing high for the 48th time this year. Likewise, the European benchmark STOXX 600 index edged higher, closing higher for the 10th consecutive day to a new record high of 475.82. As a result, investors have piled into US and European equity ETFs this year. Meanwhile, according to the World Gold Council, investment demand for gold, which includes bars, coins, and gold-backed ETFs, is down 60% in the first half of 2021.

Gold’s uptrend line broken

Gold broke below its long-term uptrend line following the sharp two-week decline this month. However, it bounced off the critical support level at 1,700 to close at 1,779 for the week. Based on technical analysis, a decisive break below 1,700 would confirm the reversal from a bullish to a bearish stance for gold.

Philequity Management is the fund manager of the leading mutual funds in the Philippines. Visit www.philequity.net to learn more about Philequity’s managed funds or to view previous articles. For inquiries or to send feedback, please call (02) 8250-8700 or email [email protected].

- Latest

- Trending