Improved sentiment signals PSEi reversal

In our previous article, we concluded that the vaccine rollout is the catalyst that will turn the tide for Philippine capital markets and the economy (see Improving Vaccine Rollout, May 24). We also noted that if the government implements the mass vaccination program efficiently, the PSEi may recover its losses and catch up with its Asian counterparts.

After a slow start, the pace of vaccination picked up considerably in May. Philippine health officials administered a record 229,769 vaccines on May 20. This is the largest number of daily vaccinations since the start of the vaccination drive in March 2021. Government representatives are optimistic that the country will hit 350,000 to 500,000 vaccinations per day in the second half of 2021.

Reacting to improved vaccine rollouts, easing quarantine restrictions, and bouncing from oversold conditions, the PSEi surged. Market sentiment has improved considerably on the back of more consistent arrival of vaccines, and the slowing COVID-19 cases. Coupled with expectations of easing quarantine restrictions this June and a more open economy in the coming months, the PSEi skyrocketed to its highest level since March 15.

The worst stock market outpaces its peers

The Philippine stock market was the world’s worst performer just over a week ago. Foreign selling has been relentless, with net outflows going on for a total of 19 months. Foreign institutions saw the Philippines as the “laggard in Asia” due to its inability to control the spread of COVID-19. Philippine stocks have slumped throughout most of the year after early delays in the vaccine rollout and the second surge in COVID-19 cases threw the market in disarray. At its lowest point of the year at 6,080, the PSE index (PSEi) was down 15 percent.

However, something remarkable happened last week. On May 27, the market went up a staggering 5.1 percent which is seldom seen. This precisely coincided with the most spectacular astronomic display of the year – the rare “super blood moon eclipse.” May 26 marked not just a supermoon, but also a total lunar eclipse or so-called “blood moon eclipse.”

Full moon, eclipse and heightened volatility

In one of our past articles, we explained that stock markets tend to move in extremes during a full moon (see Supermoon, March 21, 2011). One can expect heightened volatility during these periods and price moves to be more pronounced. This phenomenon is partly explained by the pseudo-science called moon theory. According to this theory, lunar cycles affect human behavior just as it affects the tides. The moon can influence people’s mood swings, as well as exaggerate price swings. Significant events such as an eclipse, which happens when three astronomical bodies line up in a straight line, further magnify the price swings caused by the full moon.

Turn around bright eyes

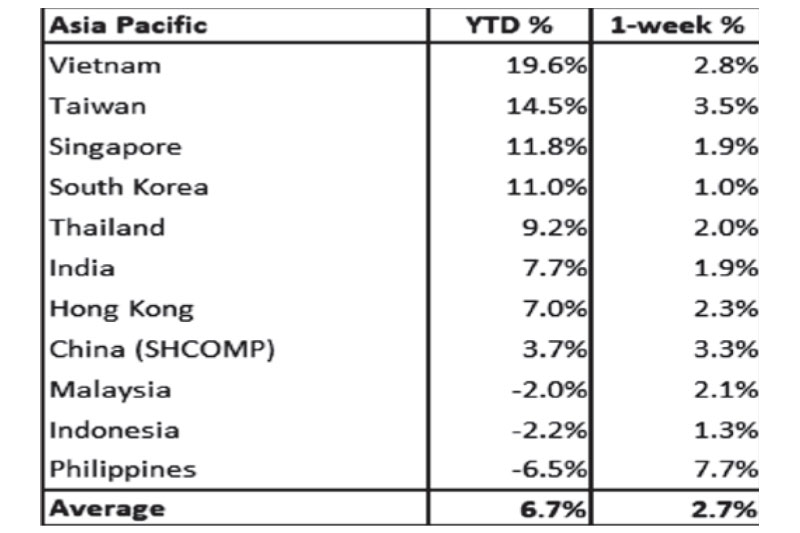

From being the world’s worst performer on a year-to-date basis, the Philippine stock market made a remarkable recovery last week. PSEi’s exceptional performance of +7.7 percent last week outpaced its Asian counterparts by an average of 500 basis points. This cuts year-to-date losses to just -6.5 percent and marks a stunning turnaround in Philippine stocks.

Start of recovery

True to form, the “super blood moon eclipse” brought heightened volatility to the PSEi last week. This event caused the PSEi to surge 7.7 percent from Wednesday to Friday, its sharpest three-day rally in almost a year. The rebound comes as investors hunt for bargains in the oversold Philippine stock market. The PSEi held significant support near 6,000. It has rebounded nearly 10 percent from its recent low of 6,080 to close at 6,675 last Friday. It broke above the multi-month downtrend that has plagued the PSEi since the start of 2021 and recovered the 40-week moving average.

Philequity Management is the fund manager of the leading mutual funds in the Philippines. Visit www.philequity.net to learn more about Philequity’s managed funds or to view previous articles. For inquiries or to send feedback, please call (02) 8250-8700 or email [email protected].

- Latest

- Trending