Government debts get cheaper, but also fall due earlier

MANILA, Philippines — Government debts are becoming cheaper, but more of them are fetching shorter payment terms, a scenario that can potentially divert more resources away from public projects toward larger interest payments.

Coupled with a heavier debt burden, National Treasurer Rosalia de Leon said shorter maturities are expected, given that investors lending funds had been more reluctant on doing so for the long term due to financial uncertainties that came with the pandemic.

“Comparators (even rating peers) have similar maturities. Appetite remains on the front and intermediate curve,” De Leon said in a Viber message over the weekend.

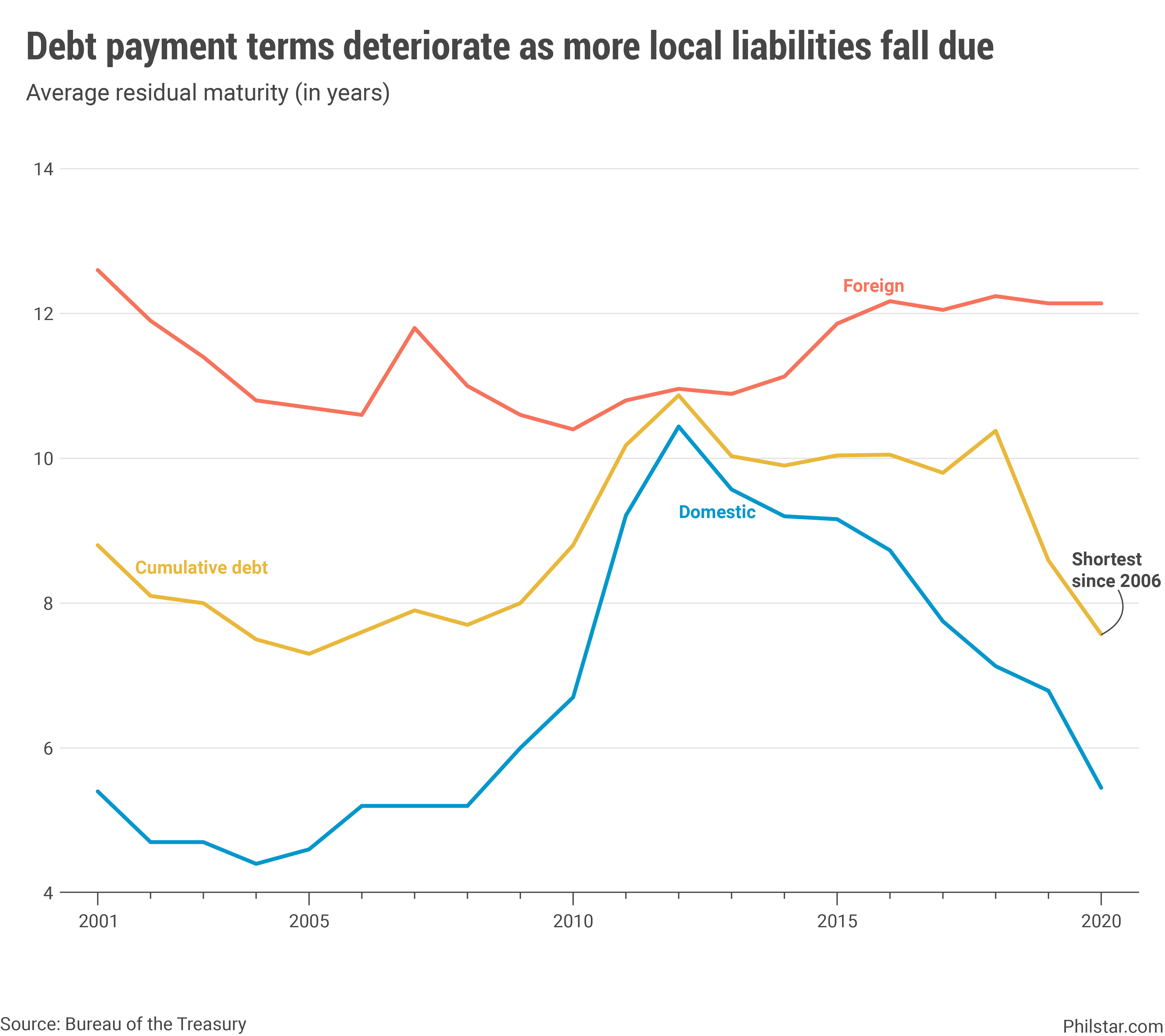

Bureau of the Treasury data showed average residual maturity of state debt shortened to 7.57 years last year, the shortest since 2005. The shortening was triggered by a drastic narrowing of payment schedules for local liabilities to 5.45 years from 6.79 years in 2019 and 7.13 years in 2018.

Foreign debts, meanwhile, largely enjoyed stable payment terms at 12.14 years in 2019 and 2020, driven mainly by large sums of coronavirus aid from multilateral agencies like the World Bank and Asian Development Bank that tend to enjoy longer settlement periods.

While the risk of default remains very low, given that the annual budget allots funds to debt payment, shorter maturities also means this allocation is only bound to increase, depriving meaningful public projects of resources to proceed.

In fact, interest payments as a percentage of economic output have increased to 2.4% as of the third quarter of 2020, up from 1.9% for all of 2019 and 2% in 2018 and 2017, Treasury figures showed. Local debt represented 68.4% of all liabilities so them falling due at much earlier dates mean funds to settle them would have to be quickly set aside.

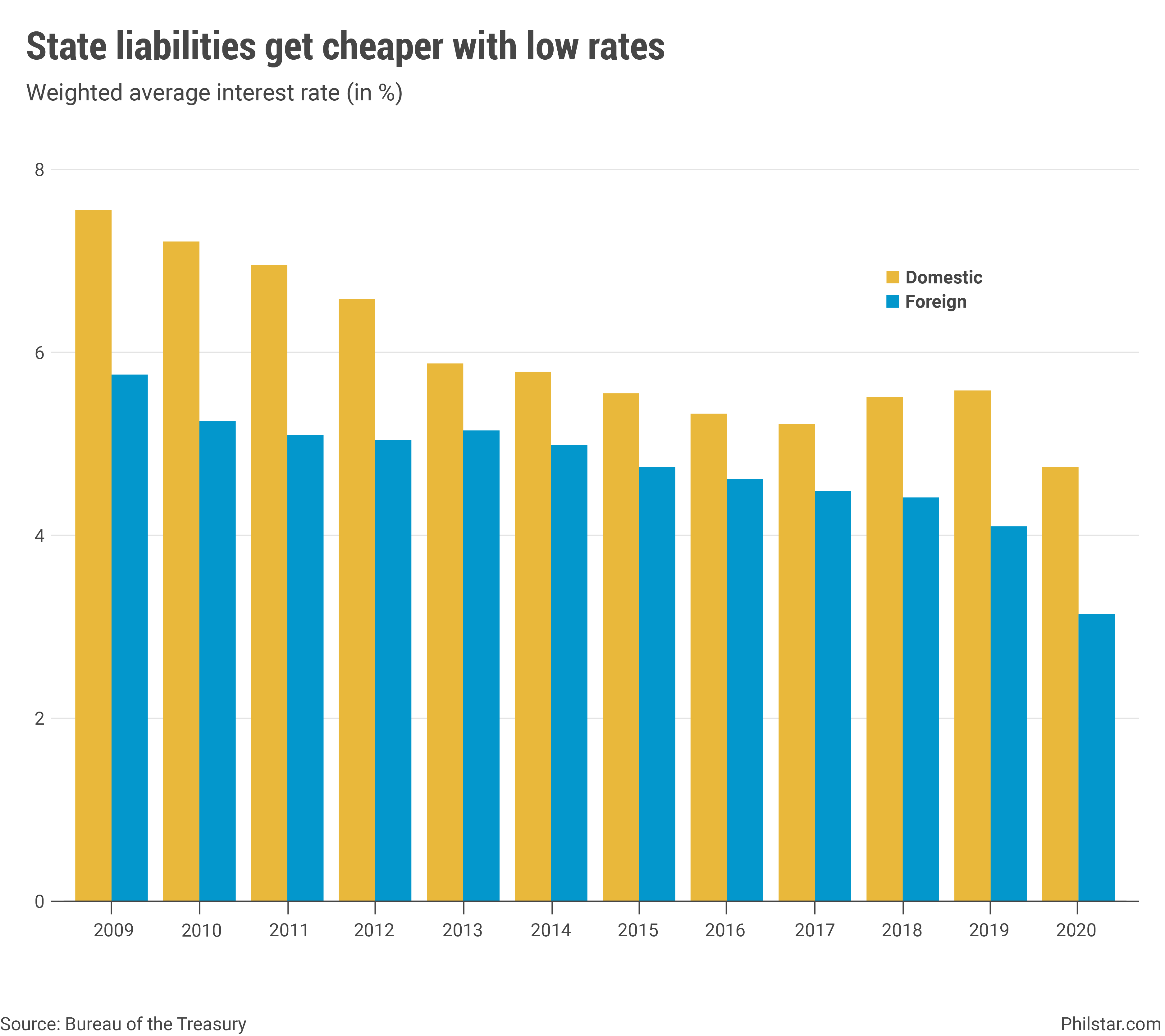

The good news is market interest rates have gone down to historic levels, helping offset the consequences of shorter maturities. As of last year, government debts were charged a weighted average interest rate of 4.17%, the lowest since at least 2008, the earliest record available.

Broken down, local debts fetched an average interest of 4.67%, while that of foreign obligations were cheaper at 3.09%.

That said, a deterioration in debt metrics had long been expected by economic managers who were forced to turn to more borrowing after tax receipts fell due to dismal economic activity, and amid rising pandemic needs that the government would have to fund one way or another.

“(We are) optimizing on interest payment to create fiscal space for productive spending to stimulate economy,” De Leon said.

- Latest

- Trending