Robinhood rattles markets

In the past two weeks, volatility spiked in the stock market. The US market fell 3.7 percent in four days before regaining its bearings and climbing to a fresh record high last week. The PSEi dropped 3.5 percent on Jan. 29 following a global selloff. The heightened volatility was caused by the short squeeze on Gamestop, which was triggered by hordes of Robinhood traders. This forced hedge funds to cover their short positions and offset these by selling long positions. The de-risking and the de-leveraging of fund managers due to the heightened volatility ultimately caused global stock markets to drop.

The rise of retail – a global phenomenon

The extraordinary growth of retail trading is a global phenomenon spurred by the pandemic. At the height of the coronavirus lockdowns, everyone was forced to stay at home. Casinos were closed down and there was no sports betting. Millions of retail traders around the world entered the stock market during this time. They were able to snag battered blue-chip stocks when the market bottomed-out in March last year. These investors subsequently bought into recovery and reopening plays such as airlines, cruise ships, hotels, banks, retailers, and restaurants.

Gamification of trading

We wrote about the rise of Robinhood traders last year (Robinhood traders, June 22, 2020). Robinhood is a retail stockbroker which pioneered zero commissions. It developed a user-friendly app which turned trading into a game-like experience in order to appeal to millennial clients. Though customer service and reliability were key issues, Robinhood made the buying and selling of stocks and options extremely convenient for retail traders. Robinhood has consequently experienced an exponential growth in client base, from one million in 2016 to more than 13 million last year.

YOLO traders

Many of Robinhood’s clients are internet-savvy millennials with an average age of 31. Most of them are young, aggressive traders who ascribe to YOLO (an acronym for “You Only Live Once”). This is the millennial version of “Carpe diem” or “Seize the day.” Robinhood traders have the appetite for extremely risky trades. Instead of focusing on fundamentals, they trade based on technicals, price action, momentum, and volatility. Many of them are short-term oriented, favor instant gratification, and engage in day-trading. They have a penchant for trading on speculation and buying on rumors. They dabble heavily in penny stocks (or stocks which are cheap in nominal value), high-flyers, momentum trades, and deeply-battered recovery plays. They have a high propensity to trade on margin while also utilizing options to magnify their returns. Collectively, these online retail accounts are referred to as Robinhood traders.

Millions of Davids vs. Wall Street Goliaths

Robinhood traders share tactics, rumors, tips, and information on social media platforms such as Facebook, Twitter, and Reddit. WallStreetBets is one of the most-followed Reddit forums with a userbase exceeding 8.4 million. Sensing that hedge funds have built outsized short positions in Gamestop and other similar stocks, retail traders and Reddit users banded together to buy up these stocks in order to force hedge funds to cover at much higher prices. From $18, Gamestop ran up to a high of $483. Hedge fund Melvin Capital lost 53 percent of its fund value in January after its short position in Gamestop was squeezed out.

Game stops

Robinhood earned the ire of clients when it limited trading and increased margin requirements for Gamestop and other stocks. This was caused by a sharp increase in Robinhood’s clearinghouse deposit requirements. The game stopped for Gamestop as it lost 80 percent of its value last week. As the speculative fever cooled, the US market promptly made new highs, with the S&P 500 closing at a fresh record of 3,886.8 last week. The PSEi closed at 7,019 last Friday after diving to a low of 6,613 during the recent market scare.

Rising local participation in Phl stock market

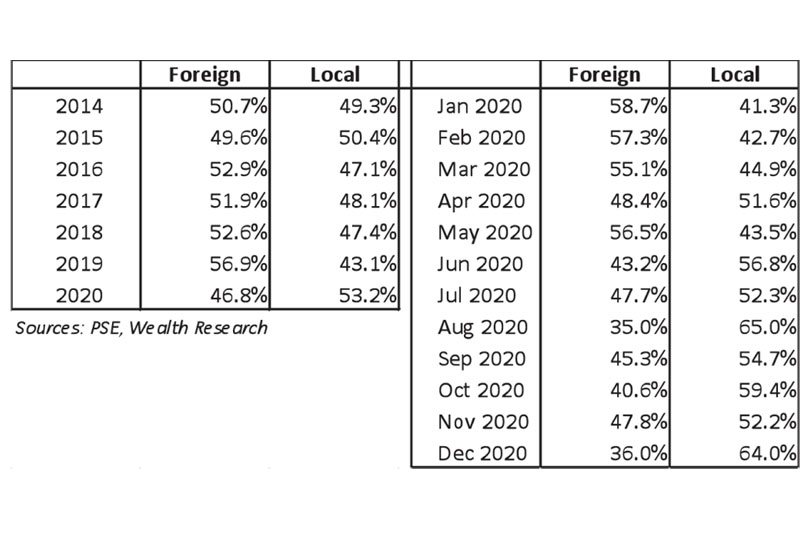

The influx of new retail investors and their increasing market participation is happening not only in the US, but all over the world. In the Philippines, this can be seen in the rising participation of local investors. In the table below, we show that over many years, trading volume was dominated by foreign investors. However, this changed last year when local investors accounted for 53.2 percent of value traded in 2020, and 58 percent in the second half of 2020. According to PSE president Ramon Monzon, local trades accounted for 75.3 percent of the total value turnover in January 2021 while volume of shares traded reached an all-time high of 1.43 trillion.

Contribution to PSEi value traded

Understanding Robinhood

The Gamestop short squeeze showed that retail traders can move markets if they congregate and coordinate their actions. Because of their sheer number, they are a force to be reckoned with. They comprise a unique and powerful demographic. It is, therefore, incumbent upon regulators, fund managers, investors, and stock brokers to understand the psychology and characteristics of Robinhood retail traders. This can help market participants in navigating the volatility arising from this new wave of investors. This can also enable regulators to come up with appropriate rules and policies that support growth while safeguarding financial markets.

Philequity Management is the fund manager of the leading mutual funds in the Philippines. Visit www.philequity.net to learn more about Philequity’s managed funds or to view previous articles. For inquiries or to send feedback, please call (02) 8250-8700 or email [email protected].

- Latest

- Trending