Fastest Nasdaq correction

Last Sept. 3, the US tech sector’s blistering run to new all-time highs came to a screeching halt. On that day, the Nasdaq Composite lost five percent of its value. After hitting a fresh record high of 12,074 on Sept. 2, the tech-heavy Nasdaq fell 10 percent in just three days. The sheer speed and magnitude of this unwinding made this the fastest move from record high to correction territory in the history of the Nasdaq. In the stock market, a correction is defined as a decline of more than 10 percent but less than 20 percent.

Megacap tech plunge drags other US indices lower

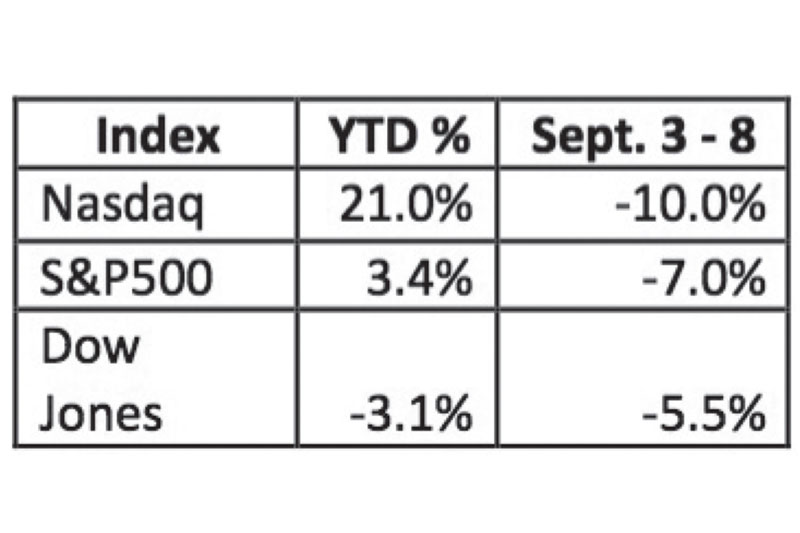

The speed of the plunge caught many investors offguard, dragging down stocks not only in the US, but also the world over. The correction started on Sept. 3 and had its lowest close on Sept. 8. However, because Sept. 4 and 5 was a weekend, and Sept. 6 was a holiday in the US, the drop unfolded over just 3 trading days. As you can see in the table below, this sudden reversal erased nearly all of the S&P 500’s gains for the year and pushed the Dow Jones index into the red for 2020.

“Nasdaq whale” sends big tech to record highs before reversal

With COVID cases on the rise in the US and Trump spewing anti-China rhetoric, analysts and fund managers were befuddled by the Nasdaq’s relentless charge to all-time highs. Moreover, it was concentrated in the biggest technology stocks. At the same time, an unusual spike in options trading activity on selected megacap tech stocks was detected. Soon, rumors surfaced of a “Nasdaq whale” which bought $2 billion of call options as a leveraged bet on selected US tech stocks. Eventually, the Nasdaq whale was revealed to be Masayoshi Son’s Softbank. Smelling blood and suspecting that the recent run-up could be artificial, hedge funds started dumping their technology stocks.

Phl best performing in Asia last week

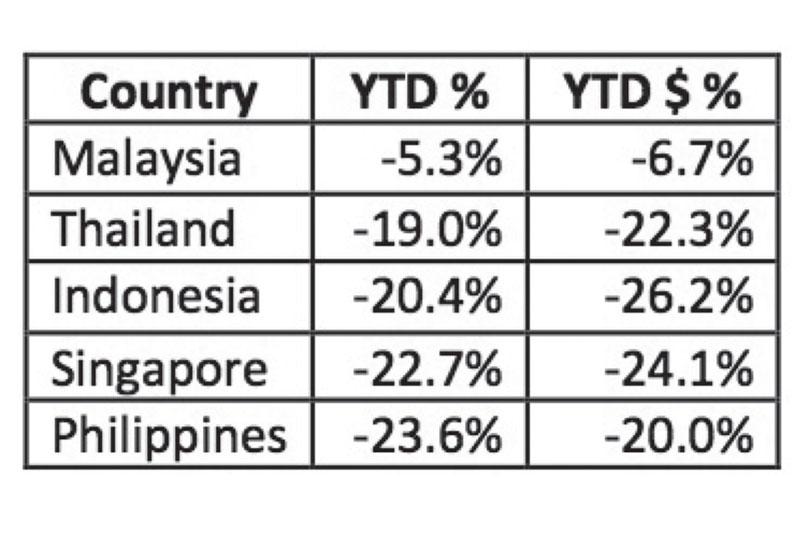

Given the magnitude of this drop, many analysts expected the PSEi to fall sharply as well. But lo and behold, the PSEi bucked this moved and gained 4.3 percent from Sept. 7 and 8. In fact, the PSEi was the best performing Asian index last week. Despite near unabated foreign selling, heavy buying from local retail and institutional investors pushed the market higher. However, with net foreign selling amounting to P92 billion YTD, the PSEi remains down 24.5 percent YTD and is Asia’s worst performing stock market in local currency terms. However, as can be seen in the table below, we are actually the second best performing ASEAN equity index in US dollar terms due to the strong peso.

Reasons for the PSEi’s recent outperformance

From being a perennial underperformer in the past months, the Philippine stock market has been stabilizing as of late. The main reasons behind its outperformance recently are:

1. Shift from technology and work-from-home stocks to battered recovery plays

During the run-up of the US from April to August, the traditional economies of ASEAN were ignored as investors favored COVID-resistant tech and work-from-home stocks, most of which are listed in the US. However, with Phase III vaccine trials under way and very high valuations for technology companies, investors have started shifting back to battered recovery plays. This will benefit the Philippine stock market which is primarily composed of cyclical sectors such as property and banking.

2. Flattening of the curve

From a high of 6,958 daily cases on Aug.10, it has now dropped to about 3,000 a day. In fact, the UP OCTA Research Team said that the Philippines has actually flattened the curve, with the R0 or reproduction rate going below one.

3. Vaccine and drug testing partnerships with many countries

News that the Philippines is partnering with countries that are in the advanced stages of vaccine development led to hopes that a vaccine may become available in the country soon. So far, we have signed partnerships with China, Russia, Japan, Taiwan, Australia and the World Health Organization (WHO). These agreements cover different areas, such as conducting Phase III trials in our country and onshore manufacturing of the vaccine itself. The availability of an efficacious vaccine in our country will hasten the recovery of our economy and bring us closer to normalcy.

Phl may outperform once COVID-19 is contained

We saw how foreign funds shifted from technology and work-from-home stocks to cyclical and recovery plays whenever there is positive news on the vaccine front. Because the Philippine stock market is mostly composed of the latter group of stocks, we may be a beneficiary of that shift. Thus, we may eventually see a dramatic outperformance in the PSEi if and when COVID-19 is contained domestically or an effective vaccine is developed.

Philequity Management is the fund manager of the leading mutual funds in the Philippines. Visit www.philequity.net to learn more about Philequity’s managed funds or to view previous articles. For inquiries or to send feedback, please call (02) 8250-8700 or email [email protected].

- Latest

- Trending