Gold at historic highs

Many events this year are unprecedented. We have the worst pandemic in the last 100 years, the deepest economic recession since World War II, the sharpest bear market decline, the biggest global monetary and fiscal stimulus, and the quickest rebound in US stock market history. The recent run-up in precious metals is, likewise, unparalleled. Gold rose above the $2,000-mark for the first time, hitting a historic high of $2,089/oz before correcting to $2,035/oz last Friday. Meanwhile, silver had run up 50 percent in just three weeks.

Reasons for owning gold

Last June, we discussed eight reasons why gold prices should continue to rise (see Pandemic sparks gold rush, June 29). Among the reasons we cited are the following: safe-haven buying due to the COVID-19 pandemic, protection against fiat debasement, hedge against inflation, portfolio diversifier, geopolitical uncertainty, record gold ETF inflows and central bank purchases of gold. The acceleration of US dollar weakness, which caused most other currencies, including the Philippine peso to rise, significantly boosted gold prices.

New high means higher for gold

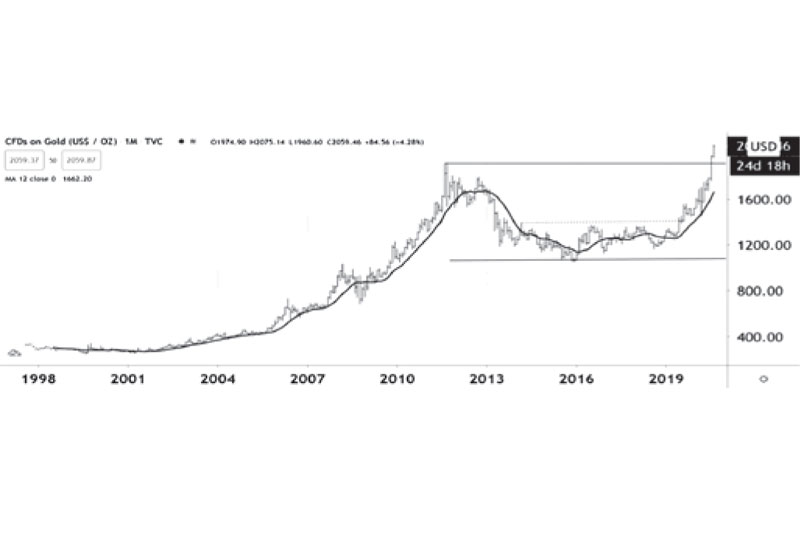

In technical analysis, new highs often lead to higher prices. Gold is now in unchartered territory and there are no resistance levels above. Note that gold has just broken out of a 10-year base. A measured move from the breakout level of 1,920 (computed by adding the base height to the breakout point) implies a target of 2,800.

Gold monthly chart

Silver’s rise outpaces gold

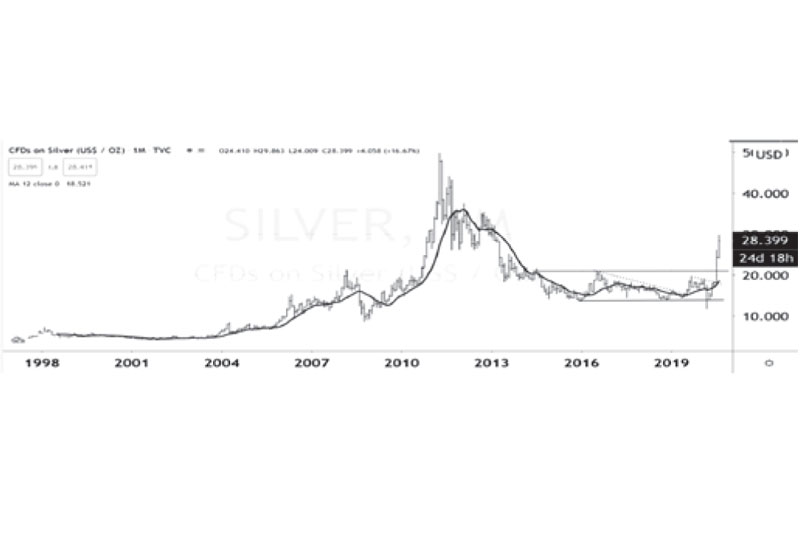

As gold hit historic highs, silver surged 30 percent in July, its biggest monthly gain since 1979. Silver registered a six-year high of $29.92/oz in intraday trading last Friday before settling at $27.54/oz. While silver has lagged behind gold at the beginning of the year, silver prices have risen by 140 percent since it bottomed in March. It has outpaced gold, which is up by 40 percent over the same period.

Silver monthly chart

Commodity cycles tend to continue for years

Just like in forex, trends in commodities tend to last for multiple years. Note that in the last bull cycle, the uptrend in gold and silver continued for 10 years (2001 – 2011). At that time, gold prices rose 800 percent and silver soared 1,20 percent. Today, gold and silver have doubled from their recent lows. Gold and silver are likely in the early part of multi-year moves. The breakout in silver is only three weeks old.

Higher gold prices boost country’s GIR

Part of the $93 billion gross international reserves (GIR) held by the BSP is in gold. According to the latest data, the value of BSP’s gold reserves is about $8 billion. However, it still reflects June 2019 gold prices. Revaluing these gold reserves to today’s prices should add roughly $3 billion to $4 billion to the country’s GIR.

A ray of sunshine in this pandemic

Last month, Environment Secretary Roy Cimatu announced the plan to reopen some of the mines earlier closed by the government. These are the mining companies that have already complied with the recommendations and corrections mandated by DENR audit reviews. The Philippine mining industry has the potential to be a significant contributor to the economy. With gold, silver, and other commodities at the incipient stage of a multi-year uptrend, the country should exhaust all efforts to reinvigorate the industry.

The COVID-19 outbreak has caused a sharp slowdown in our economy, resulting in the biggest-ever quarterly contraction in Philippine GDP. Reopening the mining firms will alleviate the debilitating negative effects of the pandemic, such as corporate bankruptcies, job losses, and the decline in OFW remittances, tourism receipts, BPO and POGO revenues. This will create jobs in the countryside, open business opportunities, expand exports, augment tax revenues, and bolster our foreign exchange buffer. The revival of the mining industry is a ray of sunshine during this pandemic.

Philequity Management is the fund manager of the leading mutual funds in the Philippines. Visit www.philequity.net to learn more about Philequity’s managed funds or to view previous articles. For inquiries or to send feedback, please call (02) 8250-8700 or email [email protected].

- Latest

- Trending