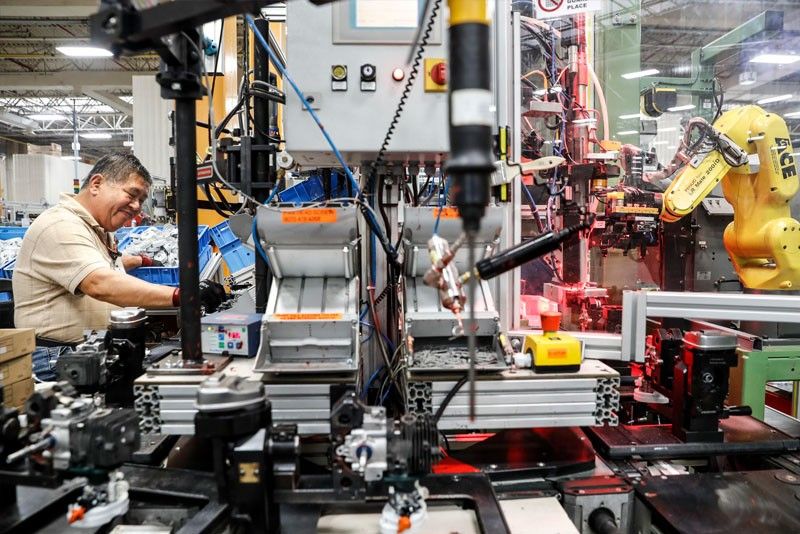

Philippines among top performers in manufacturing in ASEAN

MANILA, Philippines — The Philippine manufacturing sector was among the top performers in the ASEAN region in August, according to the results of the Nikkei ASEAN Manufacturing Purchasing Managers’ Index (PMI).

IHS Markit, the firm that collates data for the PMI, reported that the ASEAN PMI rose to 51.0 in August from 50.4 posted in July, indicating a marginal improvement in the health of the sector.

“August data showed faster rises in both new orders and output, which was accompanied by further jobs growth and firmer business confidence. However, the overall improvement in manufacturing conditions across the region was not as broad-based as those seen in previous months,” IHS Markit said.

“Four of the seven monitored countries indicated an improvement in manufacturing conditions in August, down from five in July,” it added.

Vietnam remained the top performing market in the region, posting a PMI of 53.7.

“The Philippines and Indonesia were tied in second place, with both registering a quicker pace of growth,” IHS Markit said, noting the countries both registered a PMI of 51.9 in August.

Malaysia registered its first improvement in seven months, coming in at third position with a modest improvement in operating conditions.

In contrast, Singapore and Myanmar both signaled a decline in the health of their manufacturing sectors.

“There were signs of firmer client demand midway through the third quarter. In August, total new orders rose at the second-strongest pace for four years, despite a decline in export sales. New business from abroad fell at the quickest pace since the end of 2016,” IHS Markit said.

It added that firmer demand conditions led manufacturers to scale up their production.

“Output growth accelerated from July, however, the rate of expansion remained slightly weaker than the average seen over the first half of the year,” IHS Markit said.

“With higher sales, firms were more confident to take on more workers. The rate of job creation quickened to the strongest for over two years,” it added.

Meanwhile, business confidence regarding output over the next year improved in August, with the future output index picking up from the survey record low in July.

“Vendor performance deteriorated further, although anecdotal evidence suggested that a lack of raw materials and inclement weather across the region were primary reasons for delivery delays,” IHS Markit said.

Despite the stronger rise in overall sales, purchasing activity expanded at a softer pace in August.

Reports from panelists suggested that firms were content to draw down on current inventories to meet production and client requirements.

This led to stocks of both inputs and finished goods to further fall.

IHS Markit emphasized that strong cost pressures persisted across the region, noting that the rate of input price inflation accelerated to a three-month high and remained sharp overall.

“All seven countries covered by the survey reported higher cost burdens in the middle of the third quarter. Myanmar again saw the steepest inflation, with the rate of increase surging to a series-high amid a sharp depreciation of the local currency,” IHS Markit said.

It added that increased cost burdens led firms to raise average selling prices during the period. Output charge inflation accelerated to a six-month high, but continued to lag the rise input costs.

IHS Markit principal economist Bernard Aw said while the overall manufacturing conditions across ASEAN improved, the overall upturn was not as broad-based as in previous months.

“Only four of the seven monitored countries in the region indicated an improvement in business conditions during August, down from five in July. What’s more, the bulk of the improvement was driven by a faster expansion in Indonesia, and Malaysia’s return to growth,” Aw pointed out.

Aw added that the faster gain in output and new business failed to translate into a steeper increase in input buying.

In contrast, he said purchasing activity expanded at a marginal pace, with firms tapping into current inventories to meet demand, reflecting relatively cautious sentiment.

“While optimism towards the year-ahead outlook improved, it remained well below the historical average. Notably, export sales also declined during August,” Aw said.

He emphasized that ASEAN manufacturers continued to struggle with increased cost burdens, particularly countries with a weaker exchange rate against the dollar, such as Myanmar, Indonesia and the Philippines.

“All these challenges raise questions over whether the growth pickup in August is sustainable in coming months,” Aw added.

- Latest

- Trending