Philippines, a sanctuary amidst global turmoil?

While other global markets were falling sharply the past two weeks, we noticed the Philippine markets were relatively stable. In fact, the peso appreciated against the US dollar and the stock market was steady.

Has the Philippine market become a sanctuary of stability?

What we are witnessing in the Philippine market are early signs of stability. These may indicate we are not affected as much by the increased volatility in global markets.

Calmness in ASEAN markets

We also noticed a relative calmness in the ASEAN stock markets over the past two weeks as US, Europe and Japan were fiercely sold. Major global banks such as Deutsche Bank, Credit Suisse, Bank of America and Citigroup traded well below tangible book value. Surprisingly, there was not much of an aggressive foreign selling in ASEAN stock markets.

Reversal of US dollar strength?

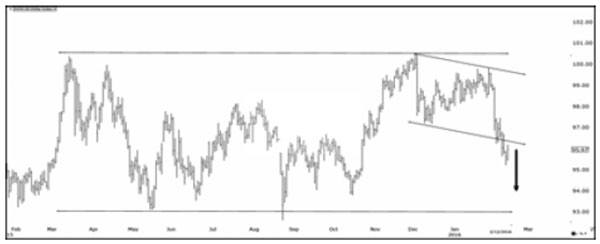

While we have been bullish on the US dollar since 2013, we are now seeing early indications the US dollar may be changing its character. Note that during the past two weeks, the US dollar index fell 3.6 percent, its sharpest two-week decline since the dollar bull-run started in 2011 (see chart below). The yen got off to its best two-week run since 2008, while crude oil posted its biggest one-day gain in seven years.

While the dollar index is still in a range and it is too early to call for a reversal in the US dollar index, the pause has certainly given the Philippine peso, EM and commodity currencies a much needed reprieve.

US dollar index daily chart (2015 to present)

Source: Telecharts, Wealth Securities Research

US rate hike expectations toned down

Recently, a slew of negative news and the testimony of Fed chair Janet Yellen to the US Congress have reduced Fed rate hike expectations. Last Feb. 3 the US ISM Non-Manufacturing PMI data missed the estimate, triggering a decline in US Treasury yields and a sharp sell-off in the US dollar.

Japanese yen bottoms out

The Bank of Japan’s announcement of negative interest rates (NIRP) last month failed to stop the yen’s appreciation. After a knee-jerk push to 121.69 on Jan. 29, the yen has since appreciated seven percent to 113.2 against the US dollar. This is the yen’s biggest two-week rally since 1998. Many of the carry trades using the yen as the funding currency are now being reversed.

The weekly chart of USD/JPY below shows a completed head and shoulders pattern last week, pointing to a target of 105.50. Despite NIRP, the chart shows that the yen may have bottomed out against the US dollar.

Japanese yen weekly chart (2011 to present)

Source: Telecharts, Wealth Securities Research

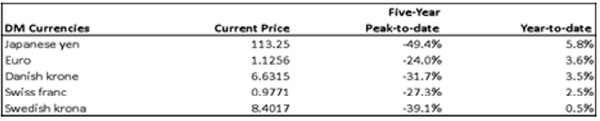

Euro and other DM currencies strengthen vs. the US dollar

In addition to the yen, a growing number of developed market currencies are already up year-to-date against the US dollar as shown below. This is a complete reversal of their weak performance last month. The yen and the euro are the top performers with a 5.8- and 3.6-percent year-to-date gains, respectively.

Source: Bloomberg, Wealth Securities Research

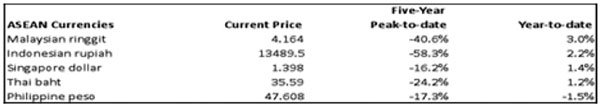

ASEAN currencies lead EM currencies

ASEAN currencies are mostly up against the greenback year-to-date with the Philippine peso trying to catch up. The peso has since rallied to 47.61 against the US dollar after hitting a six-year low of 48.05 last month. ASEAN currencies have significantly outperformed other EM currencies since the start of the 2016.

Source: Bloomberg, Wealth Securities Research

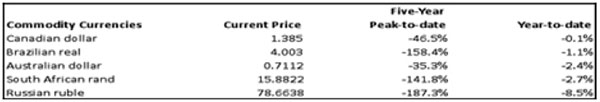

Commodity currencies continue to catch up

Commodity currencies continue to catch up, more so if the strong upsurge in oil and other commodity prices last Friday are sustained.

Crude oil and commodities post biggest gain in 7 years

Crude oil rallied 12 percent last Friday, registering its biggest one-day gain in seven years. Among the reasons cited for the rally are the renewed optimism of coordinated production cuts by OPEC and the lower rig count data released last week.

Meanwhile, the Reuters/Jeffries CRB index rallied 3.5 percent last Friday. It was led by gold and silver which were up 5.5 percent and 4.9 percent last week, respectively.

Crude oil and commodity prices generally have an inverse correlation with the US dollar, which means as the dollar falls, oil and commodity prices rise.

BSP’s steadfast stance

Unlike the US, which may have had a premature hiking of interest rates, or the ECB, BOJ and other central banks trying frantically to lower interest rates, the BSP has been steadfast in its interest rate and monetary policy.

We would like to congratulate the BSP who remained steady on its policy stance, neither hiking nor adding stimulus.

Recent signs of stability may indicate a bottom in the PSEi

Recent signs showing the Philippines as a sanctuary of stability may indicate we may have seen the worst for the Philippine stock market. As we indicated during our investors briefing last Jan. 30, the Philippine market may have reached the bottom when the PSEi hit 6,084.

Philequity Management is the fund manager of the leading mutual funds in the Philippines. Visit www.philequity.net to learn more about Philequity’s managed funds or to view previous articles. For inquiries or to send feedback, please call (02) 689-8080 or email [email protected].

- Latest

- Trending