True to form

In our book “Opportunity of a Lifetime,” we devoted a portion to discuss the different seasons in the stock market. There, we explained how the stock market behaves during different times of the year. We showed tables summarizing many years’ worth of data and statistics, with the goal of looking for trades that have high batting rates of success. So far this year, the PSE Index has acted true to form, as it slid sharply during the ghost month and in the calendar months of August and September, which have been historically weak seasons for the stock market.

The ghastly ghost month

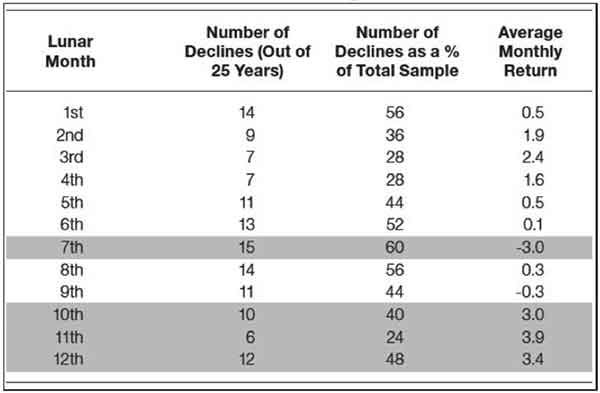

In page 195 of the book, we showed the returns of the PSE Index for each month of the lunar calendar (see Table 1). As seen in the table below, the seventh lunar month or the ghost month has the highest probably of declining at 60 percent and the lowest average monthly return of -3.0 percent

Table 1 – Stock market returns per lunar month

Source: Wealth Securities Research

August and September – weakest months for stocks

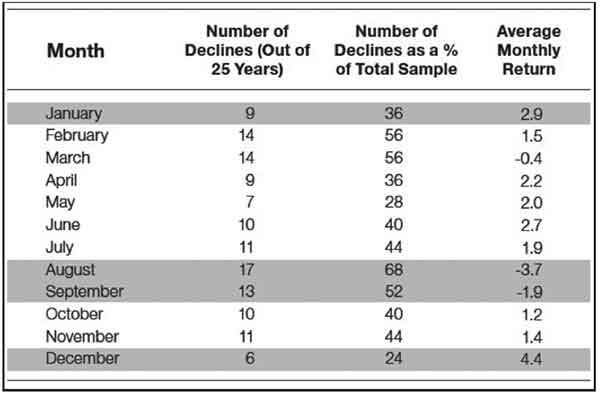

Also in page 195 of the book, we showed the monthly returns of our stock market based on the Roman calendar (see Table 2). As seen in the table below, August and September have been the weakest months of the year. Based on data we gathered, August has a 68 percent chance of declining (the highest for all 12 calendar months), with an average return of -3.7 percent (the lowest for all the months). Likewise, September has been historically weak, with a 52 percent chance of declining and an average return of -1.9 percent.

Table 2 – Stock market returns per calendar month

Source: Wealth Securities Research

December and January – strongest months for stocks

The table above also shows December and January are the strongest months of the year. Based on historical data, December is the strongest month of the year in terms of batting rate (24 percent chance of declining or 76 percent chance of gaining) and returns (average return of 4.4 percent). Similarly, January has a high batting rate (36 percent chance of declining or 64 percent chance of gaining) and an average return of 2.9 percent.

True to form in 2015

The PSE Index has acted true to form so far this year. Below, we enumerate specific instances this year when the market behaved consistently with our observations about seasonality.

1. The PSE Index declined 6.7 percent during the ghost month this year (Aug. 14 to Sept. 12). This outpaced the 3.0 percent average decline of the stock market during the ghost month.

2. Our stock market slid by 6.0 percent and 2.9 percent in the calendar months of August and September. These exceeded the average decline of 3.7 percent and 1.9 percent for the months of August and September.

3. The PSE Index started to rebound since September ended. Our stock market went up by 3.5 percent in the month of October.

4. The PSE Index was not the only stock index that rebounded after September ended. Global stocks and most global indices likewise bounced sharply from their September lows and delivered strong positive returns for the month of October. For instance, in October this year, the S&P 500 gained 8.3 percent, the biggest monthly gain since October 2011 and the German stock index (DAX) surged by 12.3 percent, its largest monthly increase since April 2009.

Halloween to Valentine’s

After going through a spooky ghost month and the weakest months of the year, we are now approaching the strongest months for stocks. The period from Halloween to Valentine’s captures the strong performance of the stock market in December and January. In page 196 of the book, we showed that Halloween to Valentine’s has a batting rate of 77 percent and an average historical return of 11 percent.

December liftoff may upset odds

Though statistics show the stock market performs strongly in December and January, the market this year may continue to be volatile in the short term due to the various headwinds and risks the global economy is facing. Specifically, the Fed has hinted at a possible rate hike in December this year or early next year. Note this will be the first increase of the Fed funds rate since 2006. This will be a risk to emerging market (EM) countries, as this will likely contribute to the US dollar’s strength and the weakness of EM stocks and currencies.

Calibrated rate hikes – positive in the long-term

Over the long-term, however, rate hikes should not derail the bull market. In fact, as we have shown in a past article (Bond Yields Rising, June 8, 2015), well-timed rate hikes are positive for the stock market, especially if they are accompanied by manageable inflation and economic growth. The Fed is certainly aware of this and has repeatedly said future rate hikes will be calibrated based on economic data. The Fed will be extremely careful in raising interest rates because it does not want to undo the economic gains it has achieved through its previous policies.

For further stock market research and to view our previous articles, please visit our online trading platform at www.wealthsec.com or call 634-5038. Our archived articles can also be viewed at www.philequity.net.

- Latest

- Trending