Contagion

Last Monday, our fund manager, Mr. Wilson Sy, was interviewed by the ANC channel in connection with the launch of his book, Opportunity of a Lifetime. The interview started out with his warning that our economy may be in the midst of a financial contagion following the devaluation of the Chinese yuan:

“I don’t want to scare anybody but what we are seeing is a contagion because of big drops in currencies and stock markets in the region. The Malaysian and the Indonesian stock markets, for example, have both declined by more than 20 percent in US dollar terms as the ringgit and rupiah plunged to Asian crisis lows.”

Indeed, subsequent declines in emerging and Asian currencies over the week, as well as drops in stock markets around the world, brought back fears of contagion and memories of the 1997 Asian Financial Crisis.

Episodes of financial contagion

In our book, Opportunity of a Lifetime, we wrote about different episodes of financial contagion. A contagion often starts with turbulence in the financial systems of a country, leading to losses in currencies and stock markets of other countries. These may then result in a pullout of capital and may cause sharp contraction in economic activity among countries and across regions.

For emerging markets, financial contagion is not a new phenomenon. Page 41 of the book mentioned countries as diverse as Mexico, Russia, a number of East Asian countries (Thailand, Indonesia, Malaysia, Philippines, South Korea) being affected in the 1990s by either currency or financial crises, or both.

Even developed economies are not immune to contagion. In page 24 of the book, we talked about how the US subprime crises later on spread and morphed into a full-blown credit crisis that nearly destroyed the global financial system.

Meanwhile, in page 96 and 97, we discussed the IPIS Theory and the PIIGS where the risk of sovereign defaults by Greece and other peripheral countries have threatened to break the whole European Union.

The spark that spread the fire

China’s decision to join the currency war two weeks ago by devaluing the yuan was the spark that spread the fire (see Currency Wars 2015, Aug. 17, 2015). The devaluation of the yuan compounded the problems faced by emerging economies already reeling from weakening global trade, plunging commodity prices, slumping Chinese demand and threat of an imminent Fed rate hike.

In response to China’s move, Kazakhstan which has China as its top export destination, decided to float its currency. The previously pegged Kazakh tenge devalued by 23 percent against the US dollar last Thursday. Another export-driven economy, Vietnam, suffered a 5.4 percent devaluation in one week on its currency, the dong.

Reminiscent of the 1997 Asian financial crisis contagion

What we are seeing now is reminiscent of the 1997 Asian crisis which basically started as a currency crisis and led to a contagion affecting not only Asia but also the whole world. This time, the contagion is not limited to Asia but involves mostly emerging countries, especially those highly dependent on commodity exports to China. However, the major difference is that most currencies back then were pegged to the dollar or moved in a tightly managed float, while most currencies today are freely floating.

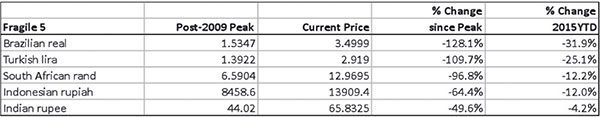

Fragile 5

The phrase Fragile 5 was originally coined by Morgan Stanley in 2013. It refers to Brazil, Indonesia, Turkey, South Africa and India whose currencies were most vulnerable after the Fed first indicated in 2013 that it was winding down its QE program. As global bond markets sold off during the “2013 taper tantrum”, the countries with huge current account deficits and weakening economic growth, such as the Fragile 5, were the most affected.

Year-to-date, with the exception of India which greatly improved its current account balance, the majority of the Fragile 5 continue to suffer against the strengthening dollar.

Source: Bloomberg, Wealth Securities Research

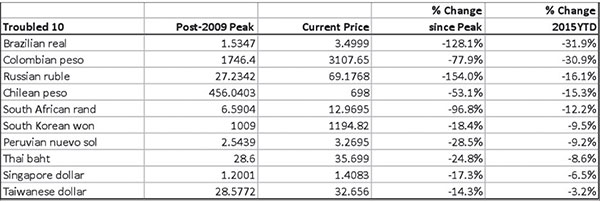

Troubled 10

Today, currencies from neighboring countries such as Malaysia, Indonesia and South Korea on one side of the globe, to Brazil, Colombia and Chile on the other side have plummeted precipitously. In fact, Morgan Stanley’s “Fragile Five” currencies has now expanded to what is now known as the “Troubled Ten.”

After the yuan was devalued two weeks ago, Morgan Stanley updated and expanded the list to 10 troubled nations whose currencies are now considered to be the most likely to weaken further. Countries with high export exposure and export competitiveness with China such as Taiwan, Singapore, Thailand, South Korea, Russia, Peru, Chile, Colombia, Brazil and South Africa make up what is now known as the “Troubled Ten.”

Chile, for example exports 24 percent of its total exports to China, while South Korea sends 25 percent of its exports to China.

Source: Bloomberg, Wealth Securities Research

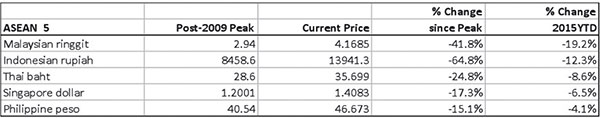

ASEAN-5

Wilson Sy mentioned in the ANC interview that “Even if the Philippine peso seems the least vulnerable currency in the region, it is not immune to the sharply rising volatility in the region…In fact, the Singapore dollar which was previously the most stable currency in the region has also fallen because most of its exports goes to China.”

The Philippines – being part of ASEAN and part of emerging markets - was not spared. Even if the problem is not ours and we are actually net importers of Chinese goods, the peso (while least affected) is down 4.1 percent year-to-date against the greenback.

Source: Bloomberg, Wealth Securities Research

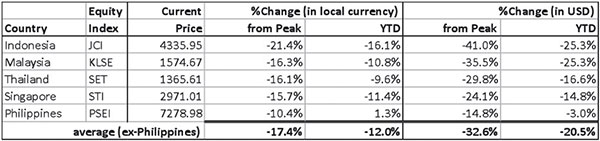

Currencies move stock markets

A drop in currency normally has an effect on the stock market. Hence, the sharp decline in ASEAN-5 currencies, have caused their respective stock markets to plummet.

ASEAN markets (ex-Philippines) are now down 32.6 percent from their highs and down 20.5 percent year-to-date, in US dollar terms.

Comparatively, the PSEi has declined substantially less. It only dropped 14.8 percent from its peak and just three percent year-to-date, in US dollar terms, because the Philippines actually imports more from China and is a beneficiary of low commodity prices.

Source: Bloomberg, Wealth Securities Research

EM contagion spreads to DM

While many thought that the contagion risks were mostly contained in Asia and emerging markets, now it appears to be going global. Last Friday, the US stock market – considered the last bastion of stability amid the recent turmoil - suffered its worst sell-off in 4 years. The Dow Jones Industrial Average fell 531 points and is now down more than 10 percent from its record high registered last May.

Meanwhile, the so-called VIX “Fear Index” jumped 46 percent last Friday, its highest close since Dec. 8, 2011. In fact, the VIX more than doubled last week for its biggest one-week percentage increase on record.

Review your asset allocation

While the Philippines is considered least vulnerable to a currency crisis, we are not immune to an emerging market contagion. We therefore urge investors to review their asset allocation. For those who are trading on leverage, it may be prudent if they remove margins and reduce exposure.

Finding treasure in the rubble

On the other hand, those with no exposure or very small exposure to equities can now start looking for potential buying levels. They can plan their purchases using peso-cost averaging.

At this point, all emerging market currencies and stocks are being sold indiscriminately because of contagion. It is like “throwing the baby out with the bath water.” While it is still early to call a bottom, this across-the-board selling will offer investors the opportunity of finding treasure among the rubble. Philippine equities will be one of the jewels.

Philequity Management is the fund manager of the leading mutual funds in the Philippines. Visit www.philequity.net to learn more about Philequity’s managed funds or to view previous articles. For inquiries or to send feedback, please call (02) 689-8080 or email [email protected].

- Latest

- Trending