China: World’s No. 1 economy, almost!

Shanghai – The big news just before we got here over the weekend had to do with China overtaking the US to become the world’s largest economy. This is according to the International Monetary Fund or IMF whose computation method adjusts for purchasing power parity or PPP.

Remember the Big Mac Index popularized by The Economist? That is based on PPP which assumes that prices aren’t the same for the same Big Mac or any other product or service in every country.

The price of a Big Mac after you convert in dollar terms will cost you less in Shanghai than in New York. PPP is a means to compare countries. A Chinese worker in China earns a lot less than an American in the US. Just converting the yuans into dollars underestimates that Chinese worker’s purchasing power.

What the IMF did was to measure both GDP in market-exchange terms and in terms of purchasing power. On the purchasing-power basis, China has just about overtaken the US and is now the world’s biggest economy. According to the IMF, by the end of 2014, China will make up 16.48 percent of the world’s purchasing-power adjusted GDP (or $17.632 trillion), and the US will make up just 16.28 percent (or $17.416 trillion).

Assuming we are impressed by this measure, The Economist observed “historians point out that China is merely regaining a title it has held for much of recorded history. In 1820 it probably produced one third of global economic output. The brief interlude in which America overshadowed it is now over.”

But others insist it will be some time before China actually overtakes the US in raw terms, not adjusted for purchasing power. By that measure, China is still more than $6.5 trillion lower than the US and isn’t likely to overtake for quite some time.

Bloomberg published a report that “the PPP, used to differentiate how far money goes in each country, hardly reflects where the two nations currently stand vis-à-vis each other. Consider this: in 2013, US GDP was at $16.8 trillion, way ahead of China’s $9.24 trillion before adjusting for inflation, which is the more commonly known measure of an economy’s size, World Bank figures show.”

According to Bloomberg, David Hensley, JPMorgan Chase & Co.’s director of global economic coordination in New York, pointed out that PPP is not quite the real thing. “By looking at a PPP comparison, especially for developing nations, you really exaggerate the importance of these economies, because it misses the command that each has over the world’s resources and its influence over global activity.”

Hensley also said that this “preoccupation with competition or foot-race captures little of the reversal in fortunes under way.” Hensly pointed out that emerging economies have lost their luster.

“The view we encounter now is a more sobering reassessment,” he said, adding that he prefers projections based on market exchange rates. “The US has cleaned up its act. China still has a lot of work to do.”

Whatever China’s ranking may be vis-à-vis the US these days, one cannot escape seeing the evidence of its fast growing economy upon landing in its economic capital of Shanghai. The Pudong airport itself is one very large airport and getting from one’s gate to immigration almost requires one to be in top physical shape.

Shanghai, once known as the Paris of the East, is China’s most populous city. It is also reputed to be the largest city proper in the entire world.

But not too long ago Manila was more modern than Shanghai. One local here told me over dinner that he first visited Manila in 1988 and was full of envy. Not only did we have an impressive row of business buildings on Ayala Avenue, but the entertainment scene was tops. Shanghai didn’t have the malls we already had then or even supermarkets at that time, he said.

Sorry to say, he said, but you simply failed to progress and Shanghai, indeed China, progressed in leaps and bounds. The buildings in Shanghai are among the tallest in the world. And yes, these buildings seem to have sprouted overnight in the rice fields across the river that Mr. Carlos Chan said he saw when he first established his Oishi business in the early ’90s.

Shanghai’s population was estimated last year at 23.9 million, which means it is larger than the entire population of Taiwan. The city itself is large in area. I remember having to get from its second airport in Hongqiao to the main international airport in Pudong, 60 kilometers away and thought I would miss my flight.

The teeming population of Shanghai gives the city a population density of 3,700 people per square kilometer, or 9,700 people per square mile. But China’s one-child policy has kept the population in check, which also contributed to a shrinking workforce and a rapidly aging population.

Mr. Chan, who has established a large factory for Oishi in the western part of Shanghai, confirmed problems in recruiting a workforce over the last few years. He said they now have to contract recruiters to secure workers from other regions of China. Labor costs have also risen significantly. But the business they generate here makes everything worthwhile.

Shanghai is now dependent on migration to fuel its future growth. They are also testing reforms to its current policies and will now offer incentives to migrants by providing them the same benefits as local residents.

On the whole, observers say it will still take a long time before Shanghai can actually replace Hong Kong as China’s principal financial hub and gateway to world trade. That is because Chinese officials are still wary about opening up and relaxing some regulations, even for the recently launched Shanghai Free Trade Zone.

As an article in The Atlantic reports it: “Instead of the rumored market-influenced interest rates, corporate income tax concessions, freer convertibility of the renminbi and the opening of China’s capital account—which would have unleashed a tidal wave of Chinese investment into overseas markets—the zone opened under cautious new regulations that were short on details and long on restrictions.”

The Atlantic concludes: “Shanghai may very well overtake Hong Kong as China’s premier financial hub, but perhaps not until 2047, the year Hong Kong loses its status as a Special Administrative Region and, possibly, the tax regime, legal system and free flow of information that have underpinned its appeal to the rest of the world.

Airports

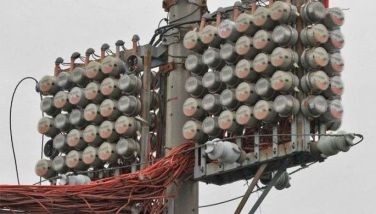

I have been to a lot of cities in China over the years, as far as the Autonomous Region of Xinjiang and I have never ceased to be amazed at how seriously they have developed their transportation system. Their airports, even those in the far flung provincial areas, will shame what we have at NAIA.

Traveling with a group of Filipinos this week, we of course have to talk about how crappy and embarrassing our main gateway airport is. Here is one joke I posted on Facebook that captures the mood.

I heard P-Noy is getting very embarrassed that NAIA, named after his martyred father, is once again the world’s worse airport. He has also given up on his buddy who is GM of NAIA being able to do anything about it, but he is standing fast by him and keeping him there.

P-Noy’s solution: blame it on Gloria Arroyo. So NAIA will be named after GMA’s father instead: Diosdado Macapagal International Airport. That makes up too for removing his name from the Clark airport.

Boo Chanco’s e-mail address is [email protected]. Follow him on Twitter @boochanco

- Latest

- Trending