DENR okays resumption of Rapu Rapu mining operations

The Department of Environment and Natural Resources has cleared the way for the Rapu Rapu polymetallic project to resume operation under its new owners.

The DENR clearance imposes certain conditions such as the payment of the proper excise taxes, funding of the required environmental trust fund (ETF), rehabilitation cash fund (RCF) and monitoring trust fund (MTF), ensuring approval of the final mine rehabilitation and/or decommissioning plan and a few others.

Officials of Rapu Rapu Processing, Inc. (RRPI) visited Environment and Natural Resources Secretary Jose L. Atienza to provide an update on RRPI and Rapu Rapu Minerals, Inc. (RRMI)’s compliance with the DENR-Mines and Geosciences Bureau (MGB) impositions.

The new owners of the Rapu Rapu polymetallic project are reportedly hoping to resume operations within the month. The project has been suspended since 2006.

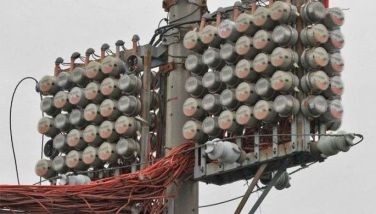

The new owners have invested $40 million to $50 million to upgrade the facilities of the mine site located on Rapu-Rapu island, Albay.

Datu Dr. Mohammad Ajib Anuar, chief executive officer of the Malaysian Smelting Corp. (MSC) which acquired 30 percent of the Rapu-Rapu polymetallic project in partnership with the LG Group of Korea and Kores (the investment arm of the Korean government) which controls 70 percent of the Rapu-Rapu project through the holding company Philco Resources Limited, had previously said that the new group hopes to recommission the processing plant by August this year.

Anuar had said that the targeted annual production is about 10,000 tons of copper ore; 50,000 ounces of gold; 600,000 ozs. of silver and 14,000 tons of zinc.

Philco and MSC acquired the Rapu-Rapu polymetallic project from Australia’s Lafayette Mining Limited.

LG and Kores, through their joint venture company Philco Resources Limited (Philco) and MSC reached an agreement with Lafayette Mining Limited last March 25 this year to purchase Lafayette’s 74-percent stake in Lafayette Philippines Inc. (LPI).

The consortium reportedly paid an initial $18 million to Lafayette.

LPI owns 99.9 percent of RRPI which holds a mineral processing permit (MPP) from the DENR.

At the same time, LPI controls 40 percent of RRMI which holds the mineral production sharing agreement (MPSA) for the Rapu-Rapu mine.

LPI also holds a 40-percent stake in Rapu Rapu Holdings, Inc. (RRHI) which, in turn, controls 60 percent of of RRMI.

LPI’s partner in RRHI is F & N Holdings, Inc. which owns 60 percent. F & N Holdings, Inc. is represented by lawyers whose principals are unknown.

The purchase was finalized on April 21 this year.

- Latest

- Trending