CREATE law signed, with vetoes

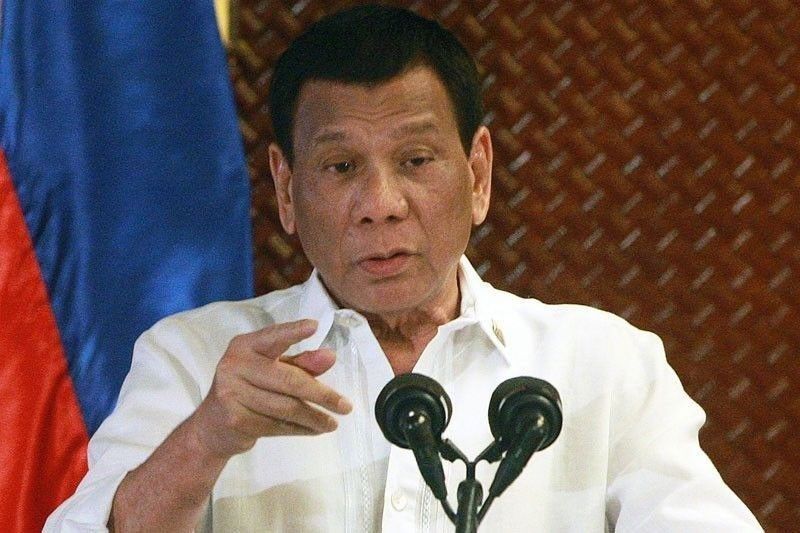

MANILA, Philippines — President Duterte yesterday signed the Corporate Recovery and Tax Incentives for Enterprises or CREATE Act that would ease the importation of COVID-19 vaccines, cut the corporate income tax (CIT) from 30 percent to 20 for micro, small and medium enterprises (MSMEs) and streamline fiscal incentives.

Duterte vetoed, however, provisions that increase the value-added tax-exempt threshold on sale of real property, the 90-day provision for the processing of general tax funds and redundant incentives for domestic enterprises, as well as the presidential powers to exempt any promotion agency from the coverage of the law.

With its enactment, Republic Act 111534 will immediately slash CIT – one of the highest in Southeast Asia – to 25 percent from 30 percent. It will also cut CIT to 20 percent for micro, small and medium enterprises with net taxable income below P5 million and total assets below P100 million.

The new measure would also exempt the importation of COVID-19 vaccines from VAT and import duties. Imports of COVID-19 medicines and personal protective equipment will also be VAT-free, but only until December 2023.

The law exempts from VAT “all drugs, vaccines and medical devises specifically prescribed and directly used for the treatment of COVID-19 and the drugs for the treatment of COVID-19 approved by the Food and Drug Administration for use in clinical trials, including raw materials directly necessary for the production of the such drugs.”

The sale of medicines for diabetes, cholesterol-control and hypertension would also be VAT-exempt, beginning Jan.1, 2020, while the VAT-exemptions for cancer, mental illness, tuberculosis and kidney medicines, meanwhile, will be retroactive to Jan. 1 this year. The measure takes effect 15 days after publication in newspapers of general circulation.

Vetoed provisions

In a nine-page veto message, Duterte underscored the importance of the CREATE Act as “guiding document for much of the Philippine business and industry over the next decades.”

“With over P600 million in tax relief for job creation in the next five years, we lay out our faith and invest in Filipino businesses for them to reinvigorate the economy, create more quality jobs and generate more revenues for the government to tide us along these trying times,” Duterte said.

He lauded the crafting the new law, which came after more than 20 years of deliberations on the countless versions filed in Congress. “Corporate income tax reform and fiscal incentives rationalization has finally come to fruition,” he said.

“It also plugs tax leakages through the rationalization of the fiscal incentives granted to our investors and shifts the administration of such incentives towards a system that is performance-based, targeted time-bound and transparent,” Duterte said.

He also explained his veto of the provision granting the President the power to exempt any investment promotion agency from the reform. “The provisions allowing any future president the power to exempt an investment promotion agency from the coverage of the CREATE Act disregards the huge steps we have taken to rationalize our fiscal incentives system,” he said.

He stressed that the provision, if not vetoed, could “become a highly political tool that could allow subsequent presidents to dismantle decades of Congress itself.”

“Fair and sensible public policy must bear the quality of the uniform application. Exempting any investment promotion agency from the CREATE Act, which provides transparency, accountability and proper administration of tax incentives, may be used as an escape from the accountability measures institutionalized in that law, and opens a wide path for discretion and capture by vested interests,” the Chief Executive said.

Duterte also vetoed the automatic approval of applications for incentives, saying the provision runs counter to the declared policy to approve or disapprove applications based on merit.

“The core of the reform is to develop a performance-based tax incentives system. The Fiscal Incentives Review Board or the investment promotion agencies, as the case may be, should be allowed to carefully review the application for tax incentives since these are privileges granted by the State. This important function should not be sacrificed for the sake of expediency,” he said.

Any concerns over inaction, he pointed out, could be addressed by the Ease of Doing Business and Efficient Government Service Delivery Act of 2018, which punishes failure to render government services within a prescribed time.– Christina Mendez

- Latest

- Trending