Lower corporate taxes to boost Phl stocks

Last week, the Department of Finance (DOF) submitted the second package of the Duterte administration’s comprehensive tax reform program to Congress. The second tranche of tax reform is envisioned to be revenue neutral as it aims to lower corporate income taxes and rationalize fiscal incentives.

The DOF’s push for lower corporate taxes follows the path paved by the US government. Optimism caused by the lowering of corporate taxes in the US pushed the Dow and S&P 500 to record high after record high. The Dow is now up 7.6 percent while the S&P 500 has gained 6.4 percent since the US Senate passed an initial version of the tax plan last Dec. 2, 2017. This move has sparked a global bull run and is one of the main reasons behind the strong performance of the PSEi (+9.5 percent) over the same period.

Trump’s tax overhaul

The primary component of the Trump administration’s tax overhaul is the lowering of the corporate income tax rate from 35 percent to 21 percent. The US tax reform also features a repatriation tax rate of 15.5 percent on accumulated offshore income, but payable over eight years. These measures are envisioned to boost the competitiveness of US corporates and will result in increased hiring.

They may also translate to higher wages and bonuses for American employees. In addition, the repatriation of offshore dollars means that US corporates will stand on massive cash piles that may be used for capital expenditures, M&As, share buybacks and dividends.

Similar to the US, the Philippines will lower its corporate income tax rate from 30 percent to 25 percent. Since package two of the tax reform program is envisioned to be revenue neutral, the corporate income tax cuts will be compensated by the rationalization of fiscal incentives.

According to Finance USec. Karl Kedrick Chua, about P300 billion of government revenues are foregone due to VAT exemptions on certain imports, custom duty exemptions, income tax holidays and special rates. Package two, therefore, aims to plug leakages caused by income tax holidays and other incentives with no sunset provisions or time limits.

Performance-based, time-bound and transparent

In its statement, the DOF said that phase two of the tax reform program aims to “modernize incentives to make them performance-based, time-bound and transparent.” This may also include the centralization of the grant of incentives under one institution to ensure proper monitoring and better transparency.

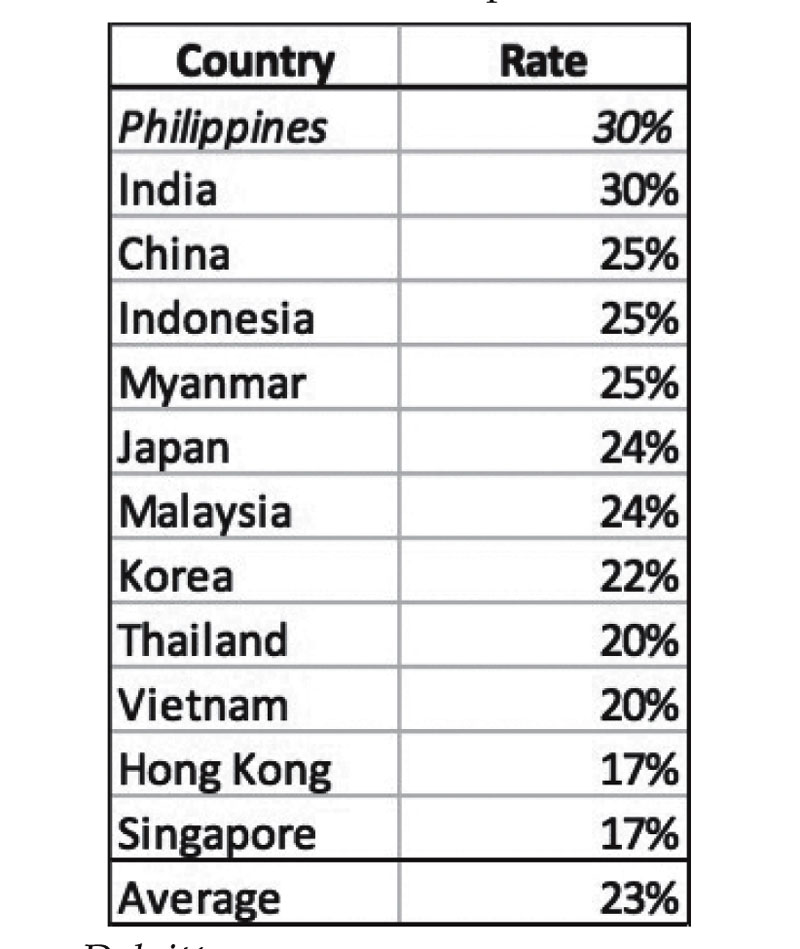

As we show in the table below, our country’s corporate income tax rate of 30 percent is currently the highest in the region (along with India). It is also much higher than the average of 23 percent for Asia. This hinders the competitiveness of Philippine corporates compared to their Asian peers. Moreover, this dampens the attractiveness of the Philippines as an investment destination compared to other Asian countries with much lower corporate tax rates.

Source: Deloitte.com

Phl stocks to tread the same path as the US

Philippine stocks, as a whole, will benefit from the lowering of corporate income taxes. The consumer sector, specifically retail-oriented businesses, stands as the clearest beneficiary of package two of the tax reform program. We, thus, expect the PSEi to perform strongly when corporate taxes in the country are lowered, similar to what we are currently witnessing in US stocks (A tale of two tax reforms, Dec. 4, 2017).

The PSEi has performed exceedingly well in the past two months because of the passage of TRAIN (All aboard, Dec. 18, 2017) and a global bull market fueled by the implementation of tax reform in the US. The PSEi is now at 8,916 and is up eight percent since the start of December. We believe that a consolidation will be healthy as this will allow the market to digest its gains.

Long-term trajectory is up

Despite the possibility of a correction or consolidation in the near-term, we maintain our key thesis that this bull market has further room to grow. We stated that this phase would be an earnings-driven bull market (Let it go, Nov. 13, 2017) which will be supported by fiscal stimulus (2017 – A record year for stocks, Jan. 1). Though there will be winners and losers from the implementation of reforms, lower corporate income taxes will have a positive impact on the long-term outlook for Philippine stocks.

Philequity Management is the fund manager of the leading mutual funds in the Philippines. Visit www.philequity.net to learn more about Philequity’s managed funds or to view previous articles. For inquiries or to send feedback, please call (02) 689-8080 or email [email protected].

- Latest

- Trending