Not too hot, not too cold

Just like in the fable, Goldilocks and the Three Bears, businessmen and investors prefer currency movements to be like the porridge of Baby Bear – not too hot and not too cold.

Excessive swings in a currency from one extreme to the other can be detrimental to the underlying economy. Currency fluctuations can adversely impact cash flows and earnings. It exposes businesses to mismatches between costs and investments in one currency and revenues in another currency. Unwarranted volatility makes it difficult for businesses to project and plan for the future.

Japanese yen – a currency that is ‘too hot’

The Japanese yen is what one might consider to be a currency that is “too hot.” Despite the initiatives of Kuroda to inflate the Japanese economy by lowering interest rates, the Japanese yen has gained 13.4 percent against the US dollar this year.

The excessive strength of the Japanese yen in recent months despite negative interest rates has raised concerns about deflation and the failure of Abenomics to revitalize the economy. A strong yen hurts Japanese exports and is seen to hurt corporate profits causing Japanese stocks to lose 18 percent so far this year.

British pound – a currency that is ‘too cold’

On the other hand, the British pound is what one might consider to be a currency that is “too cold”. It has been falling against the US dollar for two straight years and is the worst performer among major currencies this year.

Closing at 1.4358 last week, the British pound is also teetering just above major support of 1.40 which has been the floor for the currency since the mid-1980s. Fears surrounding UK’s referendum on EU membership has caused the British pound to weaken considerably ahead of the Brexit vote.

According to the IMF, Brexit would hit British living standards, stoke inflation and cause a recession. This prospect has caused the UK stock market to go down 16 percent from its peak last year.

Philippine peso – a currency that is ‘just right’

Much to the liking of Governor Tetangco and the BSP, the peso has been relatively steady this year - a currency that is “not too hot and not too cold, but just right”.

Recall the articles we wrote earlier this year when emerging market currencies were plummeting following the Chinese yuan’s devaluation. We noted that the Philippine peso was relatively stable and was recovering after hitting a low of 48.05 in mid-January (see It’s the strong dollar, stupid! – Episode 3, Jan. 18, 2016 and Philippines, a sanctuary against global turmoil, February, 2016).

When many were saying that the peso would hit 50, we concluded that the peso had reached its low for the year and would consolidate between 45.50 and 47.50 (see Peso Stabilizes below 47, March 21, 2016).

Despite election jitters when the peso weakened back to 47.26 and then the election euphoria when the peso strengthened to as much as 45.86, the peso continues to trade steadily within our target range of 45.50 to 47.50.

The Philippine stock market which is up 9.64 percent year-to-date is one of the best performing markets this year, thanks in a major way to a stable peso.

A different way to measure currency volatility

Normally, a simple criteria used to gauge whether a currency has been volatile or not is to measure the extent and direction of the price change over a given period. Thus, one says that a currency which has declined five percent over the year is more volatile than a currency which has declined by only two percent.

However, another measure is to compute for the percentage difference between the high and the low. Thus, a currency may be little changed over time but one might consider it volatile because the range between its high and its low for the same period is very large.

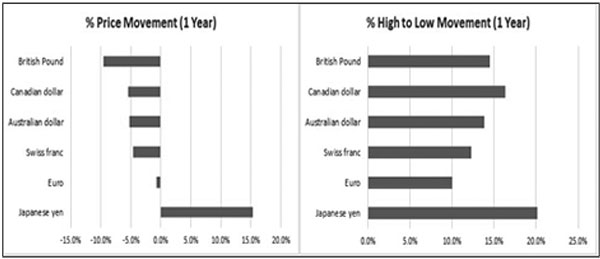

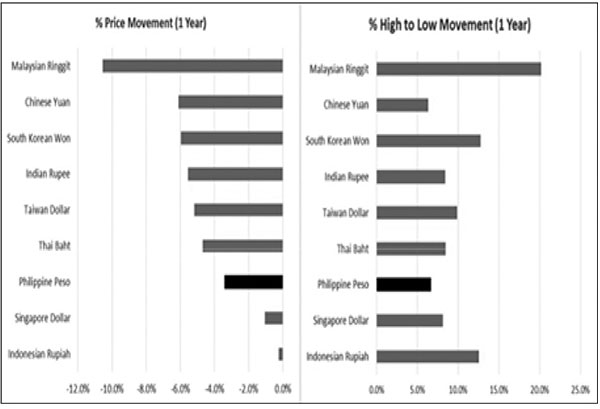

The graphs below show these two measures of volatility for different currencies:

The Price Movement graph on the left shows the extent of the price movement year-on-year.

The High to Low Movement graph on the right shows the extent of price fluctuation between the high and the low for the same time period.

Major currencies vs. the US dollar

Source: Bloomberg, Wealth Research (based on closing prices)

Among major currencies, only Japanese yen has strengthened the most against the US dollar gaining 15.3 percent year-on-year, while at the same time exhibiting the greatest volatility by fluctuating 20.1 percent from its high to its low over a one year period.

Likewise, the Canadian dollar has been quite volatile this year, declining 5.5 percent against the greenback year-on-year and fluctuating16.4 percent from high to low.

Meanwhile, the British pound which weakened the most among the major currencies is down 9.6 percent year-on-year. It has also been volatile, swinging 14.5 percent from high to low over a one-year horizon.

Asian currencies vs. the US dollar

Source: Bloomberg, Wealth Research (based on closing prices)

Among Asian currencies, clearly the Malaysian ringgit has been the most volatile, declining 10.6 percent year-on-year and fluctuating 20.2 percent between its high and low.

The Korean won had likewise a volatile year, falling 6 percent against the greenback while fluctuating 12.7 percent between its high and low.

The Indonesian rupiah is also considered volatile in terms of the High-Low measure. While it barely weakened by 0.2 percent against the US dollar, the high-low fluctuation is considerable at 12.6 percent.

Meanwhile, the Chinese yuan may appear to be less volatile with its High-Low measure just at 6.4 percent. But remember that historically the yuan was fixed to the dollar throughout 1995 – 2005. A managed float kept it steady the next ten years. However, in August 2015 Chinese authorities decided to guide it lower, bringing its year-on-year decline against the US dollar at 6.1 percent and causing the wild volatility in global assets.

Philippine peso – steady on both measures of volatility

On both measures of volatility, the Philippine peso was very steady the past year. In terms of price movement, it is only down 3.4 percent against the US dollar year-on-year. But more importantly, its high to low fluctuation is only 6.7 percent. This is substantially less compared to the major currencies’ average of 14.5 percent and the Asian currencies’ average of 10.4 percent.

Steady “Say”

Known as “Say” to his close friends, we call BSP Governor Amando Tetangco, Jr. “Steady Say” because of his policies that has kept the Philippine economy in a clear, steady and stable growth path. The steady peso which is not too hot and not too cold, but just right is a testament to the prudence of Steady Say and his monetary team.

Philequity Management is the fund manager of the leading mutual funds in the Philippines. Visit www.philequity.net to learn more about Philequity’s managed funds or to view previous articles. For inquiries or to send feedback, please call (02) 689-8080 or email [email protected].

- Latest

- Trending