And the last became first

Emerging market currencies are making a comeback this year. After a couple of contagion scares in August 2015 and January due to the depreciation of the Chinese yuan, EM currencies have rallied sharply in the past two months on the back of dovish Fed statements and rebounding commodity prices led by crude oil.

The worst became best

Indications the Fed is unlikely to pursue an aggressive interest rate tightening cycle has led the US dollar to pull back, if not completely reverse. Hence, EM currencies such as the Malaysian ringgit, the Indonesian rupiah, the Russian ruble and the Brazilian real – which were sold down the most when the dollar was strong – are leading the recovery now that the dollar is weaker. What were previously the world’s worst currencies became the best... THE LAST BECAME FIRST.

Significntly, we wrote about the “R” currencies (the ringgit, rupiah, ruble and real) back in January (see It’s the Strong Dollar, Stupid! – Episode 3, Jan. 18). It is now evident the worst currencies were the “R” currencies, which are now the best performing currencies.

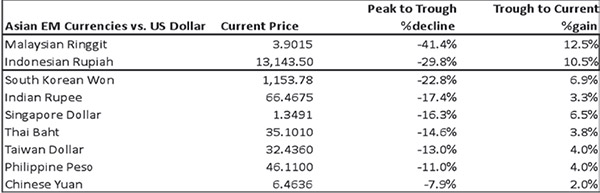

The tables below will show how currencies performed the past two years where significant highs and lows were reached.

Ringgit and rupiah lead recovery in Asian currencies

In Asia, the worst performing currencies during the past two years were the Malaysian ringgit and the Indonesian rupiah, falling as much as 41.4 percent and 29.8 percent from their 2014 highs, respectively.

In addition to poor oil and commodity prices last year, the ringgit was plagued by allegations of graft and mismanagement over indebted state fund 1Malaysia Development Berhad (1MDB). Meanwhile, President Widodo’s lack of parliamentary support to pursue his reforms weighed on the rupiah.

The Malaysian ringgit and the Indonesian rupiah both hit 17-year lows in September 2015 and have rebounded since, gaining 12.5 percent and 10.5 percent, respectively.

Source: Bloomberg, Philequity Research

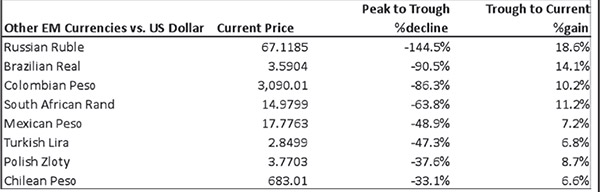

Russian ruble and Brazilian real lead EM currencies

Among EM currencies, the Russian ruble and the Brazilian real suffered the most the past two years, depreciating as much as 144 percent and 90 percent against the US dollar, respectively.

The drop in oil prices is nowhere more evident than in Russia, which is the 3rd biggest oil producer in the world and where 50 percent of federal budget and 25 percent of GDP comes from energy exports. Meanwhile Brazil, which is suffering its worst recession in history, is also facing its deepest political crisis in decades over a corruption scandal which reaches all the way to the top.

The Russian ruble bottomed out in January and is now up an impressive 18.6 percent from the low buoyed by the recent 50 percent rally in crude oil prices.

The Brazilian real is up 14.1 percent from the low established last September 2015 on investor hopes that regime change is just around the corner.

Source: Bloomberg, Philequity Research

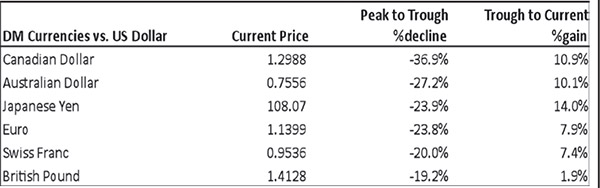

Japanese yen, Canadian & Aussie dollar lead DM currencies

Among developed market currencies, the Japanese yen strengthened the most against the US dollar, rallying 14 percent from its June 2015 low despite negative interest rates. Similarly, the Euro and the Swiss franc are rallying despite negative rates.

The Aussie and the Canadian dollar or the so-called “commodity currencies” have each advanced more than 10 percent over the US dollar since their January lows.

Source: Bloomberg, Philequity Research

Too strong a dollar is bad

Since the market turmoil in January, it does appear that major central banks have coordinated and acted on cue, issuing statements one after another on what looks like an effort to contain the strengthening US dollar, stave off the Chinese yuan devaluation shock and stabilize global growth (see Central Banks Strike Back, Feb. 1).

Too strong a dollar sparks unwanted global market volatility which we expounded in last week’s article (see She Gets It, April 4). And we quote:

“Yellen gets it and understands the US economy is not an island… She gets that dollar strength is detrimental not just to emerging economies, but to the US economy as well. Yellen understands that stability in global equities, currencies and commodities are of paramount importance before she can resume raising interest rates.”

Biding time

Whether this is just a temporary pause or an eventual reversal in the US dollar is beside the point. What’s important is that the message of Fed chair Yellen to defer future rate hikes until certain conditions are met and to contain US dollar strength is biding time for other economies to catch up on their own recovery. Additionally, it creates room for a little more policy easing from the ECB, BOJ and other CBs without risking new US dollar highs.

A stable peso is good

The pause in US dollar strength and the recovery of EM and Asian currencies is a welcome development for EM central banks as well as the BSP. In the previous article, we said that peso has reached bottom at 48.05 and we see it trading between 45.50 and 47.50 in the short- to medium-term (see Peso stabilizes below 47, March 21). Indeed a stable peso is good for the Philippine economy.

Philequity Management is the fund manager of the leading mutual funds in the Philippines. Visit www.philequity.net to learn more about Philequity’s managed funds or to view previous articles. For inquiries or to send feedback, please call (02) 689-8080 or email [email protected].

- Latest

- Trending